you position:Home > new york stock exchange > new york stock exchange

Is the US Stock Market Collapsing?

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

Are We on the Verge of a Market Meltdown?

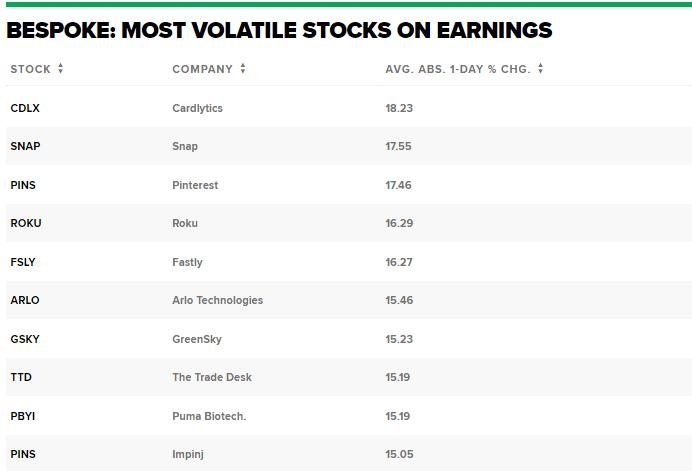

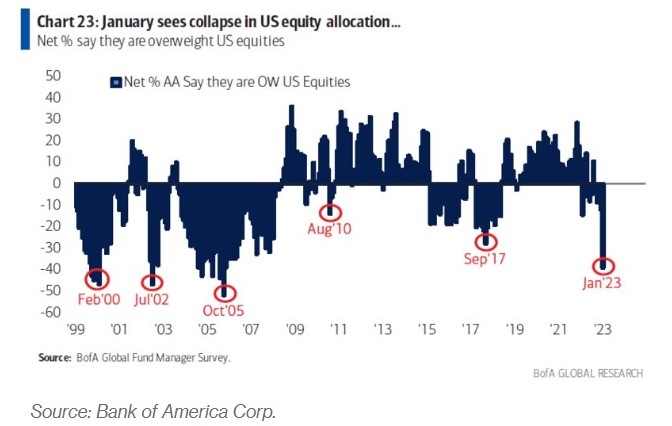

The recent volatility in the US stock market has left many investors questioning if we are on the brink of a collapse. With the markets experiencing unprecedented ups and downs, it's natural to feel concerned. This article delves into the current state of the US stock market, analyzing the factors contributing to the volatility and whether a collapse is imminent.

Market Volatility: What's Causing It?

One of the primary reasons for the current market volatility is the uncertainty surrounding the global economy. The COVID-19 pandemic has caused a ripple effect, affecting various industries and economies worldwide. Additionally, geopolitical tensions, such as the conflict between Russia and Ukraine, have added to the uncertainty.

Technological Advancements and Automation

Another factor contributing to the volatility is the rapid pace of technological advancements and automation. As more companies adopt AI and automation, there is a concern that jobs will be lost, leading to decreased consumer spending and, subsequently, a slowdown in economic growth.

Stock Market Analysis: Is a Collapse Imminent?

While the current market volatility is concerning, it does not necessarily indicate an impending collapse. Several factors suggest that a full-blown collapse is unlikely in the near future.

1. Strong Economic Fundamentals

Despite the uncertainty, the US economy remains relatively strong. The unemployment rate is low, and consumer spending is robust. These factors indicate that the economy is well-positioned to handle the current challenges.

2. Diversification of the Market

The US stock market is highly diversified, with a wide range of sectors and industries represented. This diversification helps to mitigate the impact of any single sector's decline, making a full-blown collapse less likely.

3. Low Interest Rates

The Federal Reserve has kept interest rates low to stimulate economic growth. This has led to increased borrowing and investment, further supporting the market.

Case Study: The 2008 Financial Crisis

A comparison with the 2008 financial crisis can provide some insight into the current market situation. While there are similarities between the two periods, such as high debt levels and market speculation, the current situation is not as dire.

Conclusion

While the US stock market is experiencing volatility, it is not necessarily indicative of an impending collapse. The strong economic fundamentals, market diversification, and low interest rates suggest that the market is well-positioned to handle the current challenges. Investors should remain vigilant but avoid panic, as the market has historically recovered from periods of volatility.

so cool! ()

last:Dow Jones Trend Today: What You Need to Know About Market Movements

next:nothing

like

- Dow Jones Trend Today: What You Need to Know About Market Movements

- Does TradeLocker Support US Stocks? A Comprehensive Guide

- Fidelity Total US Stock Index: A Comprehensive Guide to Understanding and Investi

- Major US Airline Stocks Drop as Jefferies Downgrades Ratings

- Dow Jones Industrial Average: A Journey Through Time"

- Unlocking the Potential of the Stock Market Com: A Comprehensive Guide

- Dow Jones & Co: The Pioneers of Financial News and Information

- Daily Life Inside an US Navy Aircraft Carrier: A Glimpse of Maritime Majesty

- Are Markets Open Today in USA? A Comprehensive Guide

- May 3, 2025: US Stock Market Summary

- What Did the Dow End At? A Comprehensive Analysis of the Stock Market's Clos

- JP Morgan Warns Us: Stock Market Dilemma Looms Ahead

hot stocks

HSBC US Stock Trading Fees: What You Need to K

HSBC US Stock Trading Fees: What You Need to K- HSBC US Stock Trading Fees: What You Need to K"

- Top Momentum Stocks in the US Market August 20"

- Unlocking Opportunities with US Small Value St"

- Shionogi Stock US: A Comprehensive Analysis of"

- Unlocking the Potential of Barclays Bank US St"

- American Stock Traders Outside the US: Opportu"

- Understanding DJIA Pre-Market Futures: A Compr"

- ACB US Stock Price Today: Current Trends and A"

recommend

Is the US Stock Market Collapsing?

Is the US Stock Market Collapsing?

Stock Market Down When US Dollar Up: Understan

Stocks Opening: A Comprehensive Guide to Under

UBS and HSBC Warn of More Downward for US Stoc

Stock Going Up: How to Identify and Invest in

Can F1 Visa Holders Invest in the US Stock Mar

Understanding the iShares US Preferred Stock E

Best US Stock Real-Time Data Subscription: You

Amway US Stock Quote: A Comprehensive Guide to

Best US Steel Stock to Buy: Top Picks for 2023

List of US Stock Indices: Comprehensive Guide

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- NYSE Closed Good Friday: Understanding the Imp"

- Stock Invest.US // UAB Exigam: Mastering the A"

- US Stock Forecast Today: What to Expect and Ho"

- Maximizing Your Business: Understanding the Im"

- The Beginning of the US Stock Market: A Journe"

- Stock Market After: Insights into the Post-202"

- Does Toys "R" Us Have Ninten"

- Multibagger US Stocks to Watch in 2025: A Stra"

- Dow Finish: The Ultimate Guide to Achieving a "

- Unlocking the Potential of PEGA Systems: A Dee"