you position:Home > new york stock exchange > new york stock exchange

Unveiling the US Stock Dividend History: A Comprehensive Guide

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

The history of stock dividends in the United States is a testament to the growth and evolution of the stock market. Dividends have been a critical component of investing, providing investors with a steady stream of income and a measure of financial security. This article delves into the fascinating history of stock dividends in the US, highlighting key milestones and their impact on the market.

The Early Days: The Birth of Dividends

The concept of dividends originated in the 17th century, but it wasn't until the 19th century that they became a standard practice in the US. The first recorded dividend was paid by the Bank of North America in 1782. However, it wasn't until the 20th century that dividends became a significant part of the stock market.

The Great Depression: Dividends as a Lifeline

The Great Depression of the 1930s had a profound impact on the stock market, but dividends played a crucial role in providing stability. Many companies continued to pay dividends during this period, which helped to retain investor confidence and stimulate economic recovery.

The Post-War Era: Dividends as a Growth Tool

After World War II, the US stock market experienced a period of rapid growth, and dividends became a key driver of this expansion. Companies began to use dividends as a tool to attract and retain investors, leading to a surge in dividend payments.

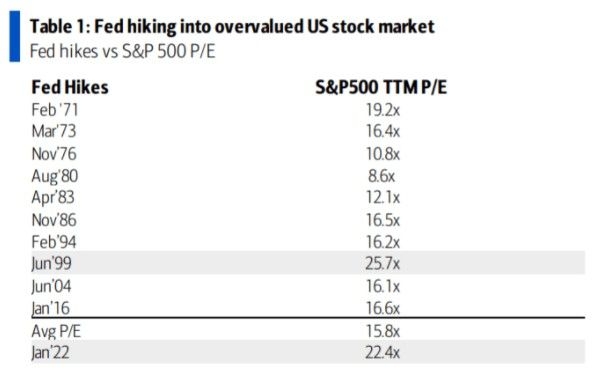

The 1970s: Dividends in a Volatile Market

The 1970s were a turbulent period for the stock market, characterized by high inflation and volatile stock prices. Despite these challenges, dividends continued to play a vital role in providing investors with a stable income source.

The 1980s and 1990s: Dividends and the Tech Boom

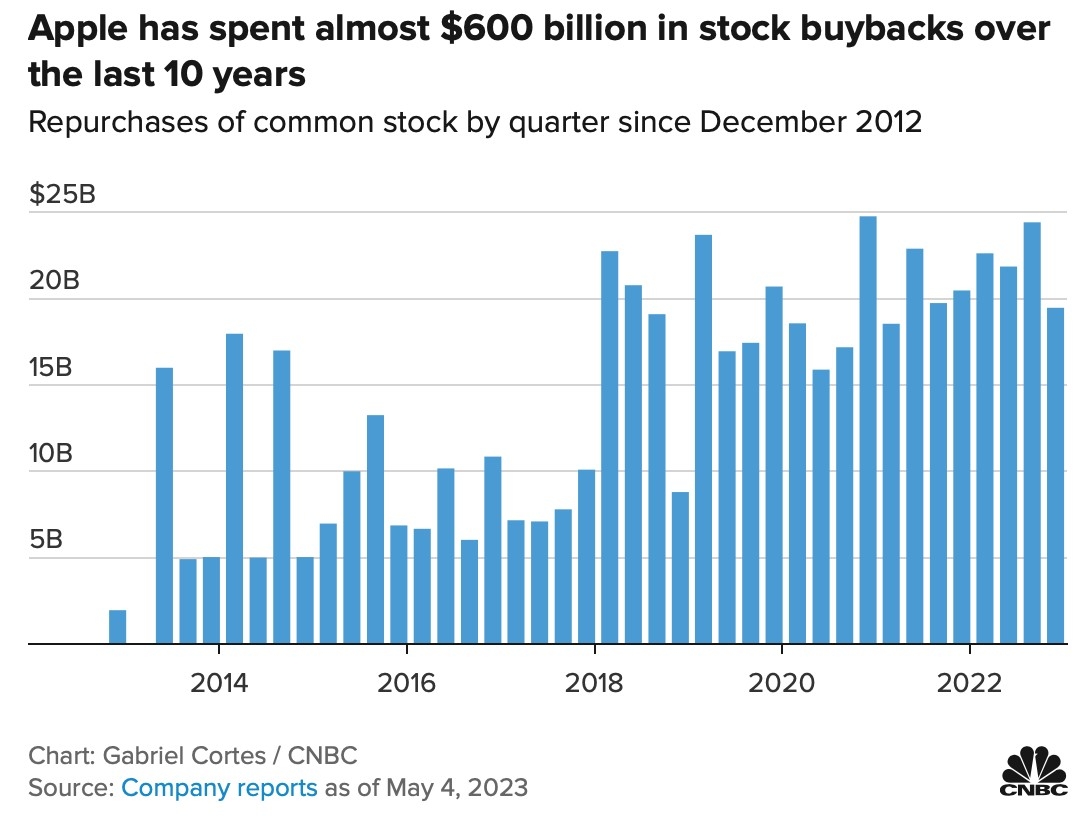

The 1980s and 1990s saw the rise of the tech boom, and dividends played a crucial role in this period. Many tech companies, such as Microsoft and Apple, began to pay dividends, which helped to drive investor interest in the sector.

The 2000s: Dividends and the Financial Crisis

The early 2000s were marked by the dot-com bubble and the subsequent financial crisis. Despite these challenges, dividends continued to be a vital source of income for investors. Many companies, including financial institutions, increased their dividend payments during this period.

The 2010s: Dividends and the Recovery

The 2010s saw a period of economic recovery, and dividends played a crucial role in this process. Many companies increased their dividend payments, which helped to drive investor confidence and stimulate economic growth.

Case Study: Procter & Gamble

One of the most notable examples of a company that has consistently paid dividends is Procter & Gamble. Since its inception in 1837, Procter & Gamble has paid dividends to its shareholders, making it one of the longest-running dividend-paying companies in the US.

Conclusion

The history of stock dividends in the US is a fascinating journey that reflects the growth and evolution of the stock market. Dividends have played a crucial role in providing investors with a stable income source and a measure of financial security. As the stock market continues to evolve, dividends will undoubtedly remain a vital component of investing.

so cool! ()

last:Top Momentum US Stocks to Watch in the Short Term

next:nothing

like

- Top Momentum US Stocks to Watch in the Short Term

- Unlock the Potential of Dow Stocks: A Comprehensive Guide

- Top 5 US Stocks to Buy in 2024: Your Ultimate Investment Guide

- Predictions for Stock Market Tomorrow: What to Expect and How to Prepare

- ACB US Stock Price Today: Current Trends and Analysis

- Swedbank Stock US: A Comprehensive Guide to Investment Opportunities

- Dow Jones Performance Year to Date: Unveiling the Stock Market's Success

- Stock Market Falls Again: What It Means for Investors

- Stock Market Performance in the Last Year: A Comprehensive Analysis"

- S&P 500 Closing: Insights and Analysis of the Market's Performance

- Maximizing Your Financial Potential with Google Finance"

- Asia Stock Markets Today: A Comprehensive Overview

hot stocks

HSBC US Stock Trading Fees: What You Need to K

HSBC US Stock Trading Fees: What You Need to K- HSBC US Stock Trading Fees: What You Need to K"

- Top Momentum Stocks in the US Market August 20"

- Unlocking Opportunities with US Small Value St"

- Shionogi Stock US: A Comprehensive Analysis of"

- Unlocking the Potential of Barclays Bank US St"

- American Stock Traders Outside the US: Opportu"

- Understanding DJIA Pre-Market Futures: A Compr"

- ACB US Stock Price Today: Current Trends and A"

recommend

Unveiling the US Stock Dividend History: A Com

Unveiling the US Stock Dividend History: A Com

Maximizing Returns: A Deep Dive into US Oil an

Lithium US Stocks: A Comprehensive Guide to In

US Steel Stock Price Chart: A Comprehensive An

Recent FDA Approval: A Game-Changer for Small

Unlocking the Potential of ELV US Stock: A Com

US Buys Up Stock of Remdesivir: What It Means

Current CAPE Ratio: A Deep Dive into the US St

UK vs US Stock Market: A Comprehensive Compari

Top Performing US Large Cap Stocks Over the Pa

InMed US Stock: A Comprehensive Guide to Inves

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Invest 10,000 in US Stock Market in 1950: What"

- Energy Sector Stocks: A Comprehensive Guide fo"

- Maximizing Your Investment: A Comprehensive Gu"

- Top US Stocks to Watch in 2025: A Comprehensiv"

- Mastering NYS Finance: A Comprehensive Guide t"

- United Airlines US Stock: A Comprehensive Anal"

- Independence Realty Trust: A Leading Player in"

- German Auto Manufacturers on the US Stock Mark"

- Top 10 US Stocks by Market Cap April 2025: A C"

- Is the Swiss National Bank Buying US Stocks? A"