you position:Home > stock coverage > stock coverage

Top 5 Preferred Stocks in US Banks: Investment Opportunities and Analysis

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

Introduction: Investing in preferred stocks of US banks can offer investors a unique blend of income and growth potential. With the banking sector's resilience and the attractive yields of preferred stocks, this investment class has become increasingly popular among investors seeking stable returns. In this article, we will explore the top 5 preferred stocks in US banks and provide an in-depth analysis of their investment opportunities and risks.

JPMorgan Chase & Co. (JPM) JPMorgan Chase & Co. is one of the largest and most respected banks in the United States. The bank's preferred stock, series J (JPM.JP), offers a yield of 5.3% and a fixed dividend rate. As a dividend-paying entity, JPMorgan Chase has a strong track record of distributing dividends to its preferred shareholders. The company's diverse business segments, including investment banking, retail banking, and asset management, contribute to its strong financial performance. Investors should consider JPMorgan Chase's preferred stock as a long-term investment with the potential for stable income.

Bank of America Corporation (BAC) Bank of America Corporation is another leading bank in the United States, offering preferred stock, series J (BAC.JP), with a yield of 4.7%. Bank of America has a well-diversified business model, encompassing retail banking, wealth management, and global markets. The bank's strong capital position and consistent dividend payments make it an attractive preferred stock investment. Moreover, Bank of America's recent acquisition of Merrill Lynch has enhanced its wealth management capabilities, further solidifying its position in the banking industry.

Wells Fargo & Company (WFC) Wells Fargo & Company, the fourth-largest bank in the United States, offers preferred stock, series K (WFC.K), with a yield of 5.2%. Despite facing challenges in the past, Wells Fargo has made significant strides to improve its operations and customer satisfaction. The bank's preferred stock provides investors with a substantial yield and the potential for long-term capital appreciation. As Wells Fargo continues to enhance its digital banking services and expand its customer base, the company's preferred stock could be a compelling investment opportunity.

Citigroup Inc. (C) Citigroup Inc., a global financial services company, offers preferred stock, series K (C.K), with a yield of 5.1%. Citigroup has a diverse range of businesses, including consumer banking, institutional clients, and corporate banking. The company's strong capital position and attractive dividend yield make it an appealing preferred stock investment. Moreover, Citigroup's global presence provides it with a wide range of growth opportunities. Investors should keep an eye on Citigroup's performance as it continues to expand its international operations.

Goldman Sachs Group, Inc. (GS) Goldman Sachs Group, Inc., a leading investment banking and securities firm, offers preferred stock, series G (GS.G), with a yield of 4.6%. Goldman Sachs has a strong reputation in the financial industry, and its preferred stock provides investors with a substantial yield and potential capital appreciation. The company's diverse business segments, including investment banking, institutional clients, and investment management, contribute to its robust financial performance. Investors looking for a high-yielding preferred stock with growth potential should consider Goldman Sachs.

Conclusion: Preferred stocks in US banks can be an excellent investment choice for investors seeking stable income and long-term capital appreciation. By analyzing the top 5 preferred stocks in US banks, we have highlighted some of the best investment opportunities available. However, it is essential for investors to conduct thorough research and assess the risks associated with each investment before making a decision. As always, investing in preferred stocks carries risks, and investors should only invest funds they can afford to lose.

so cool! ()

like

- DJIA Premarket Trading: A Comprehensive Guide to Early Market Activity"

- 2025 US Stock Market Daylight Saving Time Start Date: What You Need to Know

- Tax Implications for US Citizens Investing in Canadian Bank Stocks

- Finance3: Revolutionizing Financial Management with Advanced Technology

- Best ETF for US Stocks: Top Picks for 2023

- Understanding the Minimum Age to Buy Stocks in the U.S.

- "Us Airways Stock Clerk Salary: Unveiling the Pay Scale and Benefits&

- Pot Stock News US: The Latest Developments in the Cannabis Industry

- How to Trade US Stocks from Hong Kong: A Comprehensive Guide

- Maximize Your Investment Potential with Our Ultimate Stock Lookup Guide

- Unlock the Future: Understanding CNN Pre Market Futures

- New Hot Stocks: Unveiling the Next Market Winners

hot stocks

IEA Global EV Outlook 2021: US Electric Vehicl

IEA Global EV Outlook 2021: US Electric Vehicl- IEA Global EV Outlook 2021: US Electric Vehicl"

- Best Performing US Stock Market Sectors in 202"

- Best Stocks to Invest in the US Now: Top Picks"

- Magnificent 7 US Stocks 2023 Performance: Top "

- Undervalued US Growth Stocks: Unlocking Hidden"

- Title: In-Depth Analysis of PNRA.O: A Comprehe"

- S&P 500 Inclusion Today: What You Need"

- Exploring the Era of 1950-60 US Rolling Stock:"

recommend

Top 5 Preferred Stocks in US Banks: Investment

Top 5 Preferred Stocks in US Banks: Investment

Can I Buy VW Stock in the US? Your Ultimate Gu

Sino-US Stock: A Comprehensive Guide to Invest

How to Start Stock Trading in the US: A Step-b

Lowest Stock Price Today: What You Need to Kno

U.S. Investor Interest in China Stocks: A Grow

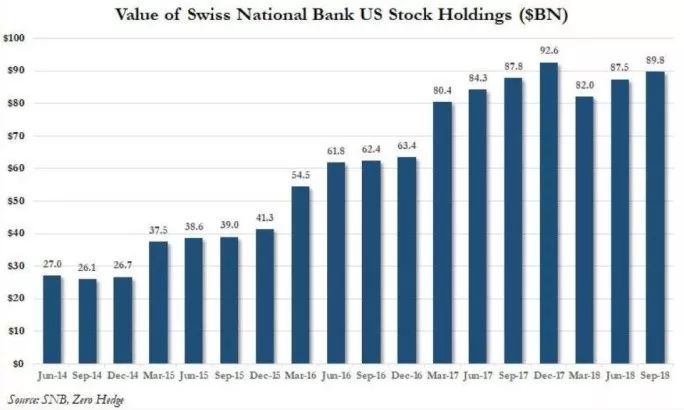

"Does the US Central Bank Buy Stocks?

US Government Shutdown Impact on Indian Stock

"Largest Stocks by Market Cap in the

1994 NHRA Pro Stock Car: "Vettes Are

US Nvidia Stock: A Comprehensive Analysis and

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- How the US Stock Market Reacts to Trade War Te"

- Understanding the Average Annual Returns of th"

- US Large Cap Stocks with Low PE Ratio: A Glimp"

- Hydropothecary Corp US Stock: A Comprehensive "

- The Cheapest Way to Buy US Stocks: A Comprehen"

- Buy Foxconn Stock in US: A Smart Investment Mo"

- Catl Stock Buy in US: Why It's a Smart In"

- Are US Bank Stocks a Buy?"

- Us Airways Stock Clerk: The Essential Role in "

- "Riot US Stock: Unveiling the Powerho"