you position:Home > us stock market live > us stock market live

How Many Different Stock Exchanges Are There in the US?

![]() myandytime2026-01-19【us stock market today live cha】view

myandytime2026-01-19【us stock market today live cha】view

info:

In the United States, the stock market is a cornerstone of the economy, with numerous stock exchanges playing a vital role in facilitating the buying and selling of shares. But just how many different stock exchanges exist in the US? Let's dive into the fascinating world of American stock exchanges and uncover the answers.

The Major Stock Exchanges in the US

1. The New York Stock Exchange (NYSE)

The NYSE is the largest stock exchange in the United States, with a history that dates back to 1792. It is home to some of the most well-known companies, including Apple, Microsoft, and General Electric. The NYSE operates on a hybrid model, combining traditional floor trading with modern electronic trading systems.

2. The NASDAQ Stock Market

The NASDAQ Stock Market, founded in 1971, is another major stock exchange in the US. It is known for hosting technology companies and startups, with giants like Amazon, Apple, and Google listed on its platform. The NASDAQ operates as an electronic exchange, allowing for high-speed and efficient trading.

3. The Chicago Stock Exchange (CHX)

The CHX, established in 1882, is the oldest stock exchange in the United States. While it is not as large as the NYSE or NASDAQ, it still plays a significant role in the US stock market. The CHX focuses on providing a fair and efficient trading environment for its members.

4. The BATS Global Markets

BATS Global Markets, founded in 2005, is a relative newcomer to the US stock exchange scene. It is known for its advanced technology and focus on providing a high-speed trading platform. BATS operates in various regions, including the US, Europe, and Asia.

5. The Chicago Mercantile Exchange (CME Group)

While not a traditional stock exchange, the CME Group is a significant player in the US financial market. It operates various exchanges, including the Chicago Board of Trade (CBOT) and the Chicago Mercantile Exchange (CME). The CME Group is known for trading futures and options contracts, particularly in the agricultural and financial sectors.

6. The Intercontinental Exchange (ICE)

The ICE is another major player in the US financial market. It operates various exchanges, including the New York Mercantile Exchange (NYMEX) and the ICE Futures U.S. The ICE is known for trading commodities, energy, and financial futures.

7. The American Stock Exchange (AMEX)

The AMEX, acquired by NYSE Euronext in 2008, was once a significant player in the US stock market. While it is now part of the NYSE, it still operates as a separate entity with its own unique offerings.

8. Regional Exchanges

In addition to the major stock exchanges, there are several regional exchanges in the US. These exchanges cater to specific geographic areas and offer a platform for local companies to raise capital.

The Role of Stock Exchanges in the US Economy

Stock exchanges are crucial for the US economy, providing a platform for companies to raise capital, investors to invest in their preferred companies, and the overall liquidity of the market. These exchanges also play a vital role in creating jobs, fostering innovation, and driving economic growth.

In conclusion, while the United States has several stock exchanges, the major players include the NYSE, NASDAQ, CHX, BATS Global Markets, CME Group, ICE, and AMEX. These exchanges are essential for the functioning of the US stock market and its contribution to the overall economy.

so cool! ()

like

- US Steel Companies Stocks: A Comprehensive Analysis

- Best Performing Large Cap US Stock in Q2 2025: NXTT Shines Bright

- How to Buy Stock in Dinglong Culture Co., Ltd. (US)

- "Ingenix (INGN.O): A Deep Dive into the Full Description of This Stock&a

- Pharmacare US Inc Stock: A Deep Dive into the Future of Healthcare

- Airline Stocks in the US Stock Market: A Comprehensive Overview

- How to Invest in the US Stock Market from Jamaica: A Comprehensive Guide

- US Oil Prices Stock: What You Need to Know

- "Shorting US Stocks: A Strategic Approach to Investment"

- Unlocking the Potential of CRCL Stock: A Comprehensive Analysis

- "S&P 500's Influence on US Stock Market Capitalization in 2

- "http stocks.us.reuters.com stocks fulldescription.asp rpc 66&sy

hot stocks

"Best Performing US Stocks: Top 5 fro

"Best Performing US Stocks: Top 5 fro- "Best Performing US Stocks: Top 5 fro"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Momentum Stocks: A 5-Day Performance Review in"

- Himalaya Capital: A Deep Dive into Their US St"

- Sprint US Stock: The Ultimate Guide to Investi"

recommend

US Steel Companies Stocks: A Comprehensive Ana

US Steel Companies Stocks: A Comprehensive Ana

Top 3 US Marijuana Stocks to Watch in 2023

Baba Us Stock: The Ultimate Guide to Navigatin

Understanding the Dow Jones Total Stock Market

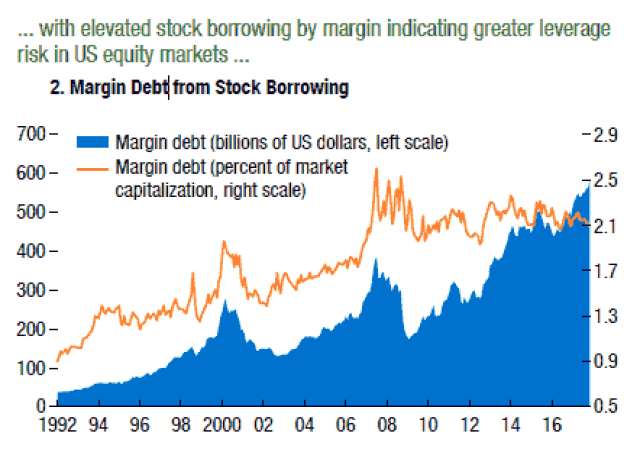

Graph of Us Stock Market Leverage: Understandi

The Evolution of the U.S. Stock Exchange: A Jo

Outlook for the US Stock Market on August 7th,

US Large Cap Value Stocks with Low PE Ratios:

2025 4 24 US Stock Market Summary: Key Insight

Best US Total Stock Market Index Fund: Your Ul

Himalaya Capital: A Deep Dive into Their US St

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- Rubbermaid Commercial 4242-88-BLA 100 US Gallo"

- "Percentage of US Population with Sto"

- Today's Top Momentum US Stocks: Unveiling"

- "How Much of the U.S. Population Owns"

- 5110 Overseas Hwy, Stock Island, FL 33040: A P"

- Maximizing Growth with MGM US Stock: A Compreh"

- Maximizing Total Return for US Stocks: Strateg"

- "Percentage of US Stocks Above 200-Da"

- Understanding Canadian Trading US Stocks Tax I"

- Top Preferred Stocks in the US: Your Ultimate "