you position:Home > us stock market today live cha > us stock market today live cha

Are U.S. Stocks in a Bubble? 2025 Analysis

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

Introduction

As we step into 2025, the financial markets remain a hot topic of discussion. One of the most pressing questions on many investors' minds is whether U.S. stocks are currently in a bubble. This article delves into the current state of the market, analyzing various factors that could indicate a bubble, and offering insights into what investors should consider.

Market Performance

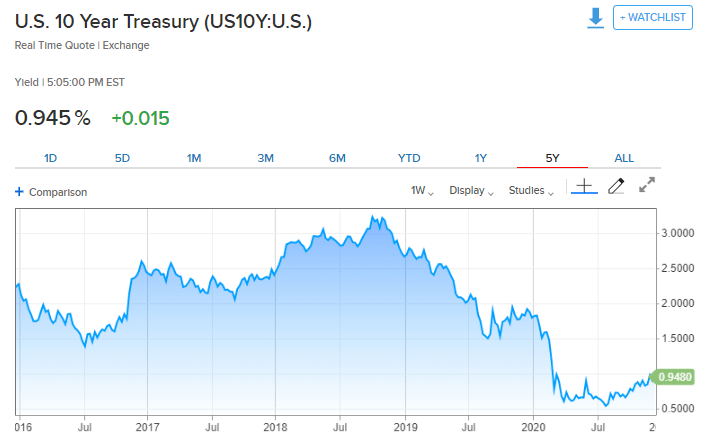

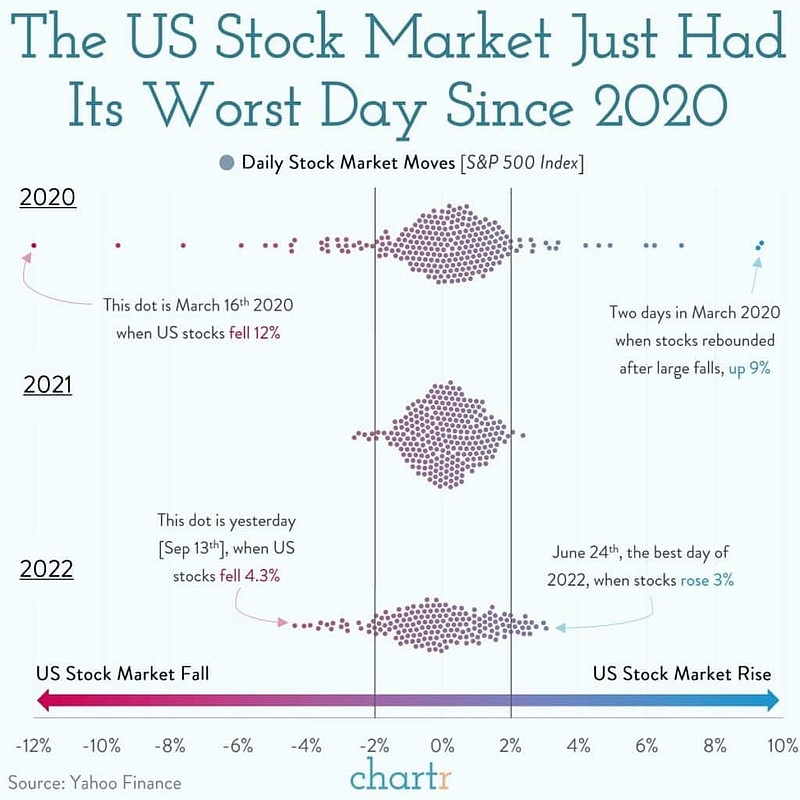

To determine if U.S. stocks are in a bubble, it's essential to look at the overall market performance. Over the past few years, the S&P 500 has experienced significant growth, with many stocks reaching all-time highs. However, this growth has been fueled by various factors, including low-interest rates, strong corporate earnings, and a recovering economy.

Valuation Metrics

One of the key indicators of a bubble is overvaluation. Several valuation metrics can be used to assess the current state of the market. The price-to-earnings (P/E) ratio is a commonly used metric that compares the current stock price to the company's earnings. As of 2025, the S&P 500's P/E ratio is around 25, which is slightly above its long-term average of 20. While this may indicate some overvaluation, it doesn't necessarily suggest a bubble.

Another metric to consider is the price-to-book (P/B) ratio, which compares the market value of a company to its book value. As of 2025, the S&P 500's P/B ratio is around 3.5, which is also slightly above its long-term average of 2.5. Again, this may indicate some overvaluation, but it doesn't necessarily suggest a bubble.

Economic Factors

Economic factors play a crucial role in determining whether U.S. stocks are in a bubble. One of the main concerns is the potential for rising interest rates. If the Federal Reserve raises interest rates significantly, it could lead to higher borrowing costs for companies, potentially causing a stock market correction.

Another economic factor to consider is inflation. With inflation remaining above the Federal Reserve's target of 2%, it could lead to higher interest rates and a potential stock market correction.

Market Sentiment

Market sentiment is another critical factor to consider when analyzing whether U.S. stocks are in a bubble. As of 2025, investor sentiment remains bullish, with many investors optimistic about the future of the market. However, this optimism could be a sign of a bubble, as investors may be overestimating the market's potential.

Case Studies

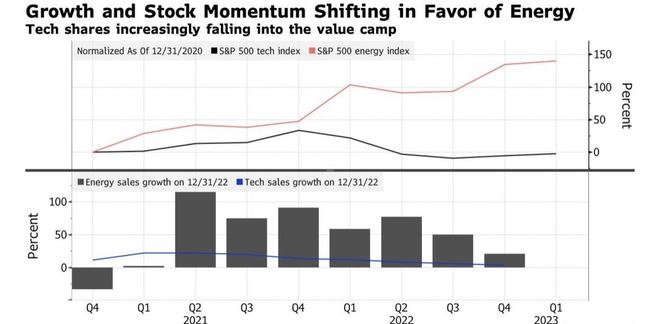

To further understand the current state of the market, let's look at a few case studies. One of the most notable examples is the tech sector, which has seen significant growth over the past few years. Companies like Apple, Microsoft, and Amazon have seen their stock prices soar, leading to concerns about overvaluation.

Another example is the biotech sector, which has seen a surge in interest due to advancements in medical research and technology. Companies like Moderna and Regeneron have seen their stock prices skyrocket, raising questions about whether this growth is sustainable.

Conclusion

While there are concerns about overvaluation in the U.S. stock market, it's essential to consider various factors before concluding that a bubble exists. Market performance, valuation metrics, economic factors, and market sentiment all play a role in determining the current state of the market. As investors, it's crucial to remain vigilant and consider these factors when making investment decisions.

so cool! ()

last:The Largest Stock Loss in US History: The 1929 Market Crash

next:nothing

like

- The Largest Stock Loss in US History: The 1929 Market Crash

- Top News Yahoo: Stay Updated with the Latest Stories

- http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol dher.

- Maximizing Investment Insights with NASDAQ and Yahoo Finance

- How to Invest in US Stocks from Australia: A Comprehensive Guide

- Weekly Market Update: Key Insights and Trends for Investors

- Sector Performance: US Stock Market Outlook for May 16, 2025

- Tcehy Stock US: The Ultimate Guide to Understanding and Investing

- Recent Stock Trends: What You Need to Know

- Best Mobile App to Buy and Sell Stocks in the US: Top Picks for Investors

- Maximizing Returns: The Ultimate Guide to Understanding "Stock in&qu

- Is the US Stock Market Open Easter Monday?

hot stocks

Unlocking Potential: Exploring US Small Cap Bi

Unlocking Potential: Exploring US Small Cap Bi- Unlocking Potential: Exploring US Small Cap Bi"

- Top US Stock to Buy: Unveiling the Ultimate In"

- "5 Crucial Things to Know Before Trad"

- Can Indian Citizens Trade in the US Stock Mark"

- US Bank Corp Stock Price Today: Key Insights a"

- US Made L1A1 Stock Set: The Ultimate Upgrade f"

- Best Performing US Stocks Past 5 Days: Momentu"

- Top 10 Dividend Stocks in the US: Secure Your "

recommend

Are U.S. Stocks in a Bubble? 2025 Analysis

Are U.S. Stocks in a Bubble? 2025 Analysis

"Unveiling the US Stock Index Returns

Drip Us Stocks Canada: Your Guide to Smart Inv

Cheap US Infrastructure Stocks: A Smart Invest

Unlocking the Potential of CBII Stock: A Compr

Brokers That Trade Canadian Stocks in the US:

Top Momentum Stocks Past 5 Days: A Deep Dive i

The Most Popular Stock Traded in the US: A Clo

How to Buy Bitcoin Stock in the US: A Step-by-

Should I Invest in US Stocks Despite Dollar We

Block One Capital Inc Stock Symbol: US – A D

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Toys R Us Hatchimals in Stock: Your Ultimate G"

- Marijuana Companies on US Stock Exchange: A Th"

- Market Watch Graph: A Comprehensive Guide to U"

- "Unlocking the Potential: The Thrivin"

- Best US Airline Stocks: Top Picks for 2023"

- Rolls-Royce US Stock: A Comprehensive Guide to"

- Casino Stock US: Unveiling the Thrilling Inves"

- The Surging Number of Companies Listed on US S"

- Trade Japanese Stocks in US SEC: A Comprehensi"

- Drip Us Stocks Canada: Your Guide to Smart Inv"