you position:Home > stock coverage > stock coverage

Unlocking the Potential of Capital Gains in US Stocks

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the dynamic world of investing, capital gains from US stocks can be a significant source of wealth. Whether you're a seasoned investor or just starting out, understanding how to maximize your returns from capital gains is crucial. This article delves into the essentials of capital gains in US stocks, providing insights and strategies to help you make informed investment decisions.

What Are Capital Gains?

Capital gains refer to the profit you make from selling a capital asset, such as stocks, for more than its original purchase price. In the United States, capital gains are taxed differently depending on how long you held the asset. Short-term capital gains, which are assets held for less than a year, are taxed as ordinary income, while long-term capital gains, held for more than a year, are taxed at a lower rate.

Strategies for Maximizing Capital Gains

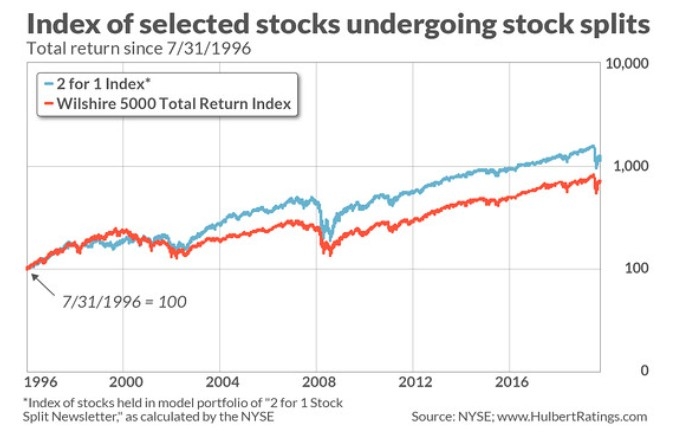

Long-Term Investing: Holding onto stocks for the long term can significantly increase your chances of generating higher capital gains. This strategy allows you to ride out market fluctuations and benefit from the potential growth of the company.

Diversification: Diversifying your portfolio can help mitigate risk and increase your chances of generating capital gains. By investing in a variety of stocks across different sectors and industries, you can reduce the impact of any single stock's performance on your overall portfolio.

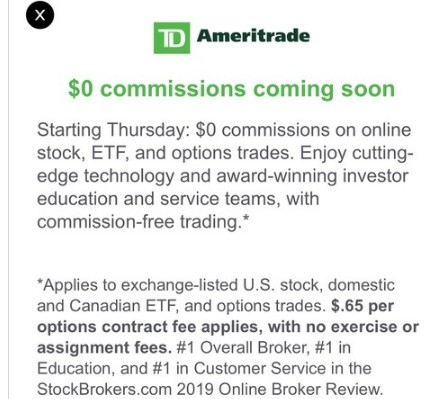

Tax-Efficient Investing: Understanding the tax implications of your investments can help you maximize your capital gains. Consider investing in tax-advantaged accounts like IRAs or 401(k)s, which can provide potential tax benefits for long-term capital gains.

Research and Analysis: Conduct thorough research and analysis before investing in stocks. Look for companies with strong fundamentals, such as solid financials, strong management, and a competitive advantage in their industry.

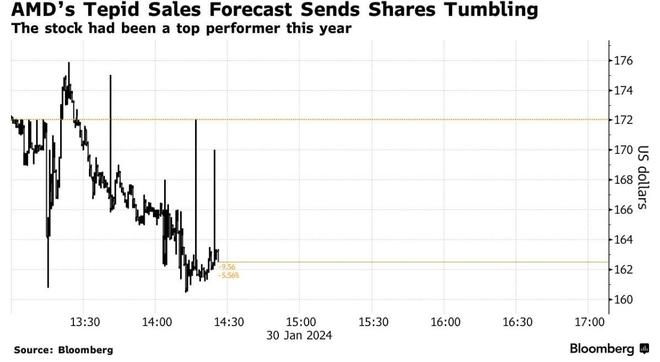

Market Timing: While it's challenging to predict market movements, being aware of market trends and economic indicators can help you make informed decisions about when to buy and sell stocks.

Case Study: Apple Inc.

Consider the case of Apple Inc. (AAPL), a leading technology company. If you had invested $10,000 in Apple stock in 2010 and sold it in 2020, you would have realized a significant capital gain. By holding onto the stock for over a decade, you would have benefited from the company's strong growth and innovation in the tech industry.

Conclusion

Capital gains from US stocks can be a powerful tool for building wealth. By adopting sound investment strategies, conducting thorough research, and understanding the tax implications of your investments, you can maximize your returns and achieve your financial goals. Remember, investing in stocks carries risks, so it's essential to do your homework and consult with a financial advisor if needed.

so cool! ()

last:Unlocking Financial Potential with Nsn Money: A Comprehensive Guide

next:nothing

like

- Unlocking Financial Potential with Nsn Money: A Comprehensive Guide

- Dow Nov 5, 2024: What to Expect in the Stock Market

- Exploring the World of China Stocks: A Comprehensive Guide for US Investors

- Danakali Stock US: The Future of Lithium Extraction

- Unlock the Potential of CNH.US Stock: Your Ultimate Guide

- Is the US Stock Exchange Closed Today? Understanding Market Hours and Closures

- Is the US Stock Market Open Today, June 27, 2025?

- Top US Mid Cap Stocks to Watch in 2025

- Historical Stocks: Unveiling the Past for a Profitable Future

- S&P 500 Percentage of US Stock Market Capitalization in 2025: A Comprehen

- Live with Quotes: Transforming Your Life with Inspirational Words

- Share Market on Today: Key Developments and Insights"

hot stocks

IEA Global EV Outlook 2021: US Electric Vehicl

IEA Global EV Outlook 2021: US Electric Vehicl- IEA Global EV Outlook 2021: US Electric Vehicl"

- Best Performing US Stock Market Sectors in 202"

- Best Stocks to Invest in the US Now: Top Picks"

- Magnificent 7 US Stocks 2023 Performance: Top "

- Undervalued US Growth Stocks: Unlocking Hidden"

- Title: In-Depth Analysis of PNRA.O: A Comprehe"

- S&P 500 Inclusion Today: What You Need"

- Exploring the Era of 1950-60 US Rolling Stock:"

recommend

Unlocking the Potential of Capital Gains in US

Unlocking the Potential of Capital Gains in US

Richemont Stock US: A Comprehensive Guide to U

US Stock Exchange Holidays 2012: A Comprehensi

Top 50 Companies Listed on the US Stock Exchan

The Thriving Landscape of Marijuana Stocks in

US-Iran War: How Stock Market Reacts

Canada-US Stocks: A Comprehensive Guide to Inv

List of US Tech Stocks: Top Investments for 20

Piperdoll US Stock: A Comprehensive Guide to I

"Number of U.S. Households Investing

"US Rate Cut: How It Impacts Japanese

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Unlocking Opportunities with Penny Stock Broke"

- Chart of the US Stock Market by President: A D"

- Unlocking the Potential of Oil and Gas Stocks "

- Defense Stocks: A Solid Investment in the US"

- Stocks for US Corporations: A Comprehensive Gu"

- Stock Market News Tomorrow: What You Need to K"

- Tech Stocks in US: A Comprehensive Guide to In"

- US Concrete Stock News: Key Insights and Futur"

- Understanding the Basics of US Citizens Purcha"

- Japan and US Stock Market: A Comparative Analy"