you position:Home > us stock market today > us stock market today

2024 US Stocks: Top Trends and Predictions

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

As we dive into the new year, investors are eagerly eyeing the 2024 US stock market. With a host of factors at play, including economic indicators, geopolitical tensions, and technological advancements, the outlook for US stocks is as dynamic as ever. In this article, we'll explore the top trends and predictions for the 2024 US stock market, providing investors with valuable insights to guide their decisions.

Tech Giants Dominate

Tech stocks have always been a cornerstone of the US stock market, and 2024 is no exception. Companies like Apple, Microsoft, and Amazon continue to dominate the industry, driving market growth. These tech giants have a strong hold on their respective markets, from smartphones to cloud computing, and are expected to continue their upward trajectory in 2024.

E-commerce Giant Amazon's Expansion

One particular company to watch is Amazon. With its vast ecosystem of products and services, Amazon has expanded its reach into various industries, from grocery to healthcare. Analysts predict that Amazon's continued expansion will drive significant revenue growth in 2024. Additionally, the company's focus on sustainability and innovation is expected to attract new customers and solidify its position as a market leader.

Biotech and Healthcare Innovation

The biotech and healthcare sectors are also poised for significant growth in 2024. With advancements in gene editing, AI, and personalized medicine, these industries are revolutionizing the way we approach healthcare. Companies like Regeneron and Moderna are leading the charge, developing groundbreaking treatments and vaccines that have the potential to transform the industry.

Sustainable Investing Gains Momentum

Sustainability is becoming an increasingly important factor in the stock market, and 2024 is expected to see a surge in sustainable investing. As more investors recognize the long-term benefits of investing in companies that prioritize environmental, social, and governance (ESG) factors, we can expect to see a shift in market dynamics. Companies that score well on ESG metrics are likely to attract greater investor interest and outperform their peers.

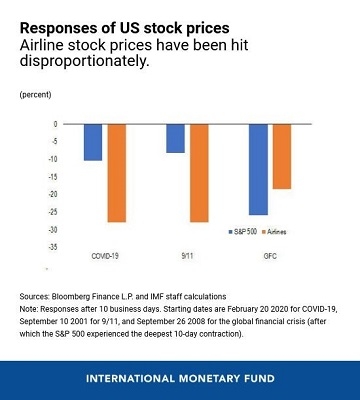

Geopolitical Tensions and Market Volatility

While there are numerous opportunities in the US stock market, geopolitical tensions remain a significant concern. Tensions between the US and China, along with other global conflicts, could lead to market volatility in 2024. Investors should stay vigilant and be prepared for potential disruptions.

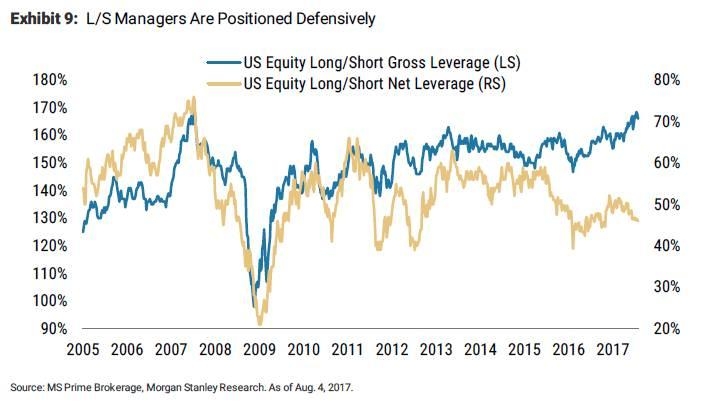

Sector Rotation and Diversification

In the face of market volatility, sector rotation and diversification will be key strategies for investors in 2024. As certain sectors outperform others, investors can capitalize on these shifts by reallocating their portfolios accordingly. Additionally, diversifying across various asset classes and regions can help mitigate risks and protect investments.

Conclusion

As we navigate the complexities of the 2024 US stock market, it's essential for investors to stay informed and adapt to the changing landscape. By focusing on key trends such as tech giants, biotech innovation, sustainable investing, and sector rotation, investors can position themselves for success in the year ahead.

so cool! ()

last:CNN and Commodities: Revolutionizing Market Analysis

next:nothing

like

- CNN and Commodities: Revolutionizing Market Analysis

- Best Finance Newspaper: Your Ultimate Resource for Financial Insights

- Bubble Us Stocks: A Comprehensive Guide to Identifying and Navigating Stock Marke

- Mounjaro Out of Stock in the US: What You Need to Know

- Cheapest US Paying Dividend Stock: Your Guide to Maximizing Returns

- Dow Chart 10 Years: A Comprehensive Analysis of the Stock Market's Journey

- Biggest Gainers: Unveiling the US Stocks on a Roll

- Stocks Diving: Understanding the Dive and How to Navigate It

- Cresco Labs US CBD Stocks: The Emerging Market to Watch

- How Long Has the US Stock Market Been Around?

- Maximizing Profits: A Deep Dive into NYSE Stock Prices"

- Unlocking the Potential of Dou Jones: A Comprehensive Guide

hot stocks

Maximizing Returns: Exploring General Electric

Maximizing Returns: Exploring General Electric- Maximizing Returns: Exploring General Electric"

- US Copper Stocks to Buy: Top Picks for Investo"

- Meip-US Stock Price: A Comprehensive Analysis"

- Ammunition Stocks: The Comprehensive Guide for"

- Buying US Stocks as a Foreigner: A Comprehensi"

- Monthly US Dividend Stocks: Your Guide to Cons"

- http stocks.us.reuters.com stocks fulldescript"

- US Pre-Market Stock: A Comprehensive Guide to "

recommend

2024 US Stocks: Top Trends and Predictions

2024 US Stocks: Top Trends and Predictions

Top Stock Companies in the US: Your Ultimate G

Understanding the KEG Stock Price: A Comprehen

US Alternative Energy Stocks: A Smart Investme

Markets Open: A Comprehensive Guide to the US

Unlocking the Potential of WFC: A Deep Dive in

Best Stock to Buy in US Market Now: Top 5 Pick

Best US Stock Today: Top Picks for Investors&a

Meip-US Stock Price: A Comprehensive Analysis

Us Cellular Stock Price Today: A Comprehensive

Average Daily Dollar Volume in the US Stock Ma

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Market Forecast Tomorrow: Unveiling the Trends"

- German Gun Stocks: A Comprehensive Guide for U"

- Historic P/E Ratio of the US Stock Market: Ins"

- US Job Data: How It Impacts the Stock Market&a"

- Dow Jones vs. CNN News: A Comprehensive Compar"

- Stock Market Change Since Trump Took Office: A"

- How Long Has the US Stock Market Been Around?"

- US President News Impact Stock Market: A Look "

- Contango Minerals US Stock Price: Insights and"

- Understanding the Daily Dollar Value of Traded"