you position:Home > stock coverage > stock coverage

US Inflation and Stock Market: Understanding the Interplay

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In recent years, the relationship between US inflation and the stock market has been a hot topic among investors and economists alike. This article delves into the dynamics of this interplay, highlighting key factors and providing insights into how inflation can impact stock market trends.

Understanding Inflation

Inflation refers to the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. In the United States, the Consumer Price Index (CPI) is often used as a key indicator of inflation. Several factors can contribute to inflation, including demand-pull inflation, cost-push inflation, and built-in inflation.

Impact of Inflation on the Stock Market

1. Bond Prices and Interest Rates

When inflation is high, the real return on bonds decreases. This is because inflation erodes the purchasing power of the bond's principal and interest payments. As a result, bond prices tend to fall, and interest rates rise. This is known as an inverse relationship between bond prices and interest rates.

2. Stock Valuations

Inflation can also affect stock valuations. High inflation can lead to higher corporate costs, which can squeeze profit margins. Conversely, low inflation can lead to lower corporate costs and higher profit margins. Additionally, investors may demand higher returns to compensate for the expected loss of purchasing power due to inflation.

3. Sector Performance

Different sectors respond differently to inflation. For example, companies in sectors like consumer discretionary, real estate, and utilities may benefit from inflation as their prices rise. On the other hand, companies in sectors like consumer staples and healthcare may suffer due to higher input costs.

Case Study: Tech Stocks and Inflation

One notable example is the tech sector, which has been a significant driver of the stock market's growth over the past few years. However, as inflation has risen, some investors have become concerned about the sector's ability to maintain its growth momentum.

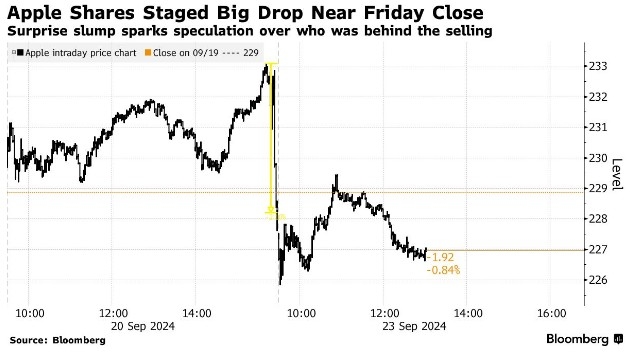

Consider the case of Apple Inc. (AAPL), one of the largest companies in the tech sector. Despite facing increased input costs due to inflation, Apple has managed to maintain its profit margins by focusing on high-margin products and services. This has helped the company's stock to remain resilient in the face of rising inflation.

Understanding Inflation and Stock Market Trends

To understand the impact of inflation on the stock market, it's crucial to consider the following factors:

Economic Indicators: Keep an eye on key economic indicators such as the CPI, Producer Price Index (PPI), and unemployment rate. These indicators can provide insights into the current and future inflation trends.

Central Bank Policies: The Federal Reserve plays a significant role in managing inflation. Keep an eye on the Fed's monetary policy decisions, including interest rate changes and balance sheet operations.

Market Sentiment: The stock market is influenced by investor sentiment, which can be influenced by inflation fears and expectations. Pay attention to market sentiment indicators such as the VIX (Volatility Index).

In conclusion, the relationship between US inflation and the stock market is complex and multifaceted. By understanding the key factors and trends, investors can make more informed decisions and navigate the challenges posed by inflation.

so cool! ()

like

- In-Depth Analysis of Kite Technology's Stock Performance: Full Description a

- Top Performing US Large Cap Stocks Past 5 Trading Days: Unveiling the Market Lead

- US Stock Futures: Your Ultimate Guide to YouTube

- Is the US Stock Market Closed Right Now? Everything You Need to Know

- Can US Investors Buy Canadian Stocks? A Comprehensive Guide"

- Foreign Companies on US Stock Exchanges: Opportunities and Challenges"

- Understanding the US Stock Exchange: A Comprehensive Guide

- Canada-US Stocks: A Comprehensive Guide to Investment Opportunities

- Green Thumb Industries US Stock Price: A Comprehensive Analysis

- Soros Liquidates US Stock: Implications and Insights

- Exploring the Current State of Crude Oil Stock in the US"

- Unlock High Dividend Stocks: Top US Investments for Income Seekers

hot stocks

IEA Global EV Outlook 2021: US Electric Vehicl

IEA Global EV Outlook 2021: US Electric Vehicl- IEA Global EV Outlook 2021: US Electric Vehicl"

- Best Performing US Stock Market Sectors in 202"

- Best Stocks to Invest in the US Now: Top Picks"

- Magnificent 7 US Stocks 2023 Performance: Top "

- Undervalued US Growth Stocks: Unlocking Hidden"

- ATVI US Stock: A Comprehensive Guide to Unders"

- "http stocks.us.reuters.com stocks fu"

- "Impact of Covid-19 on the US Stock M"

recommend

US Inflation and Stock Market: Understanding t

US Inflation and Stock Market: Understanding t

US Stock Market Bull Market Status in May 2025

Analyst Upgrades US Stocks Today: Top Picks fo

Understanding the SK Hynix US Stock Symbol: A

The Cheapest Way to Buy US Stocks: A Comprehen

Unlocking the Potential of Apha Stock US: A Co

Understanding the US Stock Exchange: A Compreh

Best US Stocks Outlook 2025: Top Picks for Inv

German Companies on the US Stock Exchange: A L

Do You Pay Tax on US Stocks in a TFSA? Everyth

Must Invest Stocks in US: Top 5 Reasons to Div

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- "Us Auto Parts Stocks: A Comprehensiv"

- Is the US Stock Market in a Bubble?"

- Tesla Stock Invest US: A Strategic Guide for I"

- Do You Pay Tax on US Stocks in a TFSA? Everyth"

- Unlocking the Potential of Apha Stock US: A Co"

- IEA Global EV Outlook 2021: US Electric Vehicl"

- Japanese Stocks Traded in the U.S. – A Compr"

- FDA US Stocks News 2025: The Future of Investm"

- "Big Stock Brokers in the US: The Hea"

- Buy Reliance Stock in US: A Smart Investment f"