you position:Home > new york stock exchange > new york stock exchange

Unlock the Potential of Dow Stocks: A Comprehensive Guide

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the ever-evolving world of investments, staying ahead of the curve is crucial. One such area that has captured the attention of many investors is the Dow Jones Industrial Average (DJIA), often simply referred to as the Dow. This article delves into the intricacies of Dow stocks, providing a comprehensive guide to help you understand and invest in this powerful index.

Understanding the Dow Jones Industrial Average

The Dow Jones Industrial Average is a price-weighted average of 30 large, publicly-traded companies in the United States. These companies are selected based on various criteria, including their market capitalization, financial stability, and industry representation. The Dow is one of the most widely followed stock market indices in the world and is often used as a benchmark for the overall performance of the U.S. stock market.

Key Components of the Dow

The Dow consists of companies from various sectors, including financials, technology, energy, and consumer goods. Some of the most well-known companies in the Dow include Apple Inc. (AAPL), Microsoft Corporation (MSFT), Visa Inc. (V), and Johnson & Johnson (JNJ). These companies not only contribute to the index's performance but also offer investors a diverse range of investment opportunities.

Investing in Dow Stocks

Investing in Dow stocks can be a great way to gain exposure to the U.S. stock market. However, it is important to understand the risks and rewards associated with these investments. Here are some key points to consider:

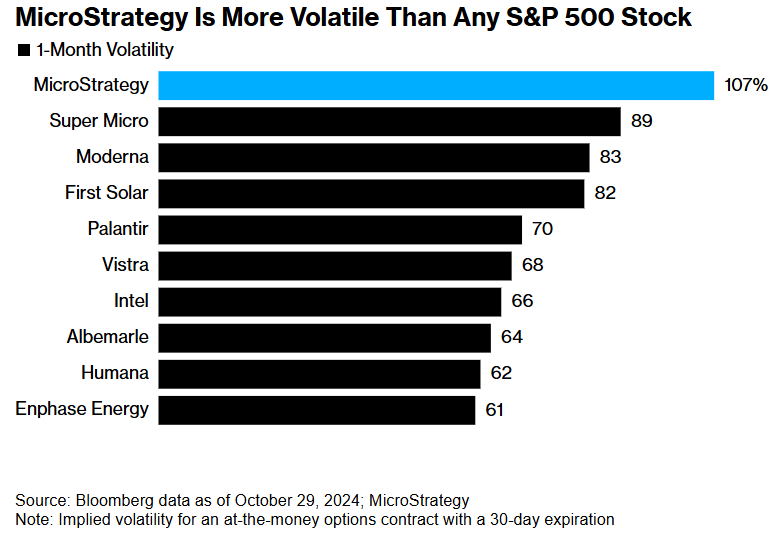

1. Diversification: Investing in Dow stocks can provide diversification, as the index includes companies from various sectors. This can help reduce the risk of portfolio volatility.

2. Stability: The Dow Jones Industrial Average includes some of the most stable and financially sound companies in the world. This can make it a relatively safe investment option for risk-averse investors.

3. Long-term Growth: Many Dow companies have a long history of profitability and growth. Investing in these companies can offer the potential for long-term capital appreciation.

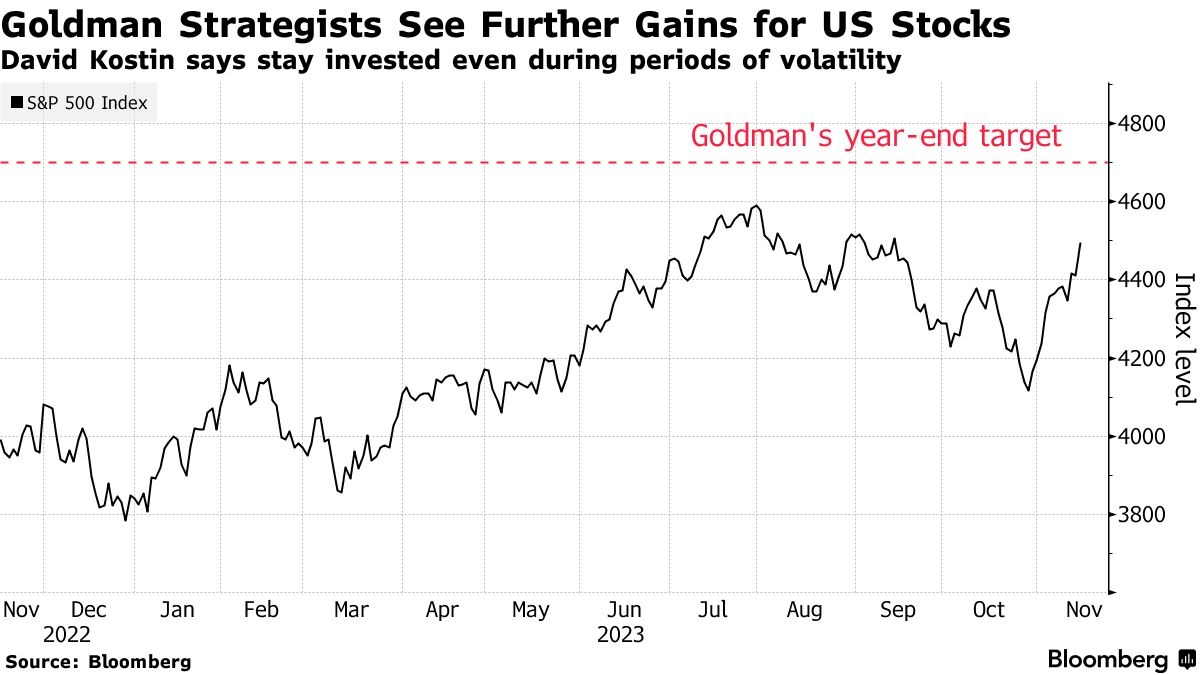

4. Market Trends: The performance of the Dow can provide insights into the broader market trends. By analyzing the index, investors can gain a better understanding of the overall economic and market conditions.

5. Dividends: Many Dow companies pay dividends, which can provide investors with a regular income stream.

Case Study: Apple Inc.

Apple Inc. is one of the most influential companies in the Dow Jones Industrial Average. Over the years, Apple has not only grown its market capitalization but has also become a global leader in technology. By investing in Apple stock, investors have enjoyed significant returns, including capital appreciation and dividends.

Conclusion

Investing in Dow stocks can be a powerful way to grow your wealth. By understanding the components of the Dow, the risks and rewards associated with these investments, and analyzing market trends, you can make informed decisions about your investments. Whether you are a seasoned investor or just starting out, the Dow Jones Industrial Average offers a wealth of opportunities for growth and diversification.

so cool! ()

last:Top 5 US Stocks to Buy in 2024: Your Ultimate Investment Guide

next:nothing

like

- Top 5 US Stocks to Buy in 2024: Your Ultimate Investment Guide

- Predictions for Stock Market Tomorrow: What to Expect and How to Prepare

- ACB US Stock Price Today: Current Trends and Analysis

- Swedbank Stock US: A Comprehensive Guide to Investment Opportunities

- Dow Jones Performance Year to Date: Unveiling the Stock Market's Success

- Stock Market Falls Again: What It Means for Investors

- Stock Market Performance in the Last Year: A Comprehensive Analysis"

- S&P 500 Closing: Insights and Analysis of the Market's Performance

- Maximizing Your Financial Potential with Google Finance"

- Asia Stock Markets Today: A Comprehensive Overview

- Unlocking Profits: A Comprehensive Guide to Online Stock Investing

- Why the Market is Down Today: Key Factors to Consider

hot stocks

HSBC US Stock Trading Fees: What You Need to K

HSBC US Stock Trading Fees: What You Need to K- HSBC US Stock Trading Fees: What You Need to K"

- Top Momentum Stocks in the US Market August 20"

- Unlocking Opportunities with US Small Value St"

- Shionogi Stock US: A Comprehensive Analysis of"

- Unlocking the Potential of Barclays Bank US St"

- American Stock Traders Outside the US: Opportu"

- Understanding DJIA Pre-Market Futures: A Compr"

- ACB US Stock Price Today: Current Trends and A"

recommend

Unlock the Potential of Dow Stocks: A Comprehe

Unlock the Potential of Dow Stocks: A Comprehe

2025 Summer US Stock Hedge Fund Selling Timing

Unlocking Opportunities in the US Stock Market

US Cellular Stock Performance: A Comprehensive

Most Volatile US Stocks to Watch in August 202

"ABcam US Stock Price: A Comprehensiv

How Will Democratic Win Affect Us Stocks?

"How Many Israeli Companies Are in th

Unlocking Your Financial Future: A Comprehensi

List of US Stock Indices: Comprehensive Guide

HSBC US Stock Fee: Understanding the Costs and

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Predictions for Stock Market Tomorrow: What to"

- Top ETFs to Invest in U.S. Stocks: Your Ultima"

- Title: US Automaker Traded on Stock Exchange: "

- Maximizing Returns with ETF Investing in US St"

- "Total Market Cap of US Stocks: A Com"

- Best Cheap US Stocks to Buy: Hidden Gems for I"

- Unlocking the Potential of the US Small Stock "

- United Airlines US Stock: A Comprehensive Anal"

- US Stock Forecast Today: What to Expect and Ho"

- "ABcam US Stock Price: A Comprehensiv"