you position:Home > us stock market today > us stock market today

Is the U.S. Stock Market in Bubble Territory?

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

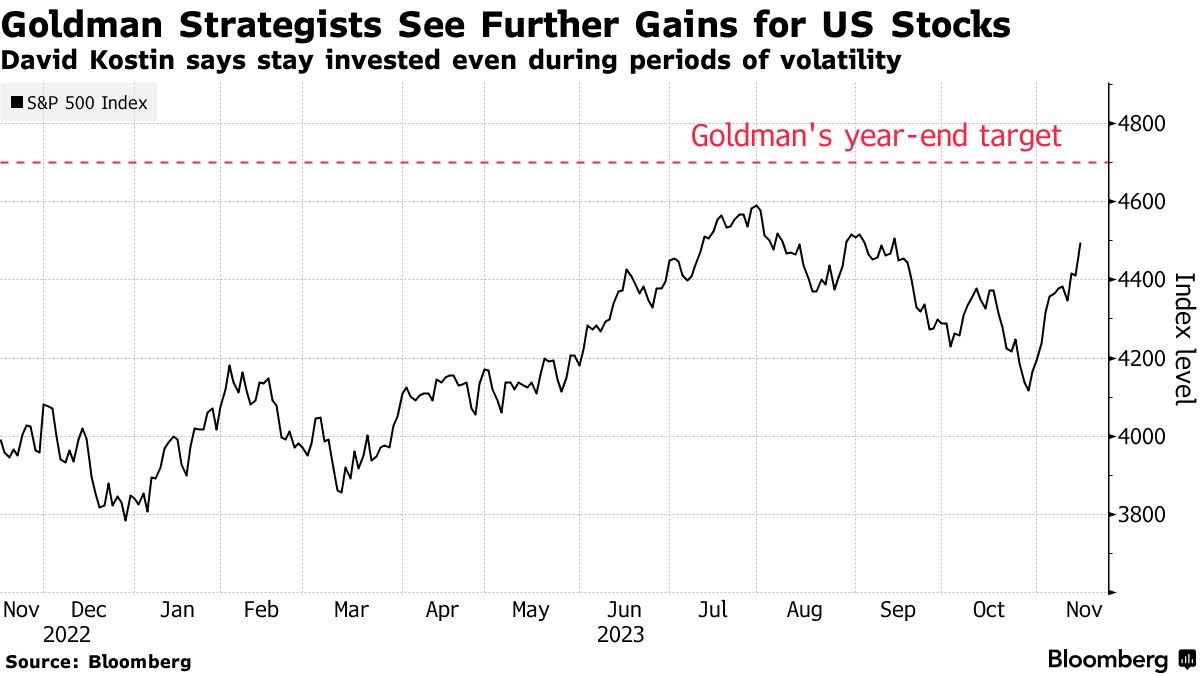

The U.S. stock market has long been the gold standard for investors seeking high returns. However, some market watchers are now questioning whether the current bull run has reached a point of no return, with concerns of a bubble forming. In this article, we'll delve into the factors that could indicate whether the U.S. stock market is in bubble territory.

Historical Perspective

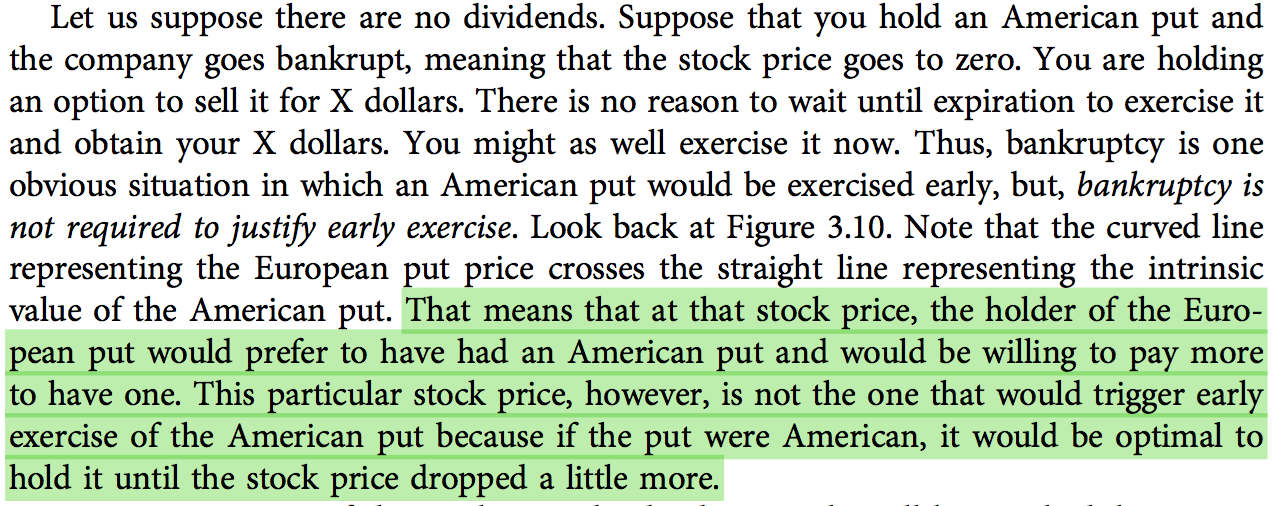

To understand whether the current stock market is in bubble territory, it's essential to look at historical data. Historically, stock market bubbles have occurred when the price of assets, such as stocks, becomes significantly detached from their fundamental value. One classic example is the dot-com bubble of the late 1990s, when technology stocks soared to absurd valuations, only to collapse spectacularly.

Valuation Metrics

One of the primary indicators of a bubble is an overheated valuation. The most commonly used valuation metrics include the Price-to-Earnings (P/E) ratio and the Price-to-Book (P/B) ratio. Currently, the S&P 500 has a P/E ratio of around 22, which is higher than its historical average of around 15. Additionally, the P/B ratio is also elevated, suggesting that stocks may be overvalued.

Economic Factors

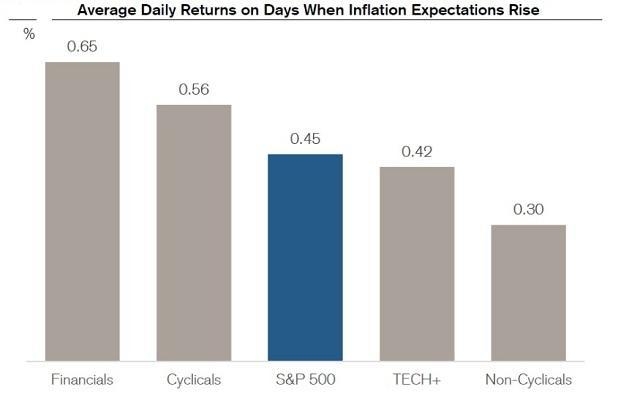

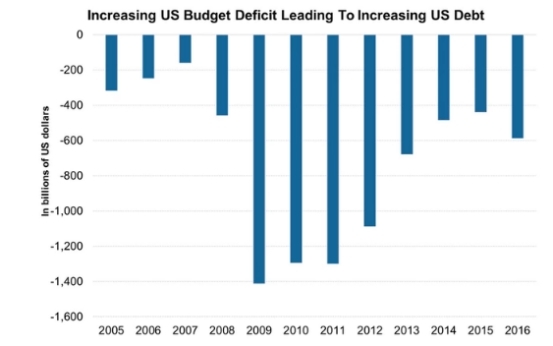

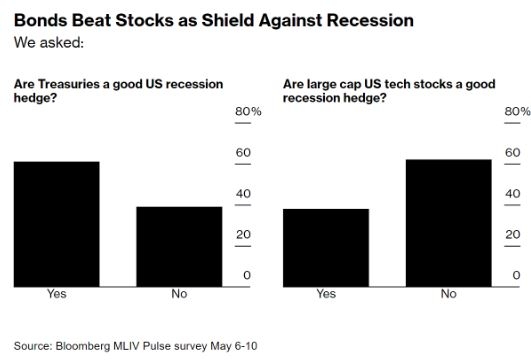

Economic factors such as interest rates and inflation can also contribute to stock market bubbles. Currently, the Federal Reserve has kept interest rates low to stimulate economic growth, which has led to increased borrowing and spending. However, if inflation starts to rise, the Fed may need to raise interest rates, which could hurt stock prices.

Market Sentiment

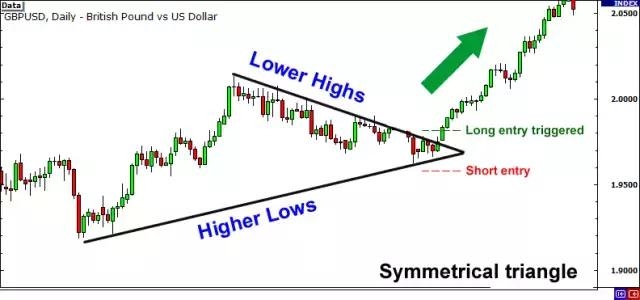

Market sentiment is another critical factor to consider. Currently, investor optimism is at an all-time high, with many believing that the bull run will continue indefinitely. This optimism can lead to excessive buying, driving stock prices even higher, potentially creating a bubble.

Sector Analysis

Certain sectors, such as technology and real estate, have seen significant growth in recent years. For example, the technology sector has seen a surge in stocks like Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN). While these companies are innovative and have strong fundamentals, their valuations may be stretched, raising concerns about a bubble.

Conclusion

While it's difficult to predict whether the U.S. stock market is in bubble territory, it's essential to consider the factors mentioned above. With valuations at historic highs, economic uncertainty, and excessive optimism, the risk of a bubble forming is indeed present. Investors should proceed with caution and conduct thorough research before making investment decisions.

so cool! ()

last:Stock Premarket Quotes: Your Gateway to Early Market Insights

next:nothing

like

- Stock Premarket Quotes: Your Gateway to Early Market Insights

- News on Dow Jones Today: Key Developments and Market Insights

- Total US Stock Market Mutual Funds: A Comprehensive Guide

- How's the NASDAQ: A Comprehensive Analysis of the Stock Market Index

- Unlocking the Potential of MNTR.PK: A Deep Dive into the Stock's Full Descri

- Dow Price Chart: A Comprehensive Guide to Understanding Market Trends

- Top US Stocks by Market Cap List: A Comprehensive Guide

- Market Friday: The Ultimate Guide to Maximizing Your Weekly Sales

- Best Small US Stocks to Buy: Top Picks for Investors"

- Dow Jones Performance Today: Key Insights and Market Analysis

- Are US Stocks Falling? What You Need to Know About the Current Market Trends&

- Maximizing Your Productivity: The Ultimate Guide to SP Tracker

hot stocks

Maximizing Returns: Exploring General Electric

Maximizing Returns: Exploring General Electric- Maximizing Returns: Exploring General Electric"

- US Copper Stocks to Buy: Top Picks for Investo"

- Meip-US Stock Price: A Comprehensive Analysis"

- Ammunition Stocks: The Comprehensive Guide for"

- Buying US Stocks as a Foreigner: A Comprehensi"

- Monthly US Dividend Stocks: Your Guide to Cons"

- http stocks.us.reuters.com stocks fulldescript"

- US Pre-Market Stock: A Comprehensive Guide to "

recommend

Is the U.S. Stock Market in Bubble Territory?

Is the U.S. Stock Market in Bubble Territory?

Is the US Stock Market Open on New Year's

US Investors Grow Cautious Despite Stock Marke

In-Depth Analysis of Vigilant's Stock Per

Activision Blizzard US Stocks: A Comprehensive

Dow Jones Stocks Decline: Understanding the La

Can I Buy VW Stock in the US? Your Ultimate Gu

Monthly US Dividend Stocks: Your Guide to Cons

Buying US Stocks as a Foreigner: A Comprehensi

US Foods Stock Yards Chesterfield: A Glimpse i

Understanding the 1929 Stock Market Crash: A D

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- "Top High Dividend Paying Stocks in t"

- Mid Cap US Stocks: A Path to Sustainable Growt"

- Understanding the Johnson & Johnson US"

- Buying US Stocks as a Foreigner: A Comprehensi"

- Title: Comprehensive Analysis of Sial Corporat"

- Hot US Stocks Today: Top Picks for Investors"

- Today's WSJ US Stock Market Summary: Key "

- Is the US Stock Market Up or Down?"

- Unlocking the Potential of Adobe: A Deep Dive "

- US Alternative Energy Stocks: A Smart Investme"