you position:Home > new york stock exchange > new york stock exchange

50 Year US Stock Market Chart: A Comprehensive Analysis

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

The 50 year US stock market chart offers a fascinating glimpse into the past, present, and future of the financial landscape. This extensive timeline provides investors and enthusiasts with valuable insights into the stock market's performance over five decades. In this article, we'll delve into the key trends, significant events, and notable shifts observed in the stock market during this period.

Introduction

The US stock market has been a pivotal component of the global financial system for decades. It has witnessed several bull and bear markets, technological advancements, and regulatory changes. By examining the 50-year stock market chart, we can identify patterns, correlations, and lessons that can be applied to current and future investment strategies.

Bull and Bear Markets

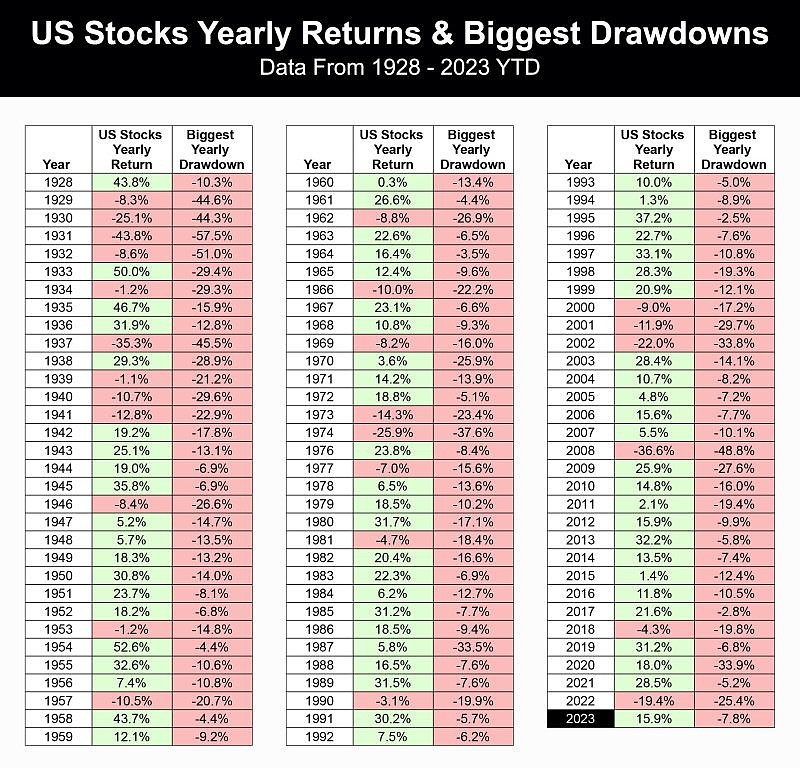

One of the most striking observations from the 50-year US stock market chart is the occurrence of bull and bear markets. Bull markets are characterized by rising stock prices, while bear markets are marked by falling stock prices. Over the past 50 years, the US stock market has experienced several bull and bear cycles, with varying durations and intensity.

Significant Events

Several significant events have influenced the US stock market over the past 50 years. These events include:

- Technological Advancements: The advent of the internet, smartphones, and social media has revolutionized the stock market, making it more accessible and efficient.

- Regulatory Changes: The implementation of the Sarbanes-Oxley Act in 2002 aimed to enhance corporate governance and financial transparency.

- Globalization: The increasing interconnectedness of the global economy has expanded the market opportunities and risks for US investors.

Trends and Patterns

Several trends and patterns have emerged from the 50-year US stock market chart:

- Long-term Growth: Despite short-term fluctuations, the stock market has shown a strong long-term growth trend.

- Sector Performance: Different sectors have exhibited varying performance over the years, with technology and healthcare leading the charge.

- Dividend Yields: Dividend yields have generally remained relatively stable, providing a consistent income stream for investors.

Case Studies

To illustrate the impact of significant events on the stock market, let's consider a few case studies:

- Dot-com Bubble (1999-2002): The rapid growth of technology stocks during the late 1990s led to the dot-com bubble. When the bubble burst, the stock market experienced a significant decline. However, it recovered quickly and continued its long-term growth trend.

- Financial Crisis (2007-2009): The financial crisis of 2007-2009 had a profound impact on the stock market, leading to a historic bear market. However, the market quickly recovered and reached new highs in subsequent years.

Conclusion

The 50-year US stock market chart provides valuable insights into the financial landscape's evolution. By understanding the trends, patterns, and significant events that have shaped the market, investors can make more informed decisions and develop effective investment strategies. As the stock market continues to evolve, it's crucial to stay informed and adapt to new challenges and opportunities.

so cool! ()

like

- Costco Stock Checker US: Your Ultimate Guide to Monitoring Costco's Stock Pe

- New York Stock Exchange Historical Chart: Decoding the Stock Market's Past

- Buy Dangote Stock in US: A Smart Investment Opportunity

- Average Rate of Return in the US Stock Market Since 1930: An Insightful Analysis&

- Stock Markets for Today: A Comprehensive Overview

- Navigating the Current Event Stock Market: A Strategic Approach

- Google Finance AMZN: A Deep Dive into Amazon's Financial Insights"

- Dow Annual Returns: A Comprehensive Guide to Understanding Stock Market Performan

- Stock W.W. II Equipment: A Dive into the US Navy's Historic Gear

- Stock Market History: A Decade in Review

- Close Chart: Mastering Financial Analysis and Investment Decisions

- Is the US Stock Market Collapsing?

hot stocks

HSBC US Stock Trading Fees: What You Need to K

HSBC US Stock Trading Fees: What You Need to K- HSBC US Stock Trading Fees: What You Need to K"

- Top Momentum Stocks in the US Market August 20"

- Unlocking Opportunities with US Small Value St"

- Shionogi Stock US: A Comprehensive Analysis of"

- Unlocking the Potential of Barclays Bank US St"

- American Stock Traders Outside the US: Opportu"

- Understanding DJIA Pre-Market Futures: A Compr"

- ACB US Stock Price Today: Current Trends and A"

recommend

50 Year US Stock Market Chart: A Comprehensive

50 Year US Stock Market Chart: A Comprehensive

"1990-2010 US Stock Market Average Re

Unlocking the Treasure Trove: A Comprehensive

Understanding Ex-Dividend Dates for US Stocks:

US Stock Investing Championship: Strategies fo

Moving Averages Analysis: Predicting US Stock

Outlook on US Stocks: A Comprehensive Analysis

Top US Stocks to Watch in 2022: A Comprehensiv

The US Stock Market News: Key Updates and Anal

Buy Stocks Outside US: A Comprehensive Guide t

Recent Breakout Stocks: US Momentum That'

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- "Us Stock Exchange Holidays List: Ess"

- Best Stock US: Unveiling the Top Investments f"

- Stock Market Performance Over the Past Month: "

- "Market-Weighted US Stock Indexes: A "

- All Stocks on NYSE: A Comprehensive Guide to t"

- Dow Graph 100 Years: A Comprehensive Analysis "

- InMed US Stock: A Comprehensive Guide to Inves"

- Buy Dangote Stock in US: A Smart Investment Op"

- In-Depth Analysis of HP Stock: A Comprehensive"

- Top Stocks to Watch in 2018 According to U.S. "