you position:Home > new york stock exchange > new york stock exchange

Interactive Brokers Commissions: Unveiling the US Stocks Pricing Structure

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the fast-paced world of stock trading, understanding the fees and pricing structures of your brokerage is crucial. One of the leading names in the industry is Interactive Brokers, known for its comprehensive suite of services. This article delves into the specifics of Interactive Brokers’ commissions for US stocks, providing you with a clear and concise overview.

Commissions Structure at a Glance

Interactive Brokers offers a straightforward commission structure for US stocks. The standard commission for equity trades is

Understanding the Pricing

The

Additional Fees and Considerations

While the standard commission rate is clear, there are a few additional fees and considerations to keep in mind:

- Market Data Fees: Interactive Brokers charges a monthly fee for market data, which can vary depending on the level of data you require.

- Regulatory Fees: Certain trades may incur regulatory fees, which are typically passed on to the customer.

- Order Types: The type of order you place can also affect your total cost. For example, market orders are generally cheaper than limit orders.

Real-World Examples

Let’s consider a few examples to illustrate how the commission structure works:

- Trading 1000 Shares: If you trade 1000 shares of a stock at

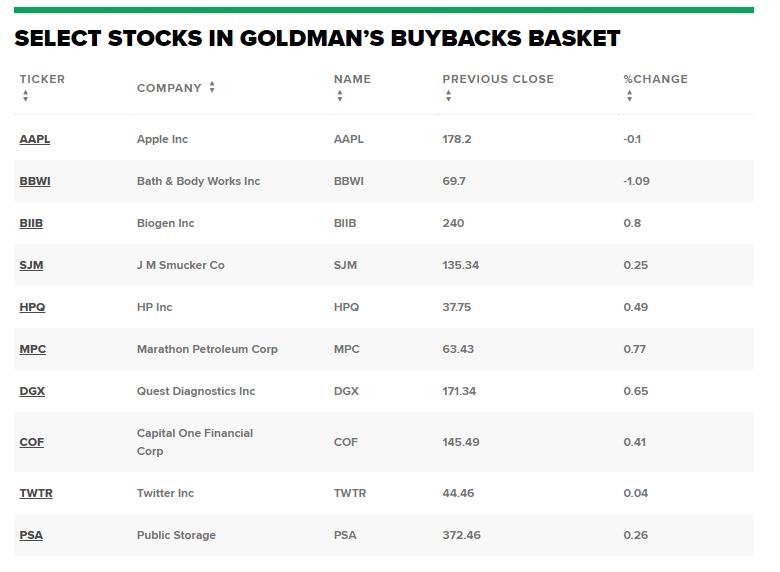

0.005 per share, your total commission would be 5.00, but since the minimum commission is1.00, you would pay 1.00. - Trading a High-Volume Stock: If you trade 10,000 shares of a high-volume stock like Apple (AAPL), your total commission would be

50.00, again subject to the 1.00 minimum.

Conclusion

Interactive Brokers’ commission structure for US stocks is straightforward and competitive, especially for active traders. With a

so cool! ()

last:Dow Chart History: Decoding the Stock Market's Evolution

next:nothing

like

- Dow Chart History: Decoding the Stock Market's Evolution

- Takeda US Stock: A Comprehensive Guide to Investing in Takeda Pharmaceuticals

- Unlocking the Treasure Trove: A Comprehensive Guide to Mercari Stock US

- Stock Market Sentiment: A Key Indicator of the US Economy

- June 21, 2025 US Stock Market Summary: Key Highlights and Analysis

- Dow Jones Industrial Historical Average: A Deep Dive into the Past and Future of

- Unlock the Power of AA Stocks: A Comprehensive Overview

- What Will the Market Do Next Week?

- NYSE Stock Quotations: Unveiling the Real-Time Market Dynamics"

- Unlock the Power of Live Trade: A Comprehensive Guide

- The Strongest US Stocks to Watch in 2023

- Unlocking the Potential of NYC Stock Market: A Comprehensive Guide"

hot stocks

HSBC US Stock Trading Fees: What You Need to K

HSBC US Stock Trading Fees: What You Need to K- HSBC US Stock Trading Fees: What You Need to K"

- Top Momentum Stocks in the US Market August 20"

- Unlocking Opportunities with US Small Value St"

- Shionogi Stock US: A Comprehensive Analysis of"

- Unlocking the Potential of Barclays Bank US St"

- American Stock Traders Outside the US: Opportu"

- Understanding DJIA Pre-Market Futures: A Compr"

- ACB US Stock Price Today: Current Trends and A"

recommend

Interactive Brokers Commissions: Unveiling the

Interactive Brokers Commissions: Unveiling the

"Unveiling the Power of the S&

Can You Buy Nintendo Stock in the US? A Compre

US Bullish on Tech Stocks: The Future of Innov

Best US Stocks to Buy in June 2025: Analyst Re

Cryptocurrency Stocks: A Lucrative Investment

Maximizing Returns with ETF Investing in US St

Undervalued US Stocks Now: Hidden Gems to Watc

US-Made VZ-58 Stocks: The Ultimate Guide to Cu

US Gold Corp Stock Forecast: A Comprehensive A

Dow Jones Industrial Average Tracker: Your Ult

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Active Small Cap US Stock Fund: A Strategic In"

- Understanding Ex-Dividend Dates for US Stocks:"

- Why the Market is Down Today: Key Factors to C"

- What Will the Market Do Next Week?"

- US-Made VZ-58 Stocks: The Ultimate Guide to Cu"

- Trump's Influence on Stock Market: A Look"

- Latest US Stock Market News: July 31, 2025 - M"

- Dow Jones Industrial Average Tracker: Your Ult"

- Can F1 Visa Holders Invest in the US Stock Mar"

- "How Many Stock Markets Are There in "