you position:Home > stock coverage > stock coverage

US Stock Exchange 2017: A Year of Transformation and Growth

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

Introduction

The year 2017 marked a significant turning point in the US stock market, characterized by transformative trends and substantial growth. This article delves into the key developments and highlights that shaped the US stock exchange in 2017.

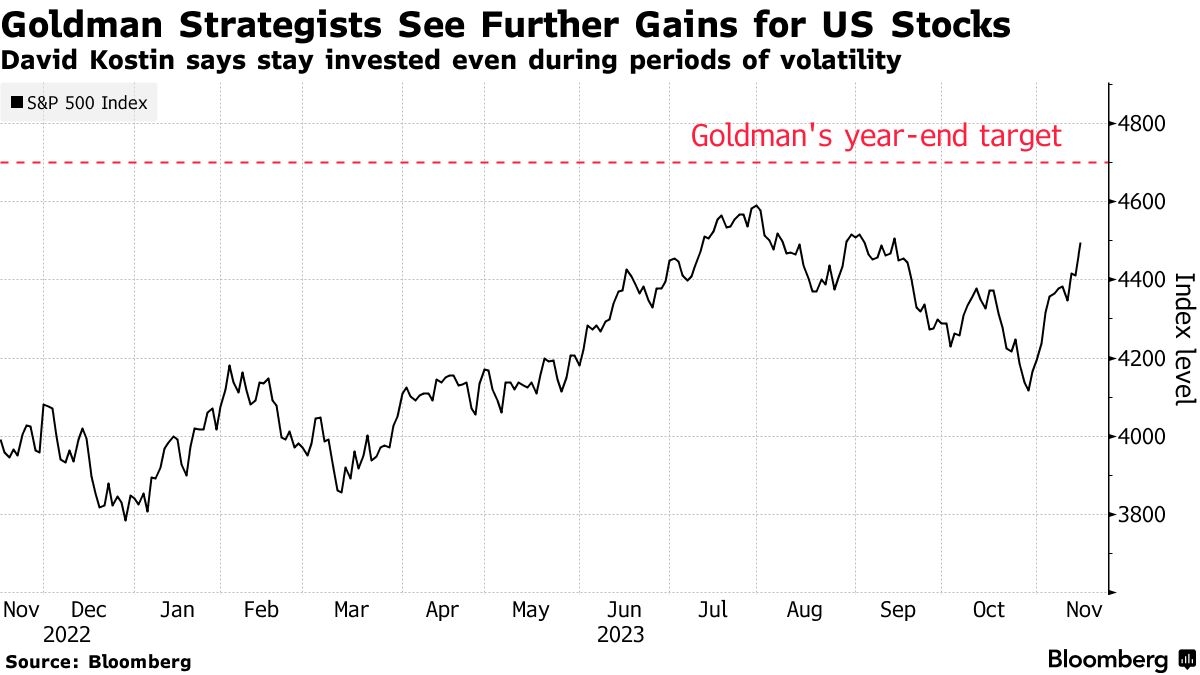

Rising Stock Market Valuations

In 2017, the US stock market experienced a surge in valuations, driven by strong corporate earnings, low unemployment rates, and supportive monetary policy. The S&P 500 index, a benchmark for the US stock market, reached an all-time high in early 2018, reflecting the overall growth and optimism within the market.

Tech Stocks Leading the Charge

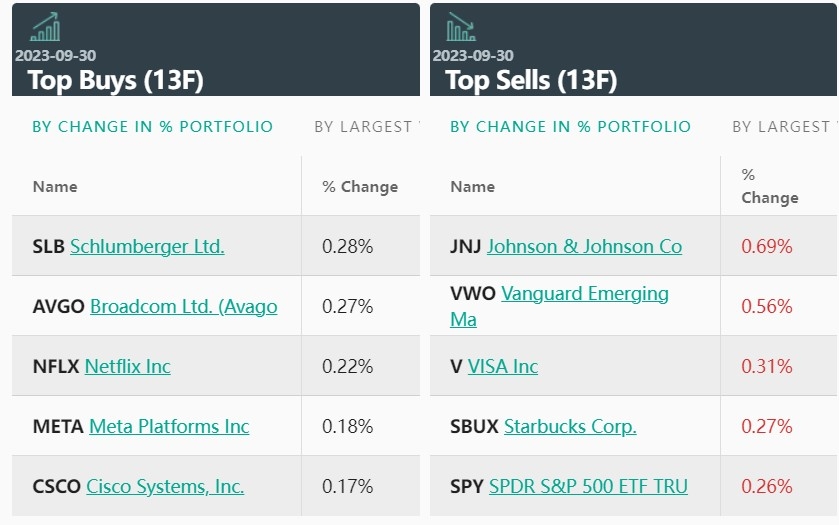

Technology stocks played a pivotal role in the 2017 US stock market, with giants like Apple, Amazon, and Microsoft driving significant growth. These companies, known as "FAANG" (Facebook, Amazon, Apple, Netflix, and Google), contributed to the overall market performance, as investors sought out high-growth opportunities in the tech sector.

Impact of Tax Reform

The Tax Cuts and Jobs Act of 2017, signed into law by President Donald Trump, had a profound impact on the US stock market. The act reduced corporate tax rates, boosting earnings and driving stock prices higher. Companies, in turn, invested in expansion, research and development, and increased shareholder returns, such as dividends and stock buybacks.

Initial Public Offerings (IPOs) on the Rise

2017 saw a significant increase in initial public offerings (IPOs), with companies like Snap, Uber, and Dropbox hitting the market. The surge in IPOs was driven by a strong economy and favorable market conditions, allowing companies to raise capital and expand their operations.

Regulatory Environment

The US stock market in 2017 faced regulatory challenges, with concerns over the implementation of the Dodd-Frank Wall Street Reform and Consumer Protection Act. However, the market remained resilient, as investors focused on long-term growth prospects and the potential for increased market efficiency.

Case Study: Snap Inc. IPO

One of the most notable IPOs of 2017 was that of Snap Inc., the parent company of social media platform Snapchat. Snap's IPO raised $3.4 billion, making it one of the largest tech IPOs in history. While the stock initially performed well, it faced downward pressure in the following months, reflecting investor concerns over its long-term prospects.

Conclusion

The US stock exchange in 2017 experienced significant growth and transformation, driven by factors such as strong corporate earnings, supportive monetary policy, and favorable regulatory conditions. As investors continue to seek high-growth opportunities, the 2017 market will serve as a benchmark for future market trends and developments.

so cool! ()

like

- China Stock US Listed: Exploring Investment Opportunities in the Chinese Market&a

- Recent Positive News: Top Penny Stocks in the US to Watch

- US Large Cap Stocks Momentum Analysis 2024: A Deep Dive into Market Trends and In

- The Thriving Landscape of Marijuana Stocks in the US

- Unlocking the Potential: Understanding US Farmland Stocks"

- US Inflation and Stock Market: Understanding the Interplay

- In-Depth Analysis of Kite Technology's Stock Performance: Full Description a

- Top Performing US Large Cap Stocks Past 5 Trading Days: Unveiling the Market Lead

- US Stock Futures: Your Ultimate Guide to YouTube

- Is the US Stock Market Closed Right Now? Everything You Need to Know

- Can US Investors Buy Canadian Stocks? A Comprehensive Guide"

- Foreign Companies on US Stock Exchanges: Opportunities and Challenges"

hot stocks

IEA Global EV Outlook 2021: US Electric Vehicl

IEA Global EV Outlook 2021: US Electric Vehicl- IEA Global EV Outlook 2021: US Electric Vehicl"

- Best Performing US Stock Market Sectors in 202"

- Best Stocks to Invest in the US Now: Top Picks"

- Magnificent 7 US Stocks 2023 Performance: Top "

- Undervalued US Growth Stocks: Unlocking Hidden"

- ATVI US Stock: A Comprehensive Guide to Unders"

- "http stocks.us.reuters.com stocks fu"

- "Impact of Covid-19 on the US Stock M"

recommend

US Stock Exchange 2017: A Year of Transformati

US Stock Exchange 2017: A Year of Transformati

Tesla Stock Invest US: A Strategic Guide for I

Canada Goose Stock US: A Comprehensive Guide t

All Us Stock Exchanges: A Comprehensive Guide

Iran's Attempt to Cause a Flash Crash in

February 2020 US Stock Market IPO Companies Li

"US Presidential Election 2024: How I

Stocks R Us Cebu Address: Your Ultimate Guide

US Large Cap Stocks with Low PE Ratio: A Glimp

Impact on Tariff on US Stock: Understanding th

Is the US Stock Market in a Bubble?

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- How 9/11 Affected the U.S. Stock Market: A Dec"

- Top Performing US Large Cap Stocks Past 5 Trad"

- "Steps to Invest in Stocks US: A Comp"

- Is the US Stock Market in a Bubble?"

- Iran's Attempt to Cause a Flash Crash in "

- Unlocking the Potential: Understanding US Farm"

- Defense Stocks: A Solid Investment in the US"

- Best US Stocks Outlook 2025: Top Picks for Inv"

- Coronavirus and the US Stock Market: A Compreh"

- US Steel Stock Premarket: A Deep Dive"