you position:Home > can foreigners buy us stocks > can foreigners buy us stocks

Understanding Capital Stock in the US Market

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the dynamic world of the US stock market, understanding capital stock is crucial for investors and financial analysts alike. Capital stock refers to the total value of a company's equity, which is the difference between its assets and liabilities. This article delves into what capital stock is, how it's calculated, and its significance in the US market.

What is Capital Stock?

Capital stock represents the ownership interest in a company. It is essentially the value of the company's equity, which is calculated by subtracting its liabilities from its assets. This value is reflected in the company's balance sheet and is a critical indicator of its financial health.

How is Capital Stock Calculated?

The formula for calculating capital stock is straightforward:

Capital Stock = Total Assets - Total Liabilities

Total assets include all the resources owned by the company, such as cash, inventory, property, and equipment. Total liabilities encompass all the company's debts and obligations, including loans, accounts payable, and other liabilities.

Significance of Capital Stock in the US Market

Understanding capital stock is vital for several reasons:

- Financial Health: A higher capital stock indicates a stronger financial position, as it suggests the company has more assets than liabilities. This can be a positive sign for investors.

- Investment Decisions: Investors often use capital stock to assess a company's financial stability and potential for growth. A higher capital stock can make a company more attractive to investors.

- Valuation: Capital stock is a key component in valuing a company. It helps determine the company's market capitalization, which is the total value of all its outstanding shares.

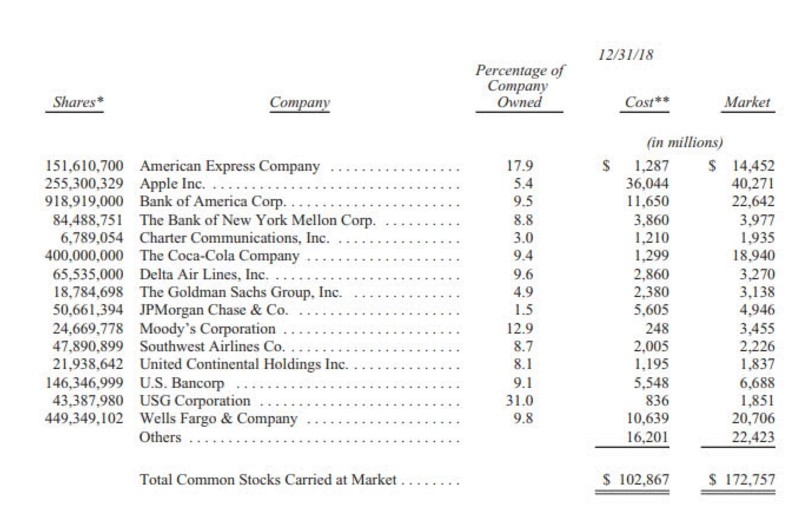

Case Study: Apple Inc.

Let's take a look at a real-world example. As of the end of 2021, Apple Inc. had a capital stock of approximately $237 billion. This indicates that Apple's assets exceeded its liabilities by a significant margin, reflecting its strong financial position.

Conclusion

In conclusion, understanding capital stock is essential for anyone involved in the US stock market. It provides valuable insights into a company's financial health, investment potential, and valuation. By analyzing a company's capital stock, investors and analysts can make more informed decisions and better understand the complexities of the stock market.

so cool! ()

last:Today's Stock Gainers: Unveiling the Market's Top Performers"

next:nothing

like

- Today's Stock Gainers: Unveiling the Market's Top Performers"

- Bump Stocks in the US: A Comprehensive Look

- S&P 500 Index Fund Cost: Understanding the Real Expenses

- Fox Business News Stock Market: The Ultimate Guide to Stay Ahead

- Unlocking the Potential of Investing in the US Stock Market

- S&P Index Announcements: What You Need to Know

- Stock Market Winners & Losers: Today's Breakdown"

- Market is Down: Navigating the Current Economic Climate

- Unlocking the Potential of US Steel Stock Offering: A Comprehensive Guide

- Sales News: The Latest Breakthroughs in Sales Techniques and Strategies

- Discover the Best Indian ETFs for US Investors

- Hebei Shenghua Chemical Industry Co., Ltd.: A Deep Dive into US Stock Performance

hot stocks

Pre-Market US Stock Movers: Key Insights and A

Pre-Market US Stock Movers: Key Insights and A- Pre-Market US Stock Movers: Key Insights and A"

- Among Us Christmas Stockings: Uniquely Celebra"

- Samsung Note 12.2 P900 Stock ROM US: A Compreh"

- Top US Cannabis Stocks to Buy in 2023: A Guide"

- Is the US Stock Market Open on Election Day 20"

- Total Market Capitalization of US Stocks: A Co"

- "Unveiling the Excitement of US New S"

- Buy Stocks Outside US: A Guide to Global Inves"

recommend

Understanding Capital Stock in the US Market

Understanding Capital Stock in the US Market

What Is a Good Stock Price? A Comprehensive Gu

Us Pot Stocks 2021: The Year of Cannabis Inves

February 2020 IPO List: Top US Stock Market Co

Momentum Stocks: Top Performers in the US Mark

The Ultimate Guide to the Best Stock Tracker S

Unlocking the Potential of SI US Stock: A Comp

US Stock Futures Climb Ahead of the Bell on Th

52 Week High Stocks: How to Identify and Inves

Hot Momentum Stocks US: Top Picks for Investor

"Maximizing Returns: Top US Franchise

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- "G abroad us stocks": A Comp"

- Number of Stocks in CRSP US Total Market Index"

- T-Mobile US Historical Stock Price: January 3,"

- Maximizing Your Investment Potential with Onli"

- "Maximizing Returns: Top US Franchise"

- How to Scan US Common Stocks with TC2000 on Yo"

- Understanding the Tencent US Stock Code: A Com"

- International ETFs Outperforming US Stocks: A "

- Nestle US Stock: A Comprehensive Guide to Inve"

- Stock with the Cheapest Price in the US: Disco"