you position:Home > us stock market live > us stock market live

How the US Dollar Impacts the Stock Market

![]() myandytime2026-01-19【us stock market today live cha】view

myandytime2026-01-19【us stock market today live cha】view

info:

The US dollar is often considered the world's reserve currency, and its influence extends far beyond just currency exchange rates. Its impact on the stock market is profound, affecting everything from individual investments to global economic trends. In this article, we'll explore how the US dollar affects the stock market, including the mechanisms behind this relationship and real-world examples to illustrate the point.

Understanding the Relationship

The US dollar plays a crucial role in global finance, and its value has a direct impact on stock market trends. Here's a breakdown of the key factors:

- Currency Strength: A strong US dollar can make American companies' products more expensive abroad, potentially affecting their overseas sales and profits. This can lead to lower stock prices for companies with significant international exposure.

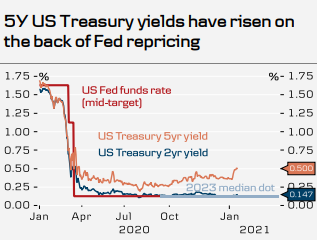

- Interest Rates: The Federal Reserve sets interest rates in the US, which can influence the value of the dollar. Higher interest rates can strengthen the dollar, making it more attractive to foreign investors. Conversely, lower interest rates can weaken the dollar.

- Inflation: The US dollar is often seen as a safe haven during times of economic uncertainty. When investors believe that the US economy is stable, they tend to invest in US stocks, boosting the market. Inflation can erode the value of the dollar, leading to lower stock prices.

Real-World Examples

Several real-world examples illustrate how the US dollar affects the stock market:

- 2018 Stock Market Decline: In 2018, the US dollar strengthened significantly, leading to a decline in the stock market. Companies with high international exposure, such as technology and consumer goods companies, experienced significant stock price drops.

- COVID-19 Pandemic: During the COVID-19 pandemic, the US dollar weakened as the Federal Reserve implemented aggressive monetary policies to stimulate the economy. This weakened dollar helped boost the stock market, as it made US companies' products cheaper abroad and attracted foreign investors.

Mechanisms Behind the Impact

The relationship between the US dollar and the stock market can be understood through several mechanisms:

- Exchange Rates: A strong US dollar makes imports cheaper, potentially boosting corporate profits. Conversely, a weak dollar can make exports more expensive, negatively impacting profits.

- Investor Sentiment: A strong dollar can make US stocks less attractive to foreign investors, leading to a decrease in demand and lower stock prices.

- Interest Rates: Higher interest rates can attract foreign investors to the US, boosting the stock market. Lower interest rates can have the opposite effect.

Conclusion

The US dollar has a significant impact on the stock market, affecting everything from individual stocks to the overall market trend. Understanding the relationship between the two can help investors make informed decisions and navigate the complexities of the global financial landscape.

so cool! ()

like

- US Steel Companies Stocks: A Comprehensive Analysis

- Best Performing Large Cap US Stock in Q2 2025: NXTT Shines Bright

- How to Buy Stock in Dinglong Culture Co., Ltd. (US)

- "Ingenix (INGN.O): A Deep Dive into the Full Description of This Stock&a

- Pharmacare US Inc Stock: A Deep Dive into the Future of Healthcare

- Airline Stocks in the US Stock Market: A Comprehensive Overview

- How to Invest in the US Stock Market from Jamaica: A Comprehensive Guide

- US Oil Prices Stock: What You Need to Know

- "Shorting US Stocks: A Strategic Approach to Investment"

- Unlocking the Potential of CRCL Stock: A Comprehensive Analysis

- "S&P 500's Influence on US Stock Market Capitalization in 2

- "http stocks.us.reuters.com stocks fulldescription.asp rpc 66&sy

hot stocks

"Best Performing US Stocks: Top 5 fro

"Best Performing US Stocks: Top 5 fro- "Best Performing US Stocks: Top 5 fro"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Momentum Stocks: A 5-Day Performance Review in"

- Himalaya Capital: A Deep Dive into Their US St"

- Sprint US Stock: The Ultimate Guide to Investi"

recommend

US Steel Companies Stocks: A Comprehensive Ana

US Steel Companies Stocks: A Comprehensive Ana

2025 4 24 US Stock Market Summary: Key Insight

Top 3 US Marijuana Stocks to Watch in 2023

Himalaya Capital: A Deep Dive into Their US St

Outlook for the US Stock Market on August 7th,

The Evolution of the U.S. Stock Exchange: A Jo

Baba Us Stock: The Ultimate Guide to Navigatin

US Large Cap Value Stocks with Low PE Ratios:

Best US Total Stock Market Index Fund: Your Ul

Graph of Us Stock Market Leverage: Understandi

Understanding the Dow Jones Total Stock Market

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- Top Preferred Stocks in the US: Your Ultimate "

- Rubbermaid Commercial 4242-88-BLA 100 US Gallo"

- Maximizing Total Return for US Stocks: Strateg"

- Today's Top Momentum US Stocks: Unveiling"

- "How Much of the U.S. Population Owns"

- "Percentage of US Stocks Above 200-Da"

- 5110 Overseas Hwy, Stock Island, FL 33040: A P"

- "Percentage of US Population with Sto"

- Maximizing Growth with MGM US Stock: A Compreh"

- Understanding Canadian Trading US Stocks Tax I"