you position:Home > stock coverage > stock coverage

How Much Nordic Investments Are in US Stock? A Comprehensive Insight

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In recent years, the global financial landscape has seen a surge in cross-border investments. One such area that has garnered significant attention is the influx of Nordic investments into the US stock market. This article delves into the magnitude of these investments, their impact on the US stock market, and the potential opportunities they present.

Nordic Investments: A Growing Trend

The Nordic region, comprising countries like Sweden, Norway, Denmark, Finland, and Iceland, has long been known for its innovation and economic stability. As these countries continue to grow their economies, they have increasingly been looking to diversify their investments globally. The US stock market, with its vast array of industries and high liquidity, has become a prime destination for these investments.

Magnitude of Nordic Investments in US Stock

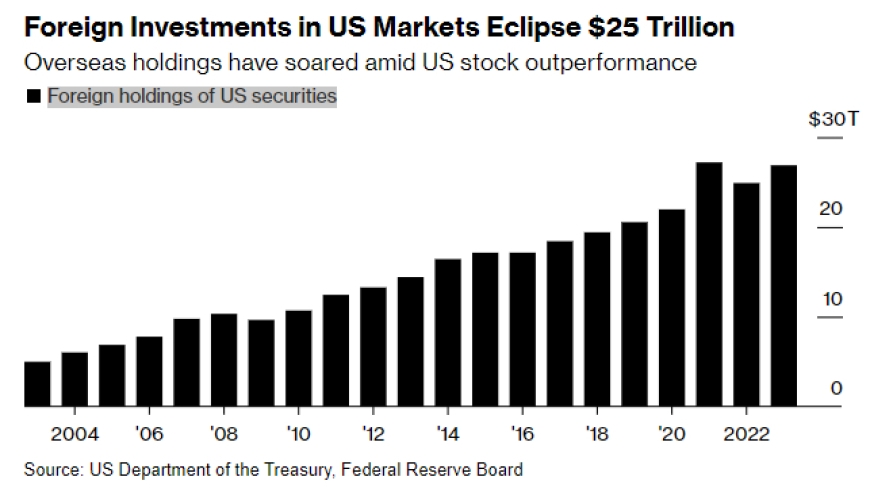

According to a report by the Swedish Institute, Nordic investments in the US stock market have seen a substantial increase over the past decade. As of 2023, the estimated value of Nordic investments in US stocks stands at approximately $100 billion. This figure includes direct investments in individual stocks, as well as investments through mutual funds and exchange-traded funds (ETFs).

Impact on the US Stock Market

The entry of Nordic investors into the US stock market has had a notable impact on various sectors. For instance, technology and healthcare have been major beneficiaries, with many Nordic companies investing in US startups and established players. This has led to increased liquidity in these sectors and a boost in overall market performance.

Potential Opportunities for Investors

For investors looking to capitalize on this trend, there are several opportunities to consider. Firstly, investing in companies with significant exposure to Nordic investments can be a lucrative strategy. Secondly, tracking the performance of specific Nordic funds can provide a direct route to these investments. Lastly, understanding the trends and sectors that are most attractive to Nordic investors can help in making informed investment decisions.

Case Study: AB InBev’s Acquisition of Suntory

One notable example of a Nordic investment in the US stock market is the acquisition of Japanese beverage company Suntory by Belgian brewing giant AB InBev. This deal, valued at $16 billion, was the largest ever for a Nordic company. The acquisition allowed AB InBev to expand its presence in the Asian market and strengthen its portfolio of premium beverages.

Conclusion

The growing presence of Nordic investments in the US stock market is a testament to the region's economic strength and investment potential. As these investments continue to rise, it presents exciting opportunities for both investors and businesses. By understanding the magnitude and impact of these investments, individuals and institutions can better position themselves to benefit from this trend.

so cool! ()

last:Dow Jones Year Chart: A Comprehensive Overview of 2022

next:nothing

like

- Dow Jones Year Chart: A Comprehensive Overview of 2022

- Bolsa de Valores de Nueva York Hoy: A Comprehensive Look at Today's Market T

- Share Bazar Price: Unlocking the Secret to Affordable Shopping

- Pot Stocks: The Booming Market on the US Border

- Future Outlook for US Stock Market 2025: Predictions and Prospects

- Best Momentum Stocks: Large Cap US Market's Recent Performance

- Understanding the US Revocable Trust Owning Canadian NSUFL Stock

- Dow Jones: A Pivotal Force in Financial News and Information

- CNBC Stocks US: Unveiling the Top Performers and Key Trends

- Unlocking the Potential of Invisting Com: A Comprehensive Guide

- Top 5 Preferred Stocks in US Banks: Investment Opportunities and Analysis

- DJIA Premarket Trading: A Comprehensive Guide to Early Market Activity"

hot stocks

IEA Global EV Outlook 2021: US Electric Vehicl

IEA Global EV Outlook 2021: US Electric Vehicl- IEA Global EV Outlook 2021: US Electric Vehicl"

- Best Performing US Stock Market Sectors in 202"

- Best Stocks to Invest in the US Now: Top Picks"

- Magnificent 7 US Stocks 2023 Performance: Top "

- Undervalued US Growth Stocks: Unlocking Hidden"

- Title: In-Depth Analysis of PNRA.O: A Comprehe"

- S&P 500 Inclusion Today: What You Need"

- Exploring the Era of 1950-60 US Rolling Stock:"

recommend

How Much Nordic Investments Are in US Stock? A

How Much Nordic Investments Are in US Stock? A

How to Trade US Stock Market from India: A Com

Navigating the China-US Trade War: Impact on S

How's the Dow Jones Doing? A Comprehensiv

Holidays of the US Stock Market: Understanding

Dow Jones Over the Last Week: A Comprehensive

Sportradar US Stock: A Game-Changing Investmen

Coronavirus and the US Stock Market: A Compreh

T-Mobile US to Give Stock to Customers: Revolu

Understanding the US Issuance of Stock: A Comp

Top US Mid Cap Stocks to Watch in 2025

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Japan and US Stock Market: A Comparative Analy"

- Berkshire Hathaway's US Real Estate Stock"

- How Many Companies in the US Stock Market: A C"

- "Geely US Stock: A Comprehensive Anal"

- All Us Stock Exchanges: A Comprehensive Guide "

- Optimizing US Building Stock: Strategies for E"

- Reddit US Stock Picks in Late 2019: A Look Bac"

- Undervalued US Growth Stocks: Unlocking Hidden"

- High Volatile US Stocks: Understanding the Ris"

- Best ETF for US Stocks: Top Picks for 2023"