you position:Home > us stock market today > us stock market today

Top US Dividend Stocks 2017: A Guide to Investment Success

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In the world of investments, dividends play a crucial role in maximizing returns. Dividend stocks have long been favored by investors seeking stable income and long-term growth. In 2017, several U.S. companies stood out as top dividend stocks, offering attractive yields and potential for capital appreciation. This article explores the top U.S. dividend stocks from 2017 and provides insights into why they were considered investment gems.

Exxon Mobil Corporation (XOM)

Exxon Mobil Corporation, often referred to as "Exxon," was a standout dividend stock in 2017. As one of the largest oil and gas companies in the world, Exxon offered a dividend yield of 3.2%. The company's robust financial performance and commitment to shareholder returns made it a top pick among dividend investors.

Johnson & Johnson (JNJ)

Johnson & Johnson, a leading healthcare company, was another top dividend stock in 2017. With a dividend yield of 2.7%, JNJ offered investors a stable source of income. The company's diverse product portfolio, including pharmaceuticals, consumer healthcare, and medical devices, contributed to its consistent performance and strong dividend payments.

Procter & Gamble (PG)

Procter & Gamble, a household name in consumer goods, was a top dividend stock in 2017. With a dividend yield of 3.0%, P&G provided investors with a reliable income stream. The company's strong brand portfolio, including brands like Gillette, Tide, and Pampers, ensured its continued success and attractive dividend payments.

Microsoft Corporation (MSFT)

Microsoft Corporation, a global leader in technology, was a top dividend stock in 2017. With a dividend yield of 1.8%, Microsoft offered investors a blend of income and growth potential. The company's diverse revenue streams, including software, cloud computing, and gaming, contributed to its strong financial performance and attractive dividend yield.

Apple Inc. (AAPL)

Apple Inc., the world's largest technology company, was another top dividend stock in 2017. With a dividend yield of 1.4%, Apple provided investors with a stable income stream and potential for capital appreciation. The company's innovative products, strong brand, and commitment to shareholder returns made it a top pick among dividend investors.

Case Study: Coca-Cola Company (KO)

While not a top dividend stock in 2017, the Coca-Cola Company is a prime example of a successful dividend-paying company. With a dividend yield of 3.1% in 2017, Coca-Cola provided investors with a consistent income stream. The company's global brand presence and strong financial performance contributed to its ability to consistently increase dividends over the years.

Conclusion

The top U.S. dividend stocks of 2017 offered investors a blend of stable income and potential for capital appreciation. Companies like Exxon Mobil, Johnson & Johnson, Procter & Gamble, Microsoft, and Apple demonstrated the power of dividends in creating wealth over time. As investors continue to seek attractive dividend opportunities, these companies serve as a testament to the importance of dividends in building a diversified portfolio.

so cool! ()

last:Unlock the Potential of US Stock KDHAX: A Comprehensive Guide

next:nothing

like

- Unlock the Potential of US Stock KDHAX: A Comprehensive Guide

- Gallup US Stock Ownership Survey: Insights into America's Investment Habits&

- Unlocking the Potential of Adobe: A Deep Dive into Adobe's Stock Performance

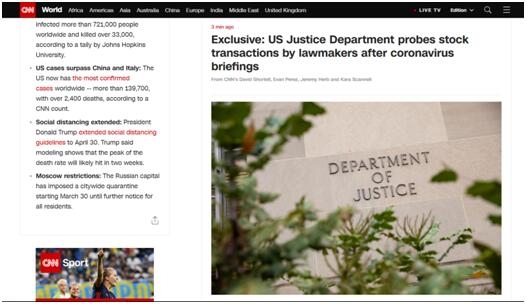

- US Senator Sold Stock Holdings: The Truth Behind the Controversy

- US Stock Exchange Opens: Key Insights and Market Movements

- US Job Data: How It Impacts the Stock Market"

- Unlocking the Potential of US Steel Mining Stocks

- US Stock Market and Trump's Signature Moves: A Comprehensive Analysis

- Title: Best US Stocks for Swing Trading: Top Picks for Investors

- US Foods Stock Market Price: A Comprehensive Analysis

- Sector Performance on June 3, 2025: A Deep Dive into the US Stock Market

- Oman Stocks: A Promising Investment Destination for US Investors

hot stocks

Maximizing Returns: Exploring General Electric

Maximizing Returns: Exploring General Electric- Maximizing Returns: Exploring General Electric"

- US Copper Stocks to Buy: Top Picks for Investo"

- Meip-US Stock Price: A Comprehensive Analysis"

- Ammunition Stocks: The Comprehensive Guide for"

- Buying US Stocks as a Foreigner: A Comprehensi"

- Monthly US Dividend Stocks: Your Guide to Cons"

- http stocks.us.reuters.com stocks fulldescript"

- US Pre-Market Stock: A Comprehensive Guide to "

recommend

Top US Dividend Stocks 2017: A Guide to Invest

Top US Dividend Stocks 2017: A Guide to Invest

Unlocking the Potential of AES: A Comprehensiv

Understanding the Dow Jones Total U.S. Stock M

Unusual Options Sweeps Today: A Deep Dive into

"Unveiling the Intricacies of US Stoc

How Does War Affect the US Stock Market?

60 Percent Stock Allocation: A Strategic Insig

How Much Tax on US Stock Gains: A Comprehensiv

Is China Investing in US Stocks? The Growing T

Evergrande US Stock: The Inside Story of a Maj

"Top Oil and Gas Stocks in the US: Yo

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- ESSO US Stock History: A Comprehensive Overvie"

- Current State of the US Stock Market in March "

- Unlocking Global Opportunities: The Ultimate G"

- Dow Jones US Total Stock Market Index Constitu"

- Best Stock to Buy in US Market Now: Top 5 Pick"

- Chinese Economic Espionage and Its Impact on t"

- Is the US Government Buying Stocks? A Comprehe"

- Diamond Stocks in the US Market: A Lucrative I"

- Canopy Growth Corp US Stock Symbol: A Comprehe"

- Australian Stock Market vs. US Stock Market: A"