you position:Home > us stock market today live cha > us stock market today live cha

Understanding the US Stock Market Indices: A Comprehensive Guide

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the ever-evolving world of finance, understanding the US stock market indices is crucial for investors and traders. These indices provide a snapshot of the overall market's health and direction, offering valuable insights into potential investment opportunities. This article aims to demystify the key US stock market indices, including the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite, and highlight their significance in today's investment landscape.

The S&P 500: A Benchmark for the Stock Market

The S&P 500 is one of the most widely followed stock market indices in the United States. It consists of 500 large-cap companies across various industries, representing approximately 80% of the total market capitalization of the US stock market. This index serves as a benchmark for the broader market, and its performance is often used to gauge the health of the economy.

The S&P 500 has several key advantages. First, it provides a diversified view of the market, as it includes companies from different sectors. This helps mitigate the risk of investing in a single industry. Second, the index is well-established and has been in existence since 1923, making it a reliable indicator of market trends. Lastly, the S&P 500 has a strong correlation with the overall market, making it a valuable tool for investors looking to gauge the broader market's direction.

The Dow Jones Industrial Average: An Iconic Index

The Dow Jones Industrial Average (DJIA) is another iconic stock market index that has been a part of the financial landscape since 1896. It consists of 30 large-cap companies from various sectors, including technology, finance, and healthcare. The DJIA is often referred to as the "blue chip" index, as it includes some of the most well-known and stable companies in the United States.

One of the key advantages of the DJIA is its simplicity. The index is calculated by adding up the stock prices of the 30 companies and dividing by a divisor. This makes it easy for investors to understand and follow. Additionally, the DJIA has a long history, providing a wealth of data and insights into market trends.

The NASDAQ Composite: The Tech Leader

The NASDAQ Composite is the world's first electronic stock market and is known for its heavy concentration of technology companies. It includes more than 3,000 companies across various sectors, making it the largest and most diverse index in the United States.

The NASDAQ Composite has gained significant prominence due to the growth of the technology sector. Many of the world's largest and most successful tech companies, such as Apple, Microsoft, and Amazon, are listed on the NASDAQ. This makes the index a valuable tool for investors looking to capitalize on the tech sector's growth potential.

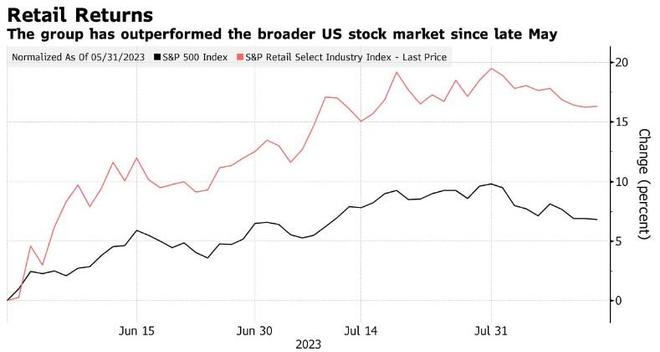

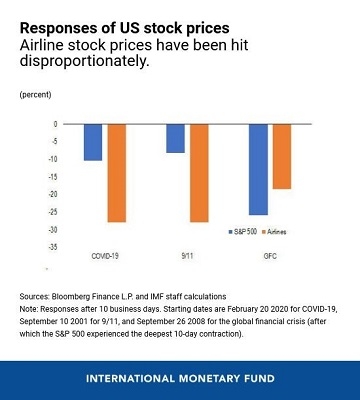

Case Study: The 2020 Stock Market Crash

One of the most significant events in recent stock market history was the 2020 stock market crash, caused by the COVID-19 pandemic. While all three indices fell sharply, the S&P 500 and the NASDAQ Composite saw larger declines due to their higher exposure to technology and other sectors most affected by the pandemic.

This event highlights the importance of diversification and understanding the risks associated with different stock market indices. Investors who had a well-diversified portfolio that included exposure to various indices were better positioned to weather the storm.

In conclusion, understanding the US stock market indices is crucial for investors and traders looking to navigate the complex world of finance. The S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite offer valuable insights into the market's direction and potential investment opportunities. By familiarizing yourself with these indices and their characteristics, you can make more informed investment decisions.

so cool! ()

like

- Is the Stock Going Up? A Comprehensive Guide to Stock Market Trends"

- Dow Jones NYC: A Comprehensive Guide to the Financial Hub

- Hil Us Stock Market: JP Morgan's US Value Insights

- Stock Futures on Yahoo Finance: A Comprehensive Guide to Trading Strategies&q

- Unlocking High Momentum US Stocks for Short-Term Gains

- Top 5 Big US Oil Stocks to Watch in 2023

- Dow Jones Industrial Average Historical Performance: A Deep Dive

- Share Price Ticker: Master the Art of Real-Time Stock Tracking"

- How the Stock Market Closed Today: Key Highlights and Analysis

- March 2020 IPOs List: A Comprehensive Review of US Stock Market Debutantes

- Samsung US Stock Exchange: A Comprehensive Guide

- Understanding Børsens Aktier: A Comprehensive Guide to Danish Stock Market Inves

hot stocks

Unlocking Potential: Exploring US Small Cap Bi

Unlocking Potential: Exploring US Small Cap Bi- Unlocking Potential: Exploring US Small Cap Bi"

- Top US Stock to Buy: Unveiling the Ultimate In"

- "5 Crucial Things to Know Before Trad"

- Can Indian Citizens Trade in the US Stock Mark"

- US Bank Corp Stock Price Today: Key Insights a"

- US Made L1A1 Stock Set: The Ultimate Upgrade f"

- Best Performing US Stocks Past 5 Days: Momentu"

- Top 10 Dividend Stocks in the US: Secure Your "

recommend

Understanding the US Stock Market Indices: A C

Understanding the US Stock Market Indices: A C

Can Indian Citizens Trade in the US Stock Mark

Unlocking the Potential of Global Mkt: Strateg

Unlocking Potential: The Ultimate Guide to US

Toys "R" Us Stock: A Journey

Average Stock Market Return Over the Last 50 Y

US Stem Cells Stock: The Future of Biotechnolo

Unlocking the Power of Market Money: A Compreh

Htht Us Stock Split: What You Need to Know

Good Dividend Stocks: Top US Investments for I

Unlocking the Day High: Maximizing Profits in

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Understanding the Significance of "Ti"

- Stock Market Sell-Off: Navigating the Volatili"

- Current Wall Street Numbers: The Latest Trends"

- "Maximize Your Investment Potential w"

- Ishares Trust S&P US PFD Stock: A Comp"

- DeepSeek US Stock: Unveiling the Potential of "

- Toyota Tacoma Mass Air Flow 2.7 2000 US Stock:"

- Tea Cafe Contact Us: Discover Our Exclusive St"

- Dow Jones Week Chart: A Comprehensive Guide to"

- Huawei Stock Buying in US: A Lucrative Investm"