you position:Home > can foreigners buy us stocks > can foreigners buy us stocks

Discover the Best Indian ETFs for US Investors

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

Investing in international markets can be a powerful strategy for diversifying your portfolio and capitalizing on global growth opportunities. For U.S. investors looking to gain exposure to the dynamic Indian market, exchange-traded funds (ETFs) are a convenient and cost-effective way to invest. In this article, we'll explore some of the top Indian ETFs for U.S. investors and what makes them attractive.

Understanding Indian ETFs

Indian ETFs are designed to track the performance of specific indexes or baskets of Indian stocks. These funds are listed on U.S. exchanges, making it easy for U.S. investors to purchase and sell them like any other stock. By investing in Indian ETFs, investors can gain exposure to the Indian stock market without having to navigate complex regulatory requirements or deal with currency exchange issues.

Top Indian ETFs for U.S. Investors

iShares MSCI India ETF (INDA)

- This ETF tracks the MSCI India Index, providing broad exposure to the Indian stock market. It includes companies from various sectors, such as finance, energy, and technology.

- Key Features:

- Expense Ratio: 0.68%

- Average Daily Volume: 4,695,050

Eaton Vance India ETF (INPF)

- The Eaton Vance India ETF aims to replicate the performance of the S&P BSE India Nifty 50 Index, focusing on large-cap stocks.

- Key Features:

- Expense Ratio: 0.59%

- Average Daily Volume: 5,317,500

Vanguard FTSE India Index ETF (VNIN)

- This ETF tracks the FTSE India Index, which includes large- and mid-cap companies across various sectors.

- Key Features:

- Expense Ratio: 0.19%

- Average Daily Volume: 1,590,000

WisdomTree India Earnings ETF (EPI)

- The WisdomTree India Earnings ETF focuses on companies with a history of generating positive earnings, aiming to provide exposure to the earnings potential of the Indian market.

- Key Features:

- Expense Ratio: 0.60%

- Average Daily Volume: 3,030,000

Global X MSCI India Consumer Discretionary ETF (INDU)

- This ETF is designed to track the performance of the MSCI India Consumer Discretionary Index, which includes companies in the consumer discretionary sector.

- Key Features:

- Expense Ratio: 0.58%

- Average Daily Volume: 4,500,000

Why Invest in Indian ETFs?

Investing in Indian ETFs offers several advantages:

- Diversification: Indian stocks can add diversity to a U.S.-focused portfolio, helping to reduce risk and improve returns over the long term.

- Growth Potential: India's rapidly growing economy, young population, and increasing urbanization present attractive investment opportunities.

- Convenience: Investing in Indian ETFs is easy and straightforward, with no need for currency conversion or complex transactions.

Case Study: iShares MSCI India ETF (INDA)

Consider the iShares MSCI India ETF (INDA). Since its launch in 2006, the ETF has delivered impressive returns, significantly outperforming major U.S. market indexes. This demonstrates the potential of Indian ETFs to provide substantial growth to investors' portfolios.

In conclusion, investing in Indian ETFs is a viable and accessible strategy for U.S. investors seeking to gain exposure to the Indian market. By understanding the available options and considering factors such as expense ratios and sector focus, investors can select the best ETFs to align with their investment goals and risk tolerance.

so cool! ()

like

- Hebei Shenghua Chemical Industry Co., Ltd.: A Deep Dive into US Stock Performance

- Understanding Symbol Stock Price: A Comprehensive Guide

- Unlock the Potential of NASDAQ Futures: Your Ultimate Guide

- Norway Boycotting US Stocks: What It Means for Global Markets

- US Market Stock Open Time: Understanding the Key Window for Investors"

- US Firms Issue Stock in Foreign Markets: A Comprehensive Guide

- Maximizing Your Financial Potential with MSM Money

- S&P 500 Highest Close Ever: A Milestone in the Stock Market

- US Congress Stock Tracker: Monitor Investments with Ease"

- Quote Live: Revolutionizing the Way We Get Insurance Quotes

- Nuclear Power Plant Stocks: Powering the Future of the U.S. Energy Sector

- The 3 Main US Stock Exchanges: A Comprehensive Guide

hot stocks

Pre-Market US Stock Movers: Key Insights and A

Pre-Market US Stock Movers: Key Insights and A- Pre-Market US Stock Movers: Key Insights and A"

- Among Us Christmas Stockings: Uniquely Celebra"

- Samsung Note 12.2 P900 Stock ROM US: A Compreh"

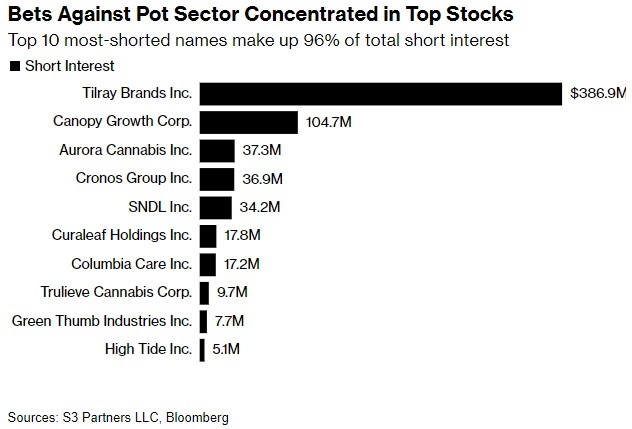

- Top US Cannabis Stocks to Buy in 2023: A Guide"

- Is the US Stock Market Open on Election Day 20"

- Total Market Capitalization of US Stocks: A Co"

- "Unveiling the Excitement of US New S"

- Buy Stocks Outside US: A Guide to Global Inves"

recommend

Discover the Best Indian ETFs for US Investors

Discover the Best Indian ETFs for US Investors

Silver Wheaton US Stock Quote: A Comprehensive

"Us Stock Market Soars Past $2 Trilli

Decoding the US Stock Market Chart History: A

Low Volatility Growth Stocks: A Strategic Inve

Momentum Stocks: Top Performers in the US Mark

Discover the Best Indian ETFs for US Investors

US Banks Stock Index: A Comprehensive Guide to

Amazon Stock Price on July 19, 2025: What to E

US Headed for Stock Market Crash: What You Nee

Can U.S. Citizens Trade in the Indian Stock Ma

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- BlackBerry Stock: A Comprehensive Analysis of "

- The 2024 US Presidential Election: What Does I"

- Penny Stocks: The Thrilling World of US Stock "

- Number of Stocks in CRSP US Total Market Index"

- The Most Expensive Stock in the US: A Deep Div"

- Investing in US Stocks from India: A Guide for"

- Unlocking the Potential of DCPH.O: A Comprehen"

- Unlocking the Potential of Enphase Energy: A D"

- Momentum Stocks: Top Performers in the US Mark"

- Best US Stocks Under $10: Top Picks for Invest"