you position:Home > us stock market today live cha > us stock market today live cha

Best US Airline Stocks: Top Picks for 2023

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

Are you looking to invest in the thriving airline industry? If so, you’ve come to the right place. In this article, we’ll delve into the best US airline stocks to consider for your portfolio in 2023. With the industry’s recovery from the COVID-19 pandemic, now is a perfect time to explore your investment options. So, let’s jump right in and discover the top picks for 2023.

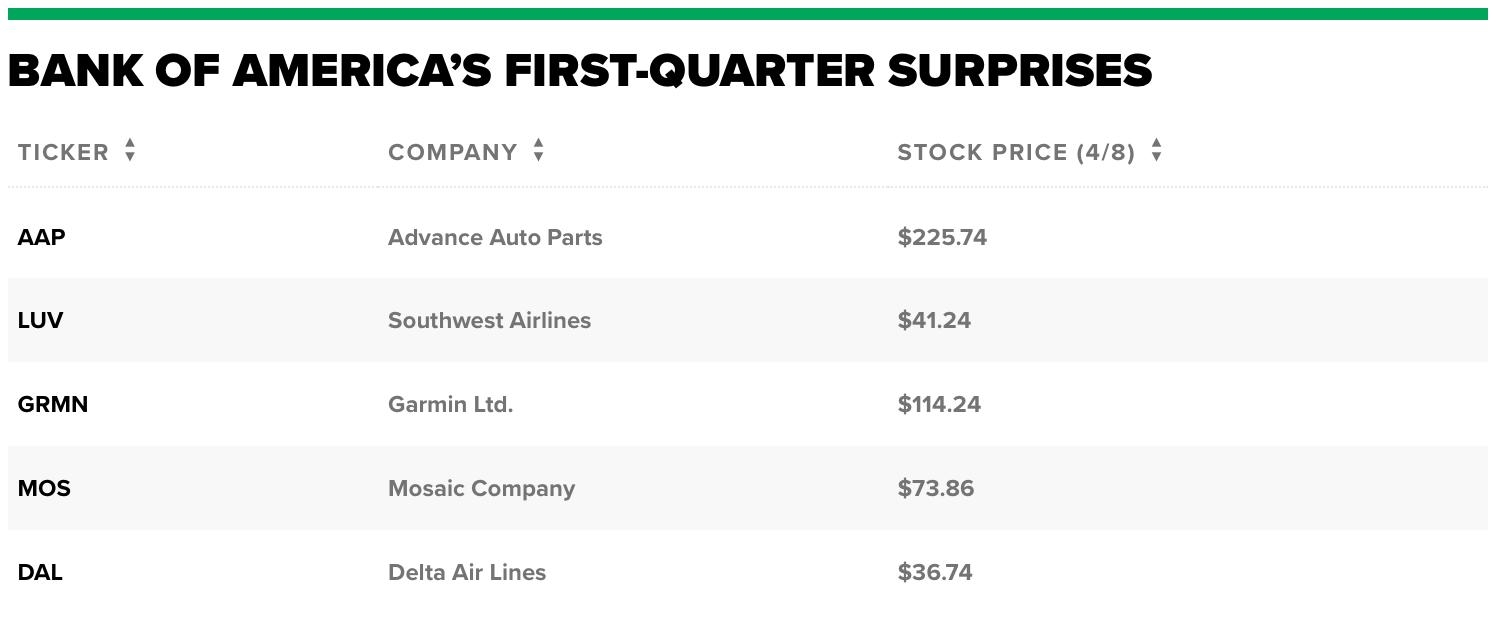

Delta Air Lines (DAL)

Delta Air Lines is one of the largest airlines in the United States, with a strong presence in the domestic and international markets. The company has been able to maintain its market share and profitability despite the challenges posed by the pandemic. With a focus on cost-cutting and improved efficiency, Delta Air Lines is well-positioned for growth in the coming years.

One of the key factors contributing to Delta’s success is its robust network. The airline operates flights to over 325 destinations worldwide, offering customers a wide range of options. Additionally, Delta has been investing in its fleet, with a significant number of new aircraft orders, which will further enhance its operational capabilities.

American Airlines Group (AAL)

American Airlines Group is another major player in the US airline industry. The company has been able to navigate the pandemic with a strong financial position, thanks to its prudent management and strategic investments.

American Airlines has been focusing on improving its customer experience, including upgrading its aircraft interiors and investing in new technology. The airline also boasts a robust network, serving over 350 destinations globally. As the industry recovers, American Airlines Group is expected to see significant growth in its revenue and profits.

United Airlines Holdings (UAL)

United Airlines Holdings is known for its premium offerings and global reach. The company has been making strides in the market, with a strong focus on technology and customer service.

United Airlines has been investing in its fleet, with the introduction of new aircraft and enhanced amenities. The airline also has a strong international presence, serving over 200 destinations worldwide. With its commitment to innovation and customer satisfaction, United Airlines Holdings is a top pick for investors looking to capitalize on the airline industry’s recovery.

Southwest Airlines (LUV)

Southwest Airlines is known for its low-cost, point-to-point service, making it a favorite among budget-conscious travelers. The airline has been able to maintain its market share and profitability even during the pandemic, thanks to its efficient operations and strong brand loyalty.

Southwest Airlines has been investing in its fleet, with a significant number of new aircraft orders. The company also has a robust network, serving over 100 destinations in the United States. As the industry continues to recover, Southwest Airlines is expected to see strong growth in its passenger numbers and revenue.

Case Study: JetBlue Airways (JBLU)

JetBlue Airways is a smaller player in the US airline industry, but it has made a significant impact with its unique business model. The airline has been able to differentiate itself from its competitors by focusing on customer service and a premium experience.

JetBlue has invested in its fleet, with new aircraft orders and enhanced amenities. The company has also been expanding its network, serving over 100 destinations in the United States and the Caribbean. As the industry recovers, JetBlue Airways is expected to see significant growth in its revenue and profits.

In conclusion, the airline industry is poised for growth in 2023, and these top US airline stocks are well-positioned to capitalize on the opportunities ahead. Whether you’re looking for a major player or a smaller, niche airline, there are plenty of options to choose from. As always, do your due diligence and consult with a financial advisor before making any investment decisions.

so cool! ()

last:Unlock the Potential of US Glass Company Stocks

next:nothing

like

- Unlock the Potential of US Glass Company Stocks

- Unlocking the Secrets of US Prison Stocks: A Comprehensive Guide

- Top US Hemp Stocks to Watch in 2023

- Does Toys 'R' Us Have Fidget Spinners in Stock?" - Your Ultima

- Sugar and Thermal Energy Companies on the US Stock Exchange: A Comprehensive Anal

- Tencent Stock US: The Latest Insights and Investment Opportunities

- Lenovo US Stock Symbol: The Ultimate Guide to Investing in the Tech Giant

- Maximize Your Stock Value with Mat Us: A Comprehensive Guide

- "Toys R Us Stocking Pay: What You Need to Know About Retail Compensation

- US Steel Stock Price Target: What Analysts Are Saying

- Toys "R" Us Stock: A Journey from 1978 to Present

- Unlocking the US Stock Exchange: The Ultimate Guide to JHolidays

hot stocks

Unlocking Potential: Exploring US Small Cap Bi

Unlocking Potential: Exploring US Small Cap Bi- Unlocking Potential: Exploring US Small Cap Bi"

- Top US Stock to Buy: Unveiling the Ultimate In"

- "5 Crucial Things to Know Before Trad"

- Can Indian Citizens Trade in the US Stock Mark"

- US Bank Corp Stock Price Today: Key Insights a"

- US Made L1A1 Stock Set: The Ultimate Upgrade f"

- Best Performing US Stocks Past 5 Days: Momentu"

- Top 10 Dividend Stocks in the US: Secure Your "

recommend

Best US Airline Stocks: Top Picks for 2023

Best US Airline Stocks: Top Picks for 2023

Top 10 Dividend Stocks in the US: Secure Your

Singapore Trade: How to Invest in US Stocks fr

"Gree Us Stock: Your Ultimate Guide t

Top US Stocks Momentum 2025: A Comprehensive G

Stocks CHK-US: Unveiling the Potential of U.S.

IG Trading Adds US Stocks: A Game-Changer for

Construction Stocks: A Smart Investment in the

Does Toys 'R' Us Have Fidget Spinner

"Unlocking the Secrets of US Stock Ch

How to Buy Shiba Inu Stock in the US: A Compre

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Unlocking the Potential of US Materials Stock:"

- US Ending Stocks of Ethane and Ethylene: A Com"

- How to Invest in US Stocks for Foreign Investo"

- Unlocking the Potential of Constellation Softw"

- Average Return in US Stock Market: Insights an"

- "Unveiling the Average Rate of Return"

- Lumber Stocks: A Boon for Investors in the US"

- Toyota Tacoma Mass Air Flow 2.7 2000 US Stock:"

- "Maximizing Your Investment Potential"

- US Election Results: A Major Impact on the Sto"