you position:Home > new york stock exchange > new york stock exchange

US Dividend Stocks Lose Luster: What Investors Need to Know

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In recent years, US dividend stocks have been a cornerstone of many investors' portfolios. However, the shine may be fading as the market evolves. This article delves into why US dividend stocks might be losing their appeal and what investors should consider moving forward.

The Changing Landscape

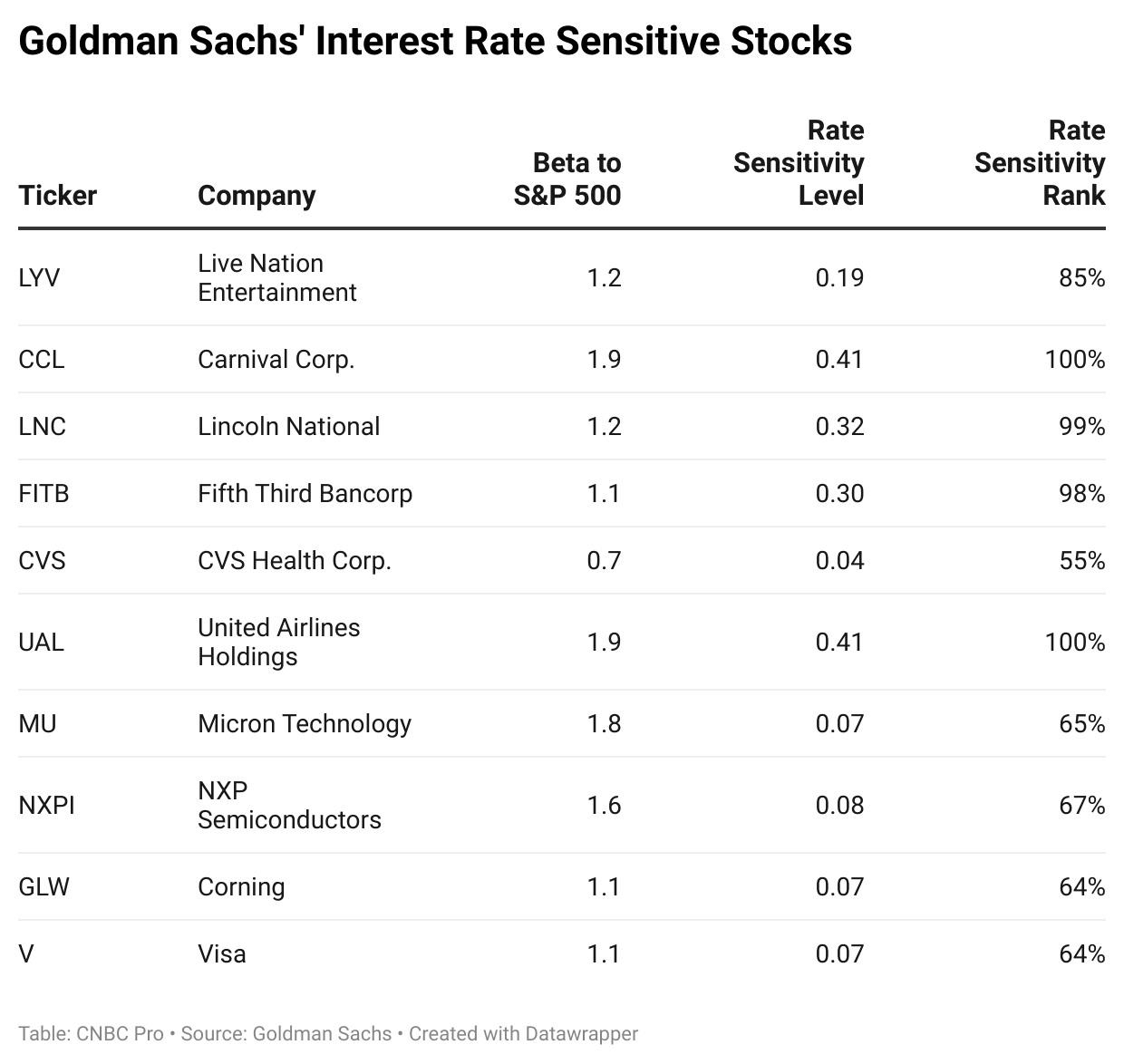

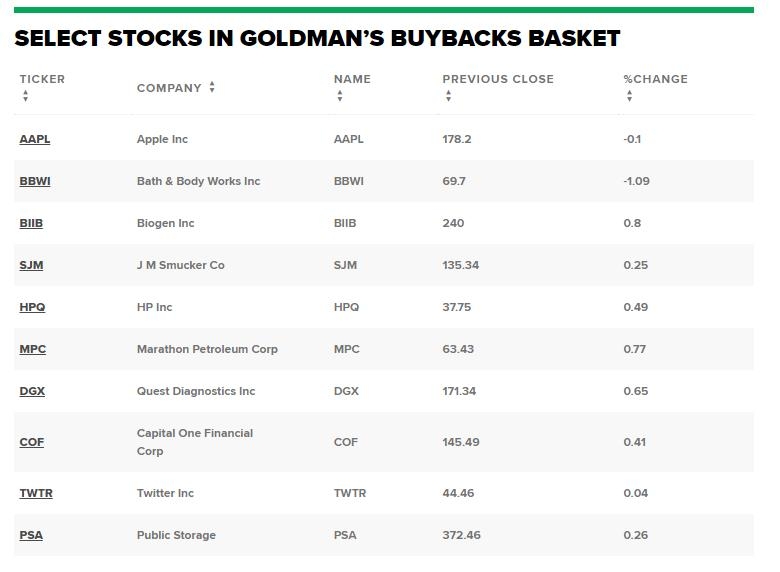

The US stock market has seen significant changes in recent years, and these changes are impacting dividend stocks. One of the primary reasons for the loss of luster is the rising interest rates. Historically low interest rates made dividend stocks more attractive, as they offered a higher yield compared to fixed-income investments. However, as rates rise, the attractiveness of these stocks diminishes.

Rising Inflation

Another factor contributing to the decline in US dividend stocks is rising inflation. Inflation erodes the purchasing power of dividends, making them less valuable to investors. This has led to a shift in focus from dividend yield to dividend growth, as investors seek stocks that can consistently increase their payouts over time.

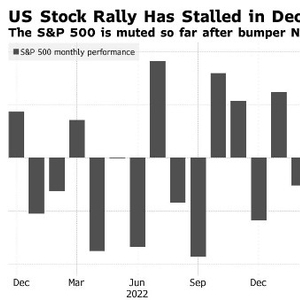

Market Volatility

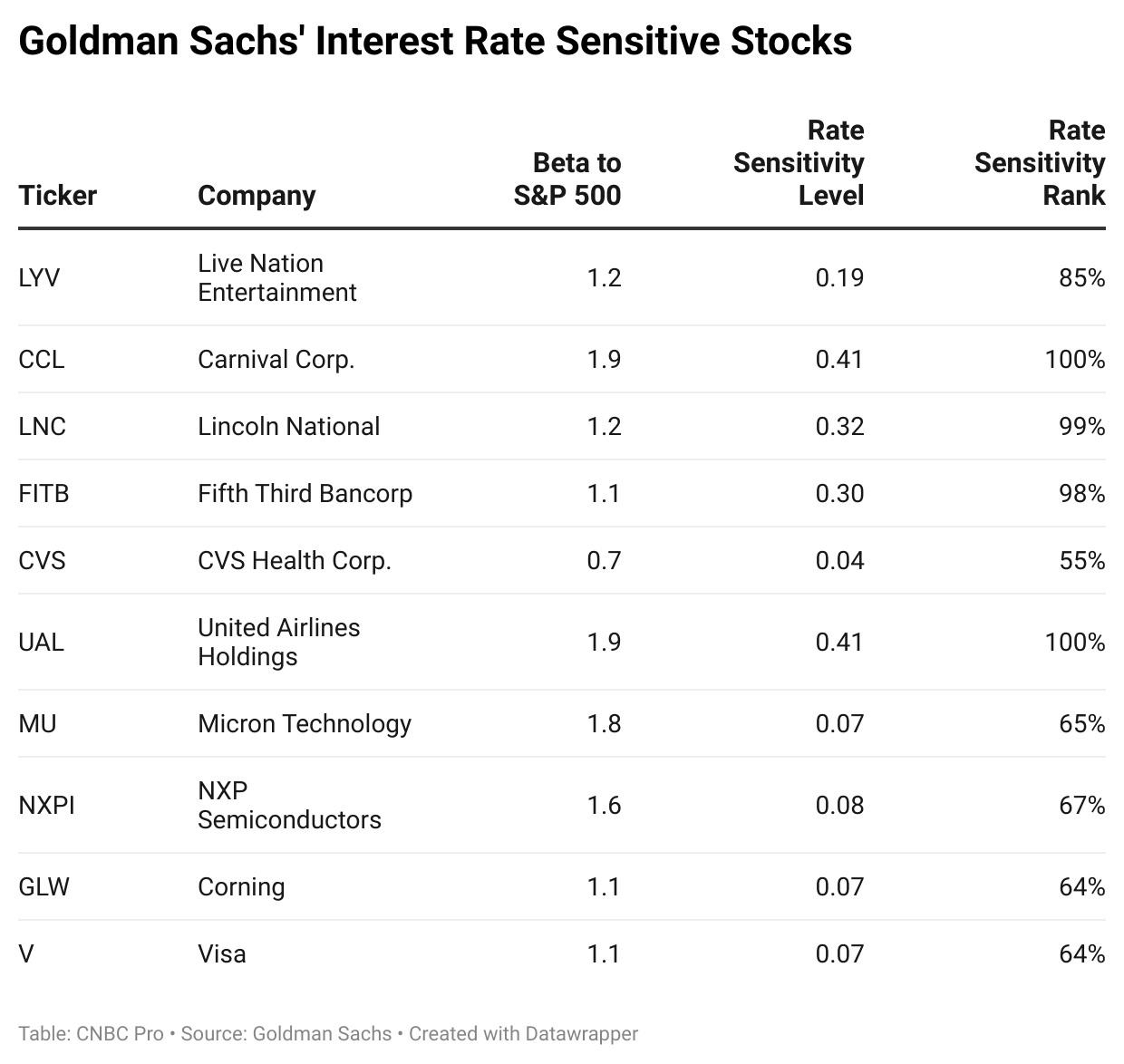

Market volatility has also played a role in the loss of appeal for US dividend stocks. The stock market has experienced significant ups and downs in recent years, leading to uncertainty and volatility in dividend stocks. This has made them riskier for some investors, particularly those nearing retirement age.

Dividend Cutbacks

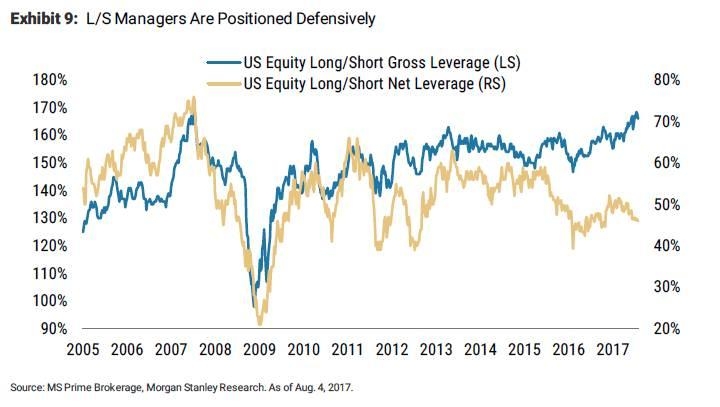

Some companies have been forced to cut their dividends due to financial strain, further dampening investor interest. This is particularly concerning for investors who rely on dividends for income, as it can significantly impact their financial well-being.

Emerging Market Alternatives

Investors are increasingly looking to emerging markets for alternative investment opportunities. These markets often offer higher dividend yields and growth potential compared to US dividend stocks. Companies in emerging markets may also be less exposed to the economic pressures affecting the US market.

Key Takeaways

- Rising Interest Rates: US dividend stocks are becoming less attractive as interest rates rise.

- Rising Inflation: Inflation erodes the purchasing power of dividends, leading investors to seek growth over yield.

- Market Volatility: Volatility in the stock market makes dividend stocks riskier for some investors.

- Dividend Cutbacks: Some companies are cutting their dividends, further reducing investor interest.

- Emerging Market Alternatives: Investors are looking to emerging markets for higher dividend yields and growth potential.

Case Study: Procter & Gamble

A notable example of a company that has recently cut its dividend is Procter & Gamble (P&G). P&G, one of the largest consumer goods companies in the world, has been a staple in many dividend investors' portfolios. However, the company announced a 50% cut to its dividend in 2020, citing the impact of the COVID-19 pandemic on its business.

This decision highlighted the vulnerability of dividend stocks during times of economic uncertainty. It also served as a reminder to investors that even well-established companies can face challenges that lead to dividend cuts.

In conclusion, US dividend stocks are losing their luster as the market evolves. Investors should consider the changing landscape and seek alternative investment opportunities to diversify their portfolios. By understanding the factors driving this shift, investors can make informed decisions to protect their financial well-being.

so cool! ()

last:Hydrogen Power Stocks: The Future of Energy in the US

next:nothing

like

- Hydrogen Power Stocks: The Future of Energy in the US

- Understanding US Capital Gains Tax on Israeli Stocks

- 2023 US Stock Market Holidays: A Comprehensive Guide

- Hunting Stock for Us Model 1903 Springfield Rifle: A Comprehensive Guide

- LTCG on US Stocks in India: A Comprehensive Guide

- Maximize Returns: The Ultimate Guide to US Shell Stock Investing"

- Active Small Cap US Stock Fund: A Strategic Investment Opportunity

- Time to Sell Us Stocks: Strategies for Maximizing Returns

- US Hospital Stocks: A Comprehensive Guide to Investing in the Healthcare Sector

- US Stock Calendar 2019: A Comprehensive Guide to Market Events

- Top ESG Stocks to Watch in the US Market in 2025"

- Top 10 US Blue Chip Stocks at 52-Week Low: Opportunities for Investors

hot stocks

HSBC US Stock Trading Fees: What You Need to K

HSBC US Stock Trading Fees: What You Need to K- HSBC US Stock Trading Fees: What You Need to K"

- Top Momentum Stocks in the US Market August 20"

- Unlocking Opportunities with US Small Value St"

- Shionogi Stock US: A Comprehensive Analysis of"

- Unlocking the Potential of Barclays Bank US St"

- Does MGM Macau Affect MGM Stocks in US?"

- Unlock the Power of Free US Stock Data: Your U"

- "Can US Residents Open a Stock Accoun"

recommend

US Dividend Stocks Lose Luster: What Investors

US Dividend Stocks Lose Luster: What Investors

How to Invest in European Stocks from the US:

AI Stocks US: The Future of Investment in Arti

Hexo Stock Price in US Dollars: Current Trends

Shutterstock Image with Monumental US Flag: A

Buying US Stocks with Wealthsimple: A Comprehe

"Best Shares to Buy in the US Stock M

How to Sell Canadian Stocks in the US: A Compr

Can a US Citizen Invest in the Russian Stock M

List of All Stock Markets in the US: Comprehen

Is It a Good Time to Buy US Stocks? A Comprehe

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- List of US Stocks Impacted by the Trade War"

- US Small Cap Clean Energy Stocks: A Lucrative "

- Micro Cap US Stocks: Upcoming Catalysts to Wat"

- Top 10 US Stocks by Market Cap April 2025: A C"

- Fed Rate Cut Impact on US Stock Market: A Comp"

- Moving Averages Analysis: Predicting US Stock "

- CD Projekt Red US Stock: A Deep Dive into the "

- Top US Stocks with High PE Ratio: Opportunitie"

- Recent Breakout Stocks: US Momentum That'"

- Transfer Stock Ownership in Canadian ULC to US"