you position:Home > us stock market today > us stock market today

Dow Price Chart: A Comprehensive Guide to Understanding Market Trends

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

Are you intrigued by the stock market and want to delve into the complexities of the Dow price chart? Look no further! This comprehensive guide will help you understand market trends, make informed decisions, and gain insights into the behavior of the Dow Jones Industrial Average.

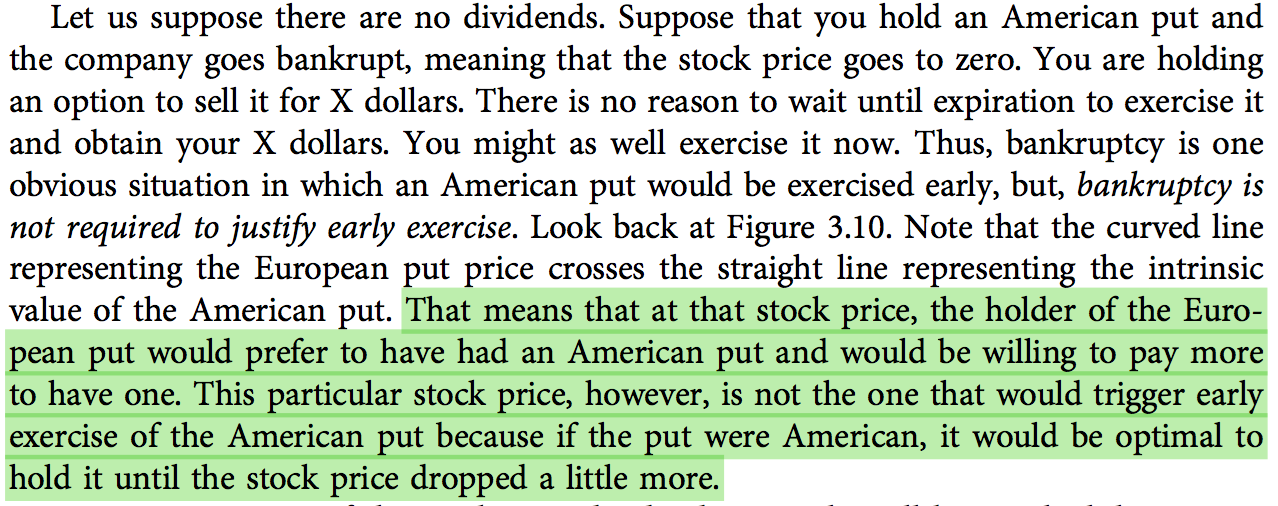

Understanding the Dow Price Chart

The Dow price chart is a graphical representation of the movement of the Dow Jones Industrial Average, one of the most iconic and widely followed stock market indices in the United States. It tracks the performance of 30 major publicly-traded companies, covering various sectors such as financials, technology, and healthcare.

The chart typically displays the stock prices over a specified period, often days, weeks, months, or even years. By analyzing this chart, investors can identify trends, patterns, and potential future movements of the Dow.

Key Features of the Dow Price Chart

- Time Frames: The Dow price chart can be viewed in different time frames, such as daily, weekly, monthly, or even yearly. Each time frame provides a different perspective on the market trends.

- Price Bars: Each price bar on the chart represents a specific time period, usually one day. It shows the opening price, closing price, high price, and low price for that period.

- Support and Resistance Levels: These levels indicate where the market may encounter strong buying or selling pressure. Understanding these levels can help you predict potential price movements.

- Moving Averages: These are indicators that smooth out price data over a specified period, helping investors identify trends and potential entry or exit points.

- Technical Indicators: These are mathematical calculations based on past price and volume data. They provide additional insights into market behavior and potential future movements.

Analyzing the Dow Price Chart

Identifying Trends: Look for patterns such as uptrends, downtrends, and sideways movements. Uptrends are characterized by higher highs and higher lows, while downtrends are marked by lower highs and lower lows. Sideways movements indicate a period of consolidation. Recognizing Patterns: Technical patterns such as head and shoulders, triangles, and flags can indicate potential reversals or continuation of the current trend. Using Indicators: Utilize indicators like the RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands to confirm your analysis and make more informed decisions.

Case Study: The Dow Price Chart in 2020

The Dow price chart in 2020 provides an excellent example of market volatility and resilience. The year started with a sharp decline following the outbreak of the COVID-19 pandemic. However, as the situation improved, the market recovered, with the Dow reaching new all-time highs by the end of the year. This case study demonstrates the importance of understanding market trends and adapting to changing conditions.

Conclusion

By understanding the Dow price chart, you can gain valuable insights into the behavior of the stock market and make informed decisions. Analyze trends, recognize patterns, and use indicators to improve your trading and investment strategies. Stay tuned for our next article, where we'll dive deeper into advanced trading strategies based on the Dow price chart.

so cool! ()

last:Top US Stocks by Market Cap List: A Comprehensive Guide

next:nothing

like

- Top US Stocks by Market Cap List: A Comprehensive Guide

- Market Friday: The Ultimate Guide to Maximizing Your Weekly Sales

- Best Small US Stocks to Buy: Top Picks for Investors"

- Dow Jones Performance Today: Key Insights and Market Analysis

- Are US Stocks Falling? What You Need to Know About the Current Market Trends&

- Maximizing Your Productivity: The Ultimate Guide to SP Tracker

- Share Market History Chart: A Visual Journey Through Stock Market Milestones&

- Moto E 2nd Gen US Cellular Stock Firmware: The Ultimate Guide

- Understanding the Premarket US Stock Market: A Comprehensive Guide

- Historical Stock Prices: Unveiling the Past with MarketWatch

- Owning Us Stocks in Canada: A Strategic Investment Move

- Best US Stock Today: Top Picks for Investors"

hot stocks

Maximizing Returns: Exploring General Electric

Maximizing Returns: Exploring General Electric- Maximizing Returns: Exploring General Electric"

- US Copper Stocks to Buy: Top Picks for Investo"

- Meip-US Stock Price: A Comprehensive Analysis"

- Ammunition Stocks: The Comprehensive Guide for"

- Buying US Stocks as a Foreigner: A Comprehensi"

- Monthly US Dividend Stocks: Your Guide to Cons"

- http stocks.us.reuters.com stocks fulldescript"

- US Pre-Market Stock: A Comprehensive Guide to "

recommend

Dow Price Chart: A Comprehensive Guide to Unde

Dow Price Chart: A Comprehensive Guide to Unde

Tickertape for US Stocks: A Comprehensive Guid

Top 50 US Stocks: The Ultimate Investment Guid

US Stock Exchange Opens: Key Insights and Mark

Data Centre Stocks: The US Market's Hidde

Investing in the USA: Top Mutual Funds for US

Stock Shorting: The Silent Killer of the US Ma

"Decoding the US Stock Market: A Deca

Stocks Down the Most Today: What You Need to K

Mesoblast US Stock Price: A Comprehensive Anal

Dow Jones Stock Market Graph: A Comprehensive

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Stock Market on 1/20/25: Key Developments and "

- Only Us Corporations Can List Their Stocks on "

- US Pre-Market Stock: A Comprehensive Guide to "

- Lowest Stock Availability: Understanding the C"

- Best US Stock to Buy Today: Top Picks for 2023"

- Understanding the US Market Value: Key Insight"

- Top US Stocks Market Cap: Unveiling the Giants"

- Can I Buy US Stocks in Australia? A Comprehens"

- "Europe vs. US Stock Market: A Compar"

- Maximizing Returns: A Deep Dive into the US St"