you position:Home > us stock market live > us stock market live

Top US Mid-Cap Stocks: Investment Opportunities to Watch

![]() myandytime2026-01-19【us stock market today live cha】view

myandytime2026-01-19【us stock market today live cha】view

info:

Investing in the stock market can be a lucrative venture, especially when you focus on mid-cap companies. These businesses are not as large as the big players but are often overlooked, presenting significant opportunities for growth. In this article, we will explore the top US mid-cap stocks to watch, offering insights into why they could be a wise investment choice.

Understanding Mid-Cap Stocks

Mid-cap stocks are defined by their market capitalization, which falls between small-cap and large-cap companies. Typically, mid-cap stocks have a market cap of between

Why Invest in Mid-Cap Stocks?

Investing in mid-cap stocks offers several advantages:

- Potential for Growth: Mid-cap companies often have the potential for significant growth as they scale up their operations.

- Better Risk-Reward Ratio: Mid-caps generally offer a better risk-reward ratio compared to large-cap stocks, making them attractive to investors seeking growth opportunities.

- Lower Volatility: While mid-caps may be more volatile than large-cap stocks, they often experience less volatility than small-caps, providing a balance between risk and return.

Top US Mid-Cap Stocks to Watch

- Apple Inc. (AAPL): Apple is a global leader in consumer electronics and has a market cap of over $2 trillion. Despite its large size, Apple is often considered a mid-cap stock due to its consistent growth and potential for future expansion.

- Tesla, Inc. (TSLA): Tesla has revolutionized the automotive industry with its electric vehicles and renewable energy products. The company's market cap is currently around $600 billion, making it a prime candidate for mid-cap status.

- NVIDIA Corporation (NVDA): NVIDIA is a leader in graphics processing units (GPUs) and is driving the growth of the artificial intelligence and gaming industries. With a market cap of around $400 billion, NVIDIA is a mid-cap stock with significant potential for growth.

- Adobe Inc. (ADBE): Adobe is a dominant player in the software industry, offering solutions for creative professionals and businesses. The company has a market cap of around $200 billion and is a top pick for mid-cap investors.

- Microsoft Corporation (MSFT): Microsoft is a global technology giant with a market cap of over $2 trillion. While it may seem like a large-cap stock, Microsoft's consistent growth and diversification make it a solid mid-cap investment.

Case Study: NVIDIA Corporation

NVIDIA's success as a mid-cap stock can be attributed to its innovative products and strategic partnerships. The company's GPUs are used in a wide range of applications, from gaming to AI and data analytics. NVIDIA's revenue has grown significantly over the past few years, and the company is expected to continue its upward trajectory as it expands into new markets.

In conclusion, investing in top US mid-cap stocks can be a smart move for investors seeking growth opportunities. These companies often offer a balance between risk and return, with substantial potential for future expansion. By focusing on mid-caps, investors can diversify their portfolios and potentially achieve higher returns.

so cool! ()

like

- US Steel Companies Stocks: A Comprehensive Analysis

- Best Performing Large Cap US Stock in Q2 2025: NXTT Shines Bright

- How to Buy Stock in Dinglong Culture Co., Ltd. (US)

- "Ingenix (INGN.O): A Deep Dive into the Full Description of This Stock&a

- Pharmacare US Inc Stock: A Deep Dive into the Future of Healthcare

- Airline Stocks in the US Stock Market: A Comprehensive Overview

- How to Invest in the US Stock Market from Jamaica: A Comprehensive Guide

- US Oil Prices Stock: What You Need to Know

- "Shorting US Stocks: A Strategic Approach to Investment"

- Unlocking the Potential of CRCL Stock: A Comprehensive Analysis

- "S&P 500's Influence on US Stock Market Capitalization in 2

- "http stocks.us.reuters.com stocks fulldescription.asp rpc 66&sy

hot stocks

"Best Performing US Stocks: Top 5 fro

"Best Performing US Stocks: Top 5 fro- "Best Performing US Stocks: Top 5 fro"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Momentum Stocks: A 5-Day Performance Review in"

- Himalaya Capital: A Deep Dive into Their US St"

- Sprint US Stock: The Ultimate Guide to Investi"

recommend

US Steel Companies Stocks: A Comprehensive Ana

US Steel Companies Stocks: A Comprehensive Ana

The Evolution of the U.S. Stock Exchange: A Jo

Baba Us Stock: The Ultimate Guide to Navigatin

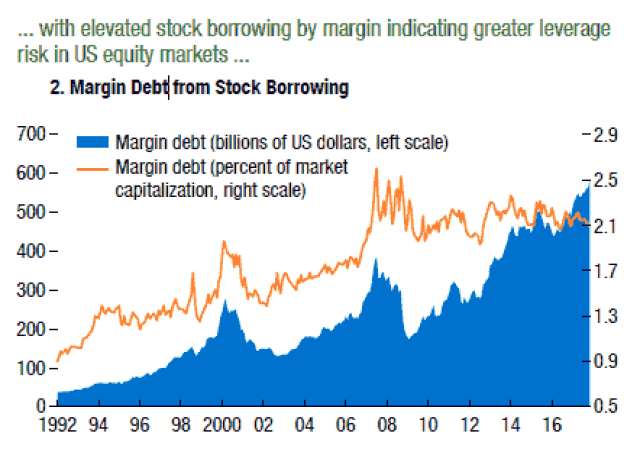

Graph of Us Stock Market Leverage: Understandi

US Large Cap Value Stocks with Low PE Ratios:

Best US Total Stock Market Index Fund: Your Ul

Himalaya Capital: A Deep Dive into Their US St

2025 4 24 US Stock Market Summary: Key Insight

Top 3 US Marijuana Stocks to Watch in 2023

Understanding the Dow Jones Total Stock Market

Outlook for the US Stock Market on August 7th,

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- Top Preferred Stocks in the US: Your Ultimate "

- "Percentage of US Stocks Above 200-Da"

- Maximizing Growth with MGM US Stock: A Compreh"

- "How Much of the U.S. Population Owns"

- Today's Top Momentum US Stocks: Unveiling"

- Understanding Canadian Trading US Stocks Tax I"

- Rubbermaid Commercial 4242-88-BLA 100 US Gallo"

- "Percentage of US Population with Sto"

- 5110 Overseas Hwy, Stock Island, FL 33040: A P"

- Maximizing Total Return for US Stocks: Strateg"