you position:Home > stock coverage > stock coverage

BB Stock Price: What You Need to Know About the Latest Trends

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

The stock market is a dynamic landscape, and staying informed about the latest trends is crucial for investors. In this article, we delve into the BB stock price, examining its current performance, potential factors influencing it, and how investors can make informed decisions.

Understanding BB Stock Price Trends

The BB stock price has experienced significant fluctuations over the past year. Understanding these trends is essential for investors looking to capitalize on potential opportunities. To gain insight, let's explore some of the key factors that have impacted the BB stock price.

Economic Factors

Economic conditions play a significant role in stock market movements. In the case of BB, several economic factors have influenced its stock price:

- Interest Rates: Changes in interest rates can impact corporate earnings and consumer spending, thereby affecting the stock price. For example, lower interest rates can stimulate economic growth and boost the BB stock price.

- Inflation: High inflation can erode purchasing power and negatively impact the stock price. Conversely, low inflation can signal a stable economic environment, potentially benefiting the BB stock price.

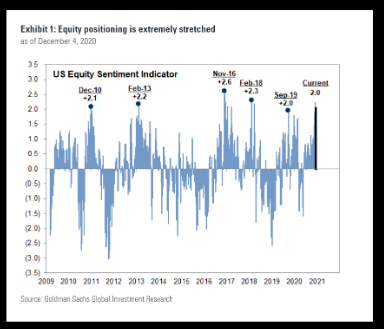

Market Sentiment

Market sentiment can drive stock prices significantly. When investors have a positive outlook on a particular stock, its price tends to rise. Conversely, negative sentiment can lead to a decline in the stock price.

In the case of BB, market sentiment has been influenced by various factors, including:

- Earnings Reports: Positive earnings reports can boost investor confidence and drive the stock price higher. Conversely, negative earnings reports can have the opposite effect.

- Industry Trends: Trends within the industry can also impact market sentiment. For example, if the industry is experiencing rapid growth, the BB stock price may benefit.

Analyzing BB Stock Performance

To gain a better understanding of BB's stock performance, let's analyze some key metrics:

- Price-to-Earnings (P/E) Ratio: The P/E ratio is a popular valuation metric that compares a company's stock price to its earnings per share. A lower P/E ratio may indicate that a stock is undervalued, while a higher P/E ratio may suggest it is overvalued.

- Market Capitalization: Market capitalization is the total value of a company's outstanding shares. Larger market capitalizations can indicate a more stable and established company.

- Dividend Yield: The dividend yield measures the annual dividend payment as a percentage of the stock price. A higher dividend yield can make a stock more attractive to income-seeking investors.

Case Study: BB Stock Price Surge

A recent case study highlights how economic factors and market sentiment can drive stock prices. In this example, the BB stock price surged after the company reported strong earnings and the economy experienced a period of low inflation and low interest rates. This surge in stock price was driven by positive market sentiment and the favorable economic environment.

Conclusion

Understanding the BB stock price is crucial for investors looking to navigate the dynamic stock market. By analyzing economic factors, market sentiment, and key performance metrics, investors can make more informed decisions. Stay tuned for our next article, where we will explore additional strategies for analyzing stock prices and making profitable investments.

so cool! ()

last:Understanding the S&P 500 Index Abbreviation: A Comprehensive Guide

next:nothing

like

- Understanding the S&P 500 Index Abbreviation: A Comprehensive Guide

- Stock Market Forecast for the Next 6 Months in 2024: What to Expect"

- ProSus Stock US: A Comprehensive Guide to Understanding ProSus Corporation's

- Buy Foxconn Stock in US: A Smart Investment Move

- Dow Jones US Completion Total Stock Market TR: A Comprehensive Guide

- CNBC Market Report: Latest Insights and Analysis

- Best Stock Market Online Trading: Unveiling the Ultimate Platform

- Understanding the Tesla Stock - Google Search Insights

- Understanding Financial Indices: A Comprehensive Guide

- Buy Us Stock Australia: A Guide to Investing in Australian Stocks from the USA&am

- Dow Jones Today Record High: A Deep Dive into the Market's Milestone

- Current US Inflation Rate: Stock Symbol Insights"

hot stocks

IEA Global EV Outlook 2021: US Electric Vehicl

IEA Global EV Outlook 2021: US Electric Vehicl- IEA Global EV Outlook 2021: US Electric Vehicl"

- Best Performing US Stock Market Sectors in 202"

- Best Stocks to Invest in the US Now: Top Picks"

- Magnificent 7 US Stocks 2023 Performance: Top "

- Undervalued US Growth Stocks: Unlocking Hidden"

- Title: In-Depth Analysis of PNRA.O: A Comprehe"

- S&P 500 Inclusion Today: What You Need"

- Exploring the Era of 1950-60 US Rolling Stock:"

recommend

BB Stock Price: What You Need to Know About th

BB Stock Price: What You Need to Know About th

Uber Stock: A Smart Investment for U.S. Invest

US Stock Futures: Your Ultimate Guide to YouTu

Latest US Stock Market News August 10, 2025

Russian Companies Making Waves in the US Stock

Toys R Us Stock Pay: Everything You Need to Kn

Unlock the Power of Investment Wisdom: Top 10

Unlock the Potential of Us Apha Stock: Your Ul

US Stock Futures Halt as Investors Await Nvidi

Title: Top US Dividend Stocks 2019: A Guide to

Is the US Stock Market Open on December 31?

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Nestlé Stock US: A Comprehensive Analysis"

- Catl Stock Buy in US: Why It's a Smart In"

- Stock Exchange Google: Unveiling the Ultimate "

- Should We Ban Chinese Companies from Buying U."

- The First US Stock Market Crash: A Pivotal Mom"

- Check Toys "R" Us Stock Onli"

- Unlocking Success with Forecaster Trading: A C"

- Danakali Stock US: The Future of Lithium Extra"

- US Inflation and Stock Market: Understanding t"

- Upcoming Stock Splits: What Investors Need to "