you position:Home > us stock market today live cha > us stock market today live cha

Understanding the Total Value of the US Stock Market

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

The total value of the US stock market is a critical indicator of the nation's economic health and the global financial landscape. This article delves into what this value represents, how it's calculated, and its implications for investors and the economy at large.

What is the Total Value of the US Stock Market?

The total value of the US stock market, often referred to as the market capitalization, is the total worth of all publicly traded companies listed on US exchanges. It's calculated by multiplying the current share price of each company by the number of its outstanding shares. This figure is a dynamic one, changing with the market's fluctuations.

Market Capitalization: The Key Factor

Market capitalization is the primary factor in determining the total value of the US stock market. It provides a snapshot of the size and influence of individual companies within the broader market. For instance, companies with a high market cap, like Apple or Microsoft, have a significant impact on the total value.

Components of the Total Value

The total value of the US stock market is composed of various sectors, including technology, healthcare, finance, and consumer goods. Each sector contributes to the overall market value, and their performance can influence the market's total value.

Calculating the Total Value

To calculate the total value of the US stock market, one would sum up the market capitalization of all publicly traded companies. This process requires access to real-time data, as stock prices and market capitalization can change rapidly.

Implications for Investors

Understanding the total value of the US stock market is crucial for investors. It provides insights into market trends, potential risks, and opportunities. For instance, a rising total value may indicate a strong market, while a falling value could signal a downturn.

Economic Indicators

The total value of the US stock market is also an important economic indicator. It reflects the overall health of the economy, investor confidence, and market sentiment. A rising total value often correlates with economic growth and increased consumer spending.

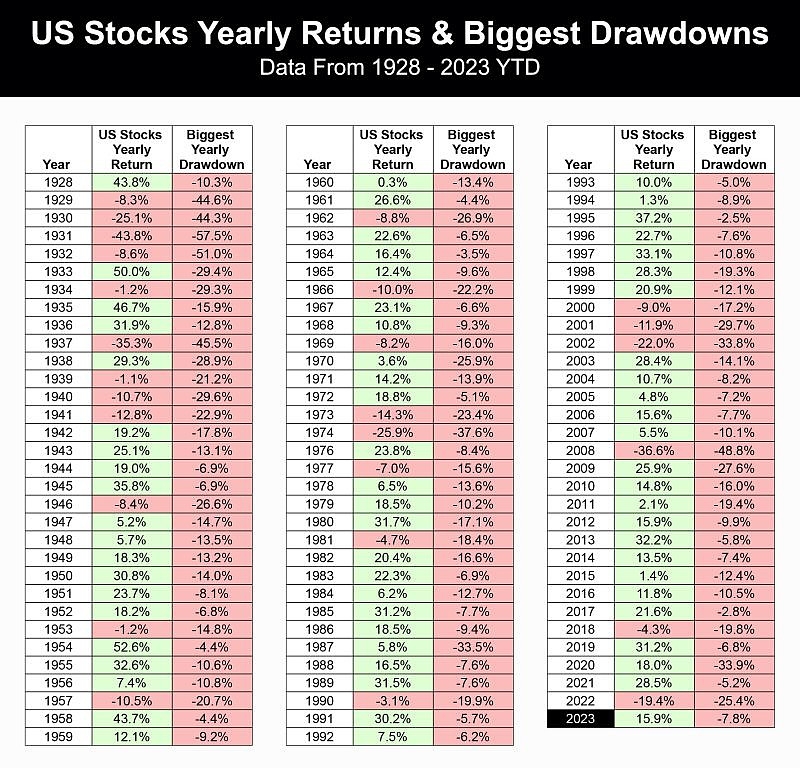

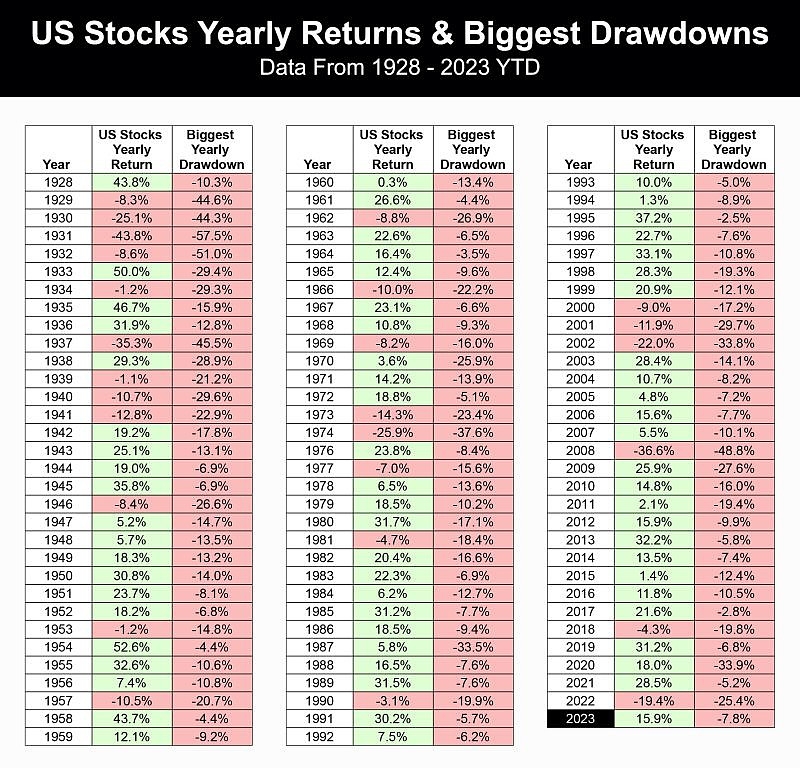

Case Study: The Dot-Com Bubble

One notable case study is the dot-com bubble of the late 1990s. During this period, the total value of the US stock market skyrocketed, driven by high-tech companies. However, this bubble eventually burst, leading to a significant decline in the market's total value. This case highlights the importance of understanding market dynamics and potential risks.

Conclusion

The total value of the US stock market is a complex and dynamic indicator that plays a vital role in the economy. By understanding its components, implications, and historical trends, investors and market participants can make informed decisions and navigate the market with greater confidence.

so cool! ()

last:Does Ubq Israeli Company Trade on US Stock Exchange?

next:nothing

like

- Does Ubq Israeli Company Trade on US Stock Exchange?

- Futures NASDAQ Yahoo: A Comprehensive Guide to Trading and Investing

- Battery Stock US: The Ultimate Guide to Investing in Battery Stocks

- Understanding the TFSA Tax on US Stocks

- Tomorrow Stock Market Forecast: Key Predictions and Strategies for Investors

- Unveiling the Power of US Military Stock Photography

- Stock Estimates: The Key to Informed Investment Decisions

- Stock Market Number: The Ultimate Guide to Understanding Market Indices

- Unlock Global Investments: The Best Offshore Stock Brokers for US Clients&quo

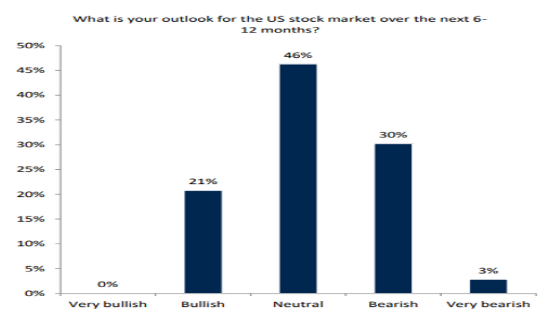

- Are U.S. Stocks in a Bubble? 2025 Analysis

- The Largest Stock Loss in US History: The 1929 Market Crash

- Top News Yahoo: Stay Updated with the Latest Stories

hot stocks

Unlocking Potential: Exploring US Small Cap Bi

Unlocking Potential: Exploring US Small Cap Bi- Unlocking Potential: Exploring US Small Cap Bi"

- Top US Stock to Buy: Unveiling the Ultimate In"

- "5 Crucial Things to Know Before Trad"

- Can Indian Citizens Trade in the US Stock Mark"

- US Bank Corp Stock Price Today: Key Insights a"

- US Made L1A1 Stock Set: The Ultimate Upgrade f"

- Best Performing US Stocks Past 5 Days: Momentu"

- Top 10 Dividend Stocks in the US: Secure Your "

recommend

Understanding the Total Value of the US Stock

Understanding the Total Value of the US Stock

Thai Agro Energy PCL US Stock Symbol: A Compre

Should I Invest in US Stocks Despite Dollar We

Stock Index World: A Global Perspective Exclud

"Toys R Us Stocking Pay: What You Nee

Unveiling the Power of US Military Stock Photo

Can I Buy Aramco Stock in the US? A Comprehens

"US Stock Exchange Market Capitalizat

Does Ubq Israeli Company Trade on US Stock Exc

Unlock Global Investments: The Best Offshore S

2025 US Stock Market Outlook: Navigating Risks

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- "List of Mid-Cap Stocks in the US: To"

- Understanding UBS US Stock: A Comprehensive Gu"

- US Military Green Screen Stock: Submarine Torp"

- Discover the Perfect "Among Us&qu"

- Unlock the Potential of US Glass Company Stock"

- Scotia iTrade Buying US Stocks: A Comprehensiv"

- Unveiling the Powerhouse of US High-Growth Sto"

- The Last of Us Part 2 Stock Market: A Comprehe"

- The Most Popular Stock Traded in the US: A Clo"

- "PDD US Stock Price: Key Insights and"