you position:Home > new york stock exchange > new york stock exchange

What Will the Market Do Next Week?

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

As we step into a new week, investors and traders are eagerly asking themselves, "What will the market do next week?" The stock market can be unpredictable at times, but there are certain factors that can provide us with some insight. In this article, we will discuss some key indicators that might help us predict the market's trajectory in the upcoming week.

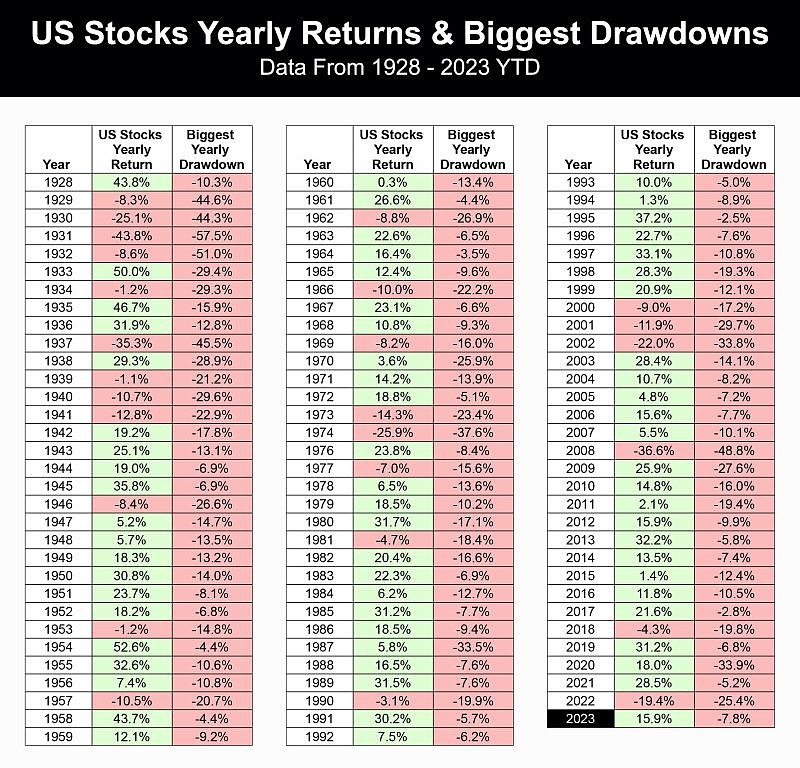

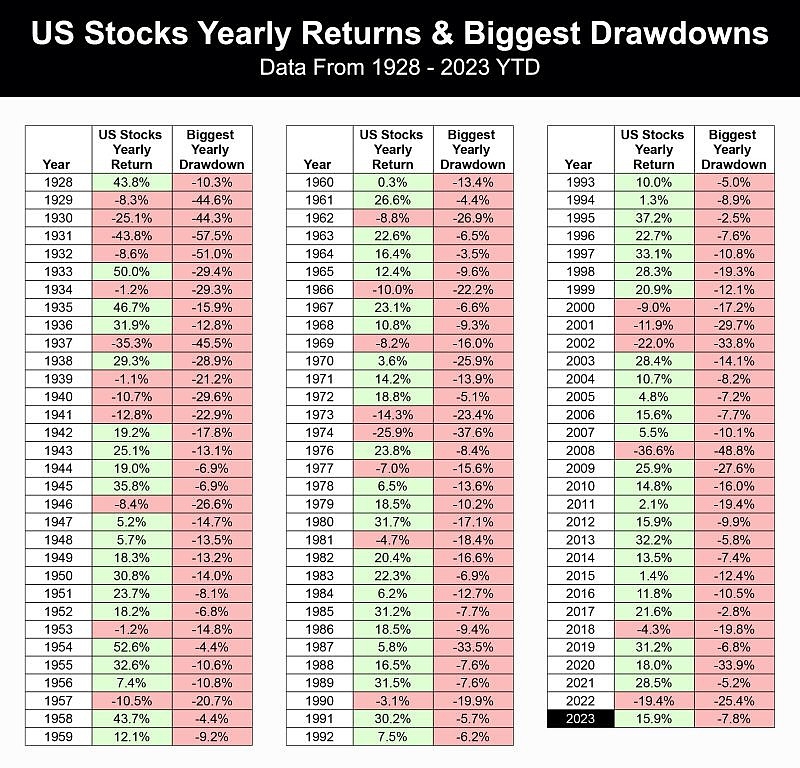

Historical Market Trends

One way to predict the market's behavior is to analyze historical market trends. By examining past patterns, we can identify potential trends that might repeat themselves in the future. For instance, if the market has shown a consistent upward trend on Mondays, there's a higher chance that it will continue that trend next week.

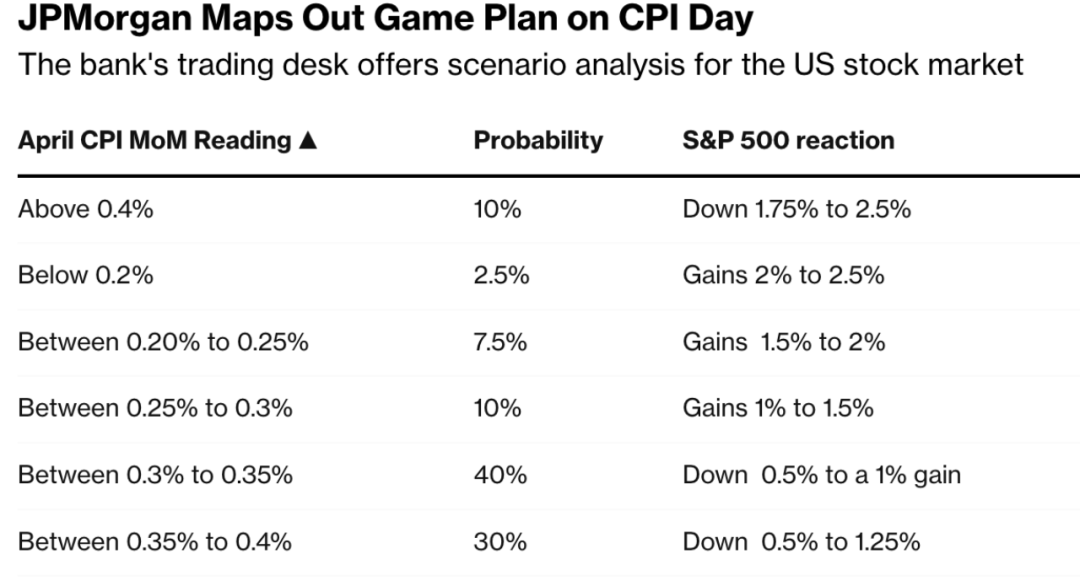

Economic Indicators

Economic indicators such as unemployment rates, inflation, and GDP growth can significantly impact the market. When the economy is doing well, investors tend to feel more confident, which usually leads to an upward trend in the stock market. Conversely, when economic indicators show signs of weakness, investors may become more cautious, resulting in a downward trend.

News and Events

The stock market is highly sensitive to news and events. Positive news, such as a breakthrough in technology or a major political victory, can boost the market. On the other hand, negative news, such as an economic recession or a geopolitical conflict, can cause the market to plummet. Keeping an eye on upcoming news and events can help us predict the market's direction.

Technical Analysis

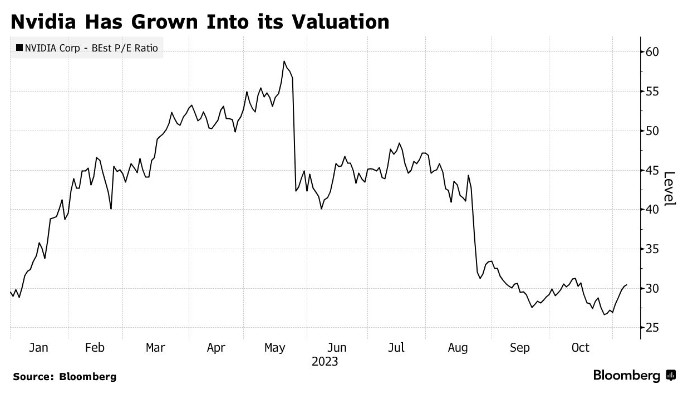

Technical analysis involves analyzing statistical trends gathered from trading activity, such as price movement and volume. Traders use various tools and indicators to identify potential market movements. Some of the popular tools include moving averages, support and resistance levels, and Fibonacci retracement levels. By examining these indicators, traders can gain insight into the market's behavior and make more informed decisions.

Market Sentiment

Market sentiment refers to the overall outlook and mood of investors. When investors are optimistic, they tend to buy more stocks, driving the market upward. Conversely, when investors are pessimistic, they sell more stocks, causing the market to fall. Understanding market sentiment can help us predict the market's direction.

Case Study: The Dot-Com Bubble

One notable case study that illustrates how external factors can impact the market is the Dot-Com bubble of the late 1990s. The bubble was fueled by irrational exuberance and speculation in the tech sector. When the bubble burst, the market experienced a significant decline. This example shows how important it is to consider external factors when predicting the market's behavior.

Conclusion

Predicting the market's behavior is no easy task, but by analyzing historical trends, economic indicators, news and events, technical analysis, and market sentiment, we can gain some insight into the market's direction. While there's no guarantee of accuracy, being aware of these factors can help us make more informed decisions and stay one step ahead of the market.

Keep an eye on the factors mentioned above, and stay tuned for updates on the market's trajectory next week. Remember, the key to successful investing is to stay informed and adapt to changing conditions.

so cool! ()

last:NYSE Stock Quotations: Unveiling the Real-Time Market Dynamics"

next:nothing

like

- NYSE Stock Quotations: Unveiling the Real-Time Market Dynamics"

- Unlock the Power of Live Trade: A Comprehensive Guide

- The Strongest US Stocks to Watch in 2023

- Unlocking the Potential of NYC Stock Market: A Comprehensive Guide"

- Dow Jones Industrial Average Tracker: Your Ultimate Guide to Market Performance

- Dow Futures Right Now: Current Trends and Analysis

- How Big Is the US Stock Market?

- Trump's Influence on Stock Market: A Look at US and UK Impacts"

- Forge World Out of Stock US: Exploring the Impact and Alternatives

- US Investment in Rare Earth Stocks Amid China's Dominance: A Strategic Move&

- Trade US Stocks from NZ: Your Ultimate Guide to Investing Across the Pond

- Us Marines Stock Photos: Capturing the Essence of Courage and Strength

hot stocks

HSBC US Stock Trading Fees: What You Need to K

HSBC US Stock Trading Fees: What You Need to K- HSBC US Stock Trading Fees: What You Need to K"

- Top Momentum Stocks in the US Market August 20"

- Unlocking Opportunities with US Small Value St"

- Shionogi Stock US: A Comprehensive Analysis of"

- Unlocking the Potential of Barclays Bank US St"

- American Stock Traders Outside the US: Opportu"

- Understanding DJIA Pre-Market Futures: A Compr"

- ACB US Stock Price Today: Current Trends and A"

recommend

What Will the Market Do Next Week?

What Will the Market Do Next Week?

US Large Cap Growth Stocks: Your Guide to Inve

June 30, 2025 US Stock Market Summary

Samsung Vendor List: Companies on the US Stock

The US Stock Market History: A Timeline of Mil

How Are US Stocks Doing? A Comprehensive Analy

Stocks That Benefit from a Weak US Dollar: A S

Title: US Automaker Traded on Stock Exchange:

Can You Buy Us Stocks in UK ISA? A Comprehensi

Fidelity US Total Stock Market Index Fund: You

Highest Dividend Stocks in the US: Unveiling t

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Understanding Ex-Dividend Dates for US Stocks:"

- Maximizing Returns with ETF Investing in US St"

- Best Marijuana Stocks to Buy in the US: Top Pi"

- US Stock Futures Plunge: What You Need to Know"

- Stocks Against Us: Understanding the Risks and"

- Toys "R" Us Stock 2021: A Co"

- US Stock Calendar 2016: A Comprehensive Guide "

- Asia Stock Markets vs. US Stock Markets: A Com"

- Understanding DJIA Pre-Market Futures: A Compr"

- Transfer Stock Ownership in Canadian ULC to US"