you position:Home > us stock market live > us stock market live

SP500 Highest Ever: A Deep Dive into the Milestone

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

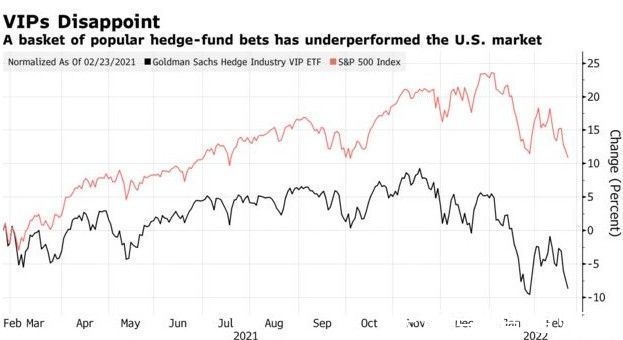

The S&P 500, a widely followed index of the top 500 companies in the U.S., has recently hit an all-time high. This milestone is a testament to the resilience and strength of the American economy. In this article, we'll explore the factors contributing to this achievement and its implications for investors and the broader market.

The S&P 500's All-Time High: What Does It Mean?

When the S&P 500 reaches an all-time high, it signifies that the combined market value of its constituent companies has never been higher. This is a clear indicator of strong economic growth, robust corporate earnings, and investor confidence.

Factors Contributing to the S&P 500's Milestone

- Economic Growth: The U.S. economy has been experiencing steady growth over the past few years, driven by factors such as low unemployment, strong consumer spending, and robust business investment.

- Corporate Earnings: Many companies in the S&P 500 have reported strong earnings, fueled by factors such as increased sales, cost-cutting measures, and efficient operations.

- Investor Confidence: The positive economic outlook and strong corporate earnings have bolstered investor confidence, leading to increased stock purchases and higher stock prices.

- Interest Rates: The Federal Reserve's decision to keep interest rates low has made borrowing cheaper, encouraging businesses to invest and consumers to spend.

- Global Economic Growth: The recovery of the global economy, particularly in Asia and Europe, has also contributed to the S&P 500's growth.

Implications for Investors

The S&P 500's all-time high presents both opportunities and challenges for investors. Here are some key considerations:

- Diversification: It's important for investors to maintain a diversified portfolio to mitigate risks associated with market volatility.

- Long-Term Investing: Historically, the S&P 500 has delivered strong returns over the long term, making it an attractive option for long-term investors.

- Market Volatility: While the S&P 500's all-time high is a positive sign, it's important to be aware of potential market volatility and adjust investment strategies accordingly.

- Dividend Yields: The S&P 500 has a strong history of paying dividends, making it an attractive option for income-seeking investors.

Case Studies: Companies Driving the S&P 500's Growth

Several companies have played a significant role in driving the S&P 500's growth. Here are a few examples:

- Apple: As the world's largest technology company, Apple has been a key driver of the S&P 500's growth. Its strong product lineup, including the iPhone, iPad, and Mac, has helped drive sales and earnings.

- Microsoft: The software giant has been a consistent performer, with its cloud computing and productivity software offerings contributing to its strong financial performance.

- Amazon: The e-commerce giant has expanded its operations beyond online retail to include cloud computing, streaming, and logistics, making it a key player in the S&P 500.

Conclusion

The S&P 500's all-time high is a significant milestone for the American economy and investors. Understanding the factors contributing to this achievement and their implications can help investors make informed decisions. As the market continues to evolve, staying informed and diversified remains crucial for long-term success.

so cool! ()

last:Are US Stocks Too Expensive? A Comprehensive Analysis

next:nothing

like

- Are US Stocks Too Expensive? A Comprehensive Analysis

- Us Airline Stocks: The Current State and Future Prospects

- Market Shot: Mastering the Art of Strategic Photography for Brand Promotion

- Best Stock Watchlist: Unveiling the Top 10 Must-Have Stocks for 2023

- Stock Watch: Google's Impressive Performance and Future Projections"

- Stock Up Today: The Ultimate Guide to Smart Shopping and Savings

- Wall St Stock Market Live: Real-Time Updates and Insights

- US Airline Stocks Plunge: What You Need to Know

- Indexes of the US Stock Market: Understanding Key Indicators"

- Does US Bank Offer Stocks? A Comprehensive Guide

- Stock L: Unlocking the Potential of Your Investment Portfolio

- How Does US Stock Price Affect the Strength of the Dollar?"

hot stocks

"Best Performing US Stocks: Top 5 fro

"Best Performing US Stocks: Top 5 fro- "Best Performing US Stocks: Top 5 fro"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Percentage of South Koreans Investing in US St"

- Buying U.S. Stocks from Australia: A Guide for"

- New US Stocks 2020: Exploring the Emerging Opp"

recommend

SP500 Highest Ever: A Deep Dive into the Miles

SP500 Highest Ever: A Deep Dive into the Miles

Nse Dow Jones Live Today: Real-Time Insights f

Unlocking the Potential of Industrial Stocks:

Historical Returns: A Comparative Analysis of

Best Performing US Large Cap Stocks Last Week:

"Unlocking Profit Potential: Top US G

Top US Steel Stocks to Watch in 2023"

Stock Premarket Today: A Comprehensive Guide t

Unlocking the Potential of US E&P Stoc

Five US Tech Giants Spend $115B on Buying Back

Momentum Stocks: A 5-Day Performance Review in

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Stock Market Correlation with US Election Cycl"

- Us Stock Index Futures Charts: Your Ultimate G"

- Understanding the AVGO US Stock Price: A Compr"

- Maximizing Returns: A Comprehensive Guide to F"

- How the US Dollar Impacts the Stock Market"

- Understanding the Prima Moda S.A. US Stock Sym"

- Us Bancorp Historical Stock Prices: A Comprehe"

- "How to Invest in the US Stock Market"

- Toys R Us Overnight Stock Crew: The Unsung Her"

- "Is It the Right Time to Invest in th"