you position:Home > us stock market live > us stock market live

US Small Cap Stocks Performance 2025: A Comprehensive Outlook

![]() myandytime2026-01-19【us stock market today live cha】view

myandytime2026-01-19【us stock market today live cha】view

info:

Introduction

The US small cap stock market has always been a significant area of interest for investors seeking high-growth potential. As we approach 2025, it's crucial to understand the performance trends and opportunities that these stocks might offer. This article delves into the expected performance of US small cap stocks in 2025, highlighting key factors that could influence their growth trajectory.

Market Dynamics

In recent years, the US small cap stock market has witnessed a surge in interest due to the attractive growth prospects offered by these companies. Typically, small cap stocks are those with a market capitalization of less than $2 billion. These companies often operate in niche markets or are in the early stages of expansion, making them more volatile but also more rewarding.

Economic Factors

Several economic factors are expected to impact the performance of US small cap stocks in 2025. Here are some of the key factors:

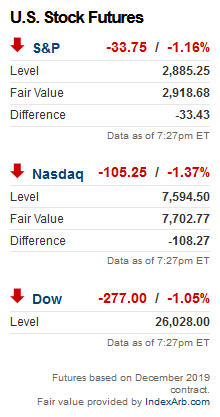

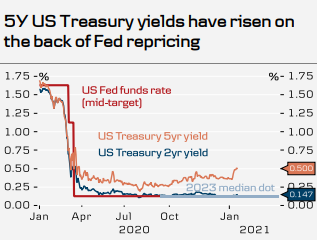

- Interest Rates: The Federal Reserve's monetary policy will play a crucial role in determining the performance of small cap stocks. Lower interest rates can lead to increased borrowing and investment, which can boost small cap companies' growth prospects.

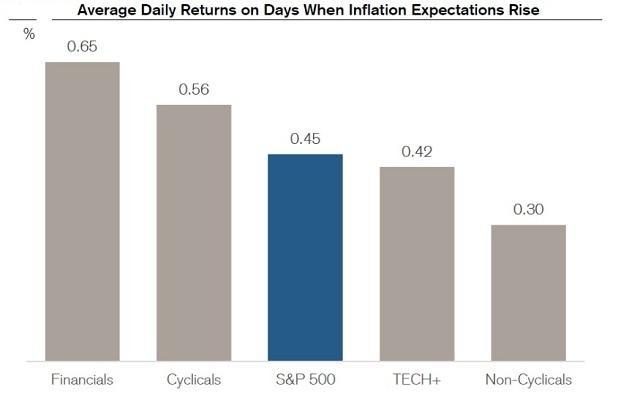

- Inflation: High inflation can erode the purchasing power of consumers and investors, potentially affecting the profitability of small cap companies. However, some small cap companies may benefit from inflation due to their ability to pass on increased costs to customers.

- Global Economic Conditions: The global economic landscape, including trade policies and economic growth in major economies, can significantly impact the performance of US small cap stocks.

Sector Trends

Different sectors within the small cap market are expected to perform differently in 2025. Here are some sector trends to watch:

- Technology: The technology sector has been a major driver of growth in the small cap market. Companies involved in artificial intelligence, cybersecurity, and cloud computing are expected to continue performing well.

- Healthcare: The healthcare sector is another area with significant potential for growth. Companies involved in biotechnology, medical devices, and telemedicine are expected to benefit from increasing demand for healthcare services.

- Energy: The energy sector, particularly renewable energy companies, is expected to see strong growth due to increasing environmental concerns and government incentives.

Case Studies

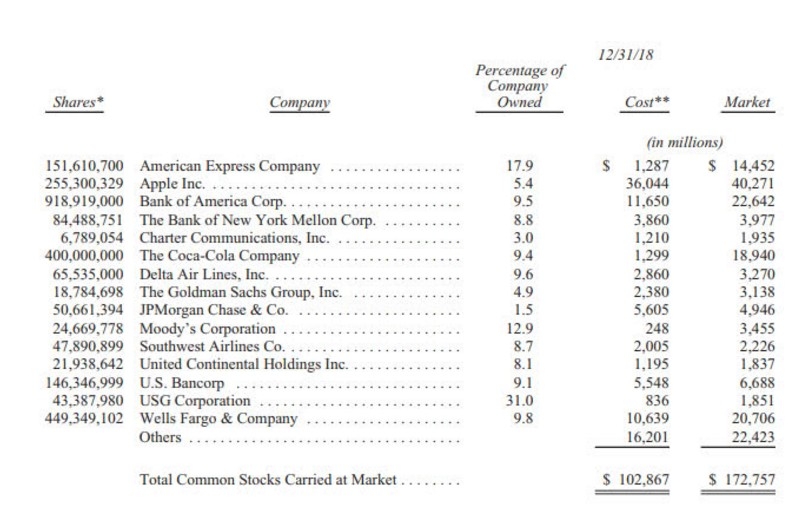

To provide a clearer picture of the potential performance of US small cap stocks in 2025, let's look at a couple of case studies:

- Company A: A technology company with a market capitalization of $1.5 billion has been investing heavily in research and development. With the expected growth in the AI market, this company is poised to see significant returns on its investments.

- Company B: A healthcare company with a market capitalization of $1.2 billion has developed a new drug that has shown promising results in clinical trials. If approved, this drug could lead to substantial revenue growth for the company.

Conclusion

The performance of US small cap stocks in 2025 will be influenced by a variety of factors, including economic conditions, sector trends, and individual company performance. While the market is expected to present attractive opportunities, investors should conduct thorough research and consider the risks associated with investing in small cap stocks.

so cool! ()

last:Understanding Canadian Trading US Stocks Tax Implications

next:nothing

like

- Understanding Canadian Trading US Stocks Tax Implications

- Foreigners Investing in US Stock Market: Opportunities and Considerations

- How to Buy Raspberry Pi Stock in the US: A Comprehensive Guide

- Can You Put Us Stocks in a TFSA? The Ultimate Guide to TFSA Stock Investing

- Chinese EV Stocks in the US: A Comprehensive Guide

- Unleash the Power of US Stock Analysis Screener: Your Ultimate Investment Tool

- Recent Momentum Stocks: US Tech's Rising Stars

- How Many Stocks Were Sold in the US in 2018? A Deep Dive into the Numbers

- Maximizing Efficiency: The Ultimate Guide to US Parts Stock

- Title: "Best Performing US Stocks: Top 5 from August 2025"

- How to Invest in US Stocks from India in 2025: A Comprehensive Guide

- High Volatile US Stocks: Navigating the Turbulent Waters

hot stocks

Title: "Best Performing US Stocks: To

Title: "Best Performing US Stocks: To- Title: "Best Performing US Stocks: To"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- Momentum Stocks: A 5-Day Performance Review in"

- Himalaya Capital: A Deep Dive into Their US St"

- Sprint US Stock: The Ultimate Guide to Investi"

- The Future of the U.S. Stock Market: Trends an"

recommend

US Small Cap Stocks Performance 2025: A Compre

US Small Cap Stocks Performance 2025: A Compre

US Border Patrol 28 1/24 Scale Stock Car: The

Five US Tech Giants Spend $115B on Buying Back

Title: "Is Today a US Stock Market Ho

Himalaya Capital: A Deep Dive into Their US St

Aritzia Stock US: A Comprehensive Analysis for

US Cellular Stock Drop: What's Behind the

Buying US Stocks in Canada with Questrade: A C

Title: "Best Performing US Stocks: To

Best Cheap US Stocks: Discover Hidden Gems for

Best Performing US Stocks Last Hour: Dividend

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- Title: Maximizing Total Return for US Stocks: "

- 5110 Overseas Hwy, Stock Island, FL 33040: A P"

- Coupang US Stock: A Deep Dive into the South K"

- Can a Non-US Citizen Buy Stocks in the United "

- Chinese EV Stocks in the US: A Comprehensive G"

- The Future of the U.S. Stock Market: Trends an"

- Maximizing Returns: The Power of US Banking St"

- Momentum Stocks: A 5-Day Performance Review in"

- Mounjaro Out of Stock in the US: What You Need"

- US Nuclear Stock Price: A Comprehensive Guide "