you position:Home > stock coverage > stock coverage

Unlock the Future: Understanding CNN Pre Market Futures

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

Are you curious about the world of financial trading and want to know how to capitalize on the potential of pre-market futures? Look no further! In this article, we'll dive into the concept of CNN Pre Market Futures, providing you with a comprehensive guide to help you understand how it works and why it's crucial for successful trading.

What Are CNN Pre Market Futures?

CNN Pre Market Futures refer to the trading of financial contracts that are set to begin trading at the opening of the market. These contracts are typically based on a variety of assets, such as stocks, currencies, commodities, and indexes. Traders and investors often use pre-market futures to gain an edge on the market and to hedge against potential losses.

Understanding the Pre Market Window

The pre-market window, also known as the pre-open session, typically opens one hour before the regular trading session begins. This window allows traders to place orders and execute trades before the market officially opens. During this time, the trading volume may be lower, which can result in greater volatility and price movement.

Benefits of Trading CNN Pre Market Futures

1. Early Access to Market Information One of the primary benefits of trading CNN Pre Market Futures is that you get access to market information before the regular trading session starts. This allows you to make informed decisions based on the latest news and events that could impact the market.

2. Take Advantage of Volatility As mentioned earlier, the pre-market window can be characterized by increased volatility. This means that there are greater opportunities to capitalize on price movements. Whether you're looking to buy low and sell high or short the market, the pre-market can offer significant opportunities.

3. Prepare for the Regular Trading Session Trading pre-market futures can help you prepare for the regular trading session. By familiarizing yourself with market movements and trends, you can develop a strategy that will help you succeed throughout the day.

4. Risk Management The pre-market window can also be a great opportunity for risk management. By understanding the market's movement, you can hedge your positions and minimize potential losses.

Key Factors to Consider When Trading CNN Pre Market Futures

1. News and Economic Reports Staying informed about the latest news and economic reports is crucial when trading CNN Pre Market Futures. Pay attention to significant events and releases that could impact the market, such as earnings reports, economic indicators, and geopolitical developments.

2. Technical Analysis Incorporate technical analysis into your trading strategy to identify trends, patterns, and potential trading opportunities. Tools like charts, indicators, and oscillators can provide valuable insights into the market's behavior.

3. Risk Management Always practice proper risk management by setting stop-loss orders and determining your position sizes based on your risk tolerance and trading capital.

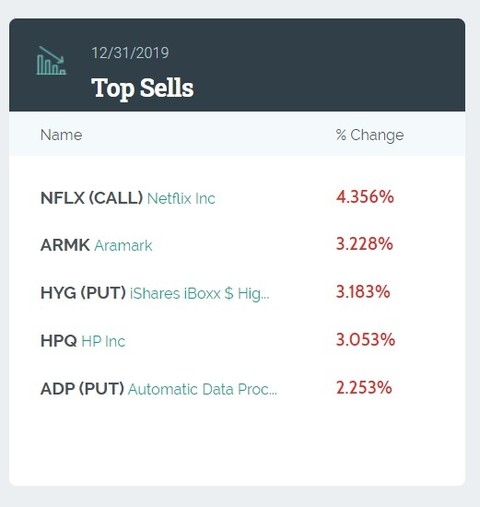

Case Study: The Impact of Earnings Reports on CNN Pre Market Futures

A perfect example of the significance of pre-market futures is when a major company releases its earnings report. If the report is stronger than expected, the stock price may increase significantly before the regular trading session begins. Conversely, if the report is weaker, the stock price may decline.

By monitoring these developments and reacting accordingly, traders can capitalize on the volatility and potential price movements.

Conclusion

In conclusion, CNN Pre Market Futures offer a unique opportunity for traders and investors to gain an edge in the financial markets. By understanding the pre-market window, staying informed about market events, and incorporating effective trading strategies, you can unlock the future and maximize your trading potential. Remember to always practice proper risk management and never risk more than you can afford to lose.

so cool! ()

last:New Hot Stocks: Unveiling the Next Market Winners

next:nothing

like

- New Hot Stocks: Unveiling the Next Market Winners

- Dow Jones Index History Data: A Comprehensive Overview

- Understanding the Market Cap of the Total US Stock Market

- How to Invest in US Stocks from India: A Comprehensive Guide

- Level 1 Stock Program: A Comprehensive Overview of the US Navy's Innovative

- Unveiling the US Foods Stock Yards in Charlotte, NC: A Hub of Agribusiness Excell

- Hydropothecary Corp US Stock: A Comprehensive Guide to Investment Opportunities

- MarketWatch C: Unveiling the Future of Financial News

- How Many Stocks Are There in the US Stock Market?"

- Oil Stock Today: A Comprehensive Guide to Current Market Trends and Investment Op

- Stock Market Schedule for Today: Your Ultimate Guide

- Unlocking the Power of the New York Stock Exchange Life US Index: A Comprehensive

hot stocks

IEA Global EV Outlook 2021: US Electric Vehicl

IEA Global EV Outlook 2021: US Electric Vehicl- IEA Global EV Outlook 2021: US Electric Vehicl"

- Best Performing US Stock Market Sectors in 202"

- Best Stocks to Invest in the US Now: Top Picks"

- Magnificent 7 US Stocks 2023 Performance: Top "

- Undervalued US Growth Stocks: Unlocking Hidden"

- Title: In-Depth Analysis of PNRA.O: A Comprehe"

- S&P 500 Inclusion Today: What You Need"

- Exploring the Era of 1950-60 US Rolling Stock:"

recommend

Unlock the Future: Understanding CNN Pre Marke

Unlock the Future: Understanding CNN Pre Marke

Markets Right Now": A Comprehensive L

Top Growth Stocks in the US: Unlocking Opportu

Best Stocks to Invest in the US Stock Market:

"Bristol-Myers Squibb: A Leader in US

Stock Market News Tomorrow: What You Need to K

Small Cap Stocks: Upcoming Catalysts Fueling U

Rare Earth Stock in US: The Future of Advanced

Unveiling the Powerhouse: US Financial Sector

Understanding the Mutual Fund US Large Cap Sto

Unveiling the US Housing Market Stock: A Compr

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Is the US Stock Market Open Today, June 27, 20"

- S&P 500 Stock Futures Sunday Rise: Wha"

- "No Market Today": Understan"

- Lev Stock US: The Ultimate Guide to Understand"

- "HDFC Securities Invests in US Stocks"

- Unlocking the Power of US Overnight Trading: S"

- DJIA January 20, 2021: A Look Back at a Histor"

- Top 50 Companies Listed on the US Stock Exchan"

- Top 500 Companies in the US Stock Daily Volume"

- Unlocking the Potential of SK hynix Stock US: "