you position:Home > can foreigners buy us stocks > can foreigners buy us stocks

S&P Announcements: The Latest Updates and Implications

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the world of finance, staying informed about the latest S&P announcements is crucial for investors and financial professionals alike. The Standard & Poor's ratings agency is renowned for its comprehensive and reliable financial insights, making its announcements a pivotal source of information for the market. This article delves into the recent S&P announcements, analyzing their implications and providing valuable insights for those in the financial sector.

Recent S&P Announcements

One of the most significant S&P announcements in recent times was the downgrade of the United States' credit rating. This move, which saw the rating dropped from AAA to AA+, sent shockwaves through the financial markets and raised concerns about the nation's economic stability. The downgrade was attributed to a range of factors, including rising debt levels and political gridlock.

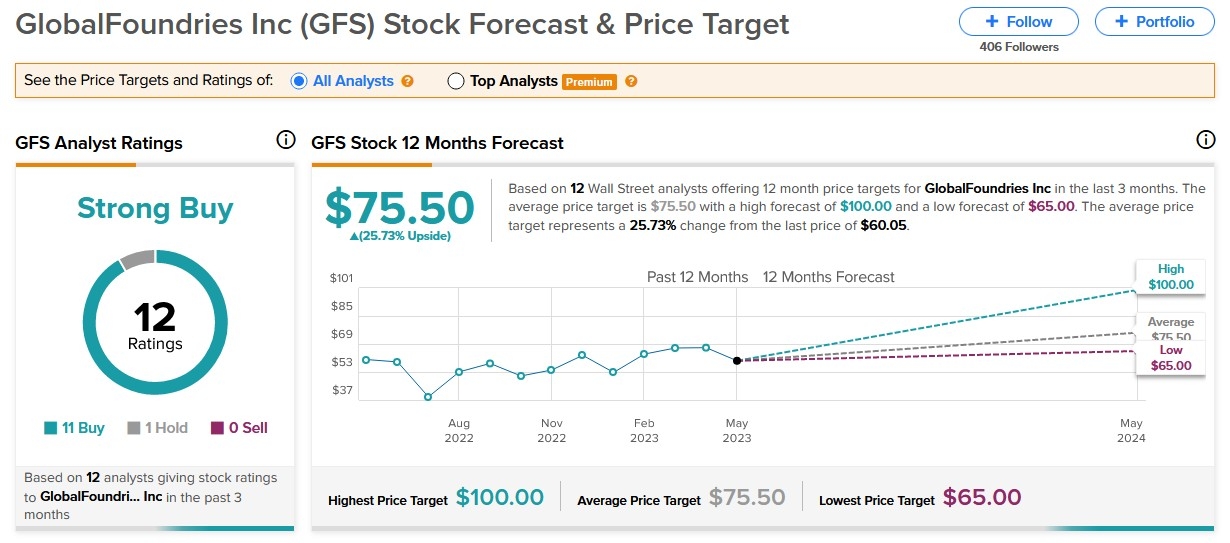

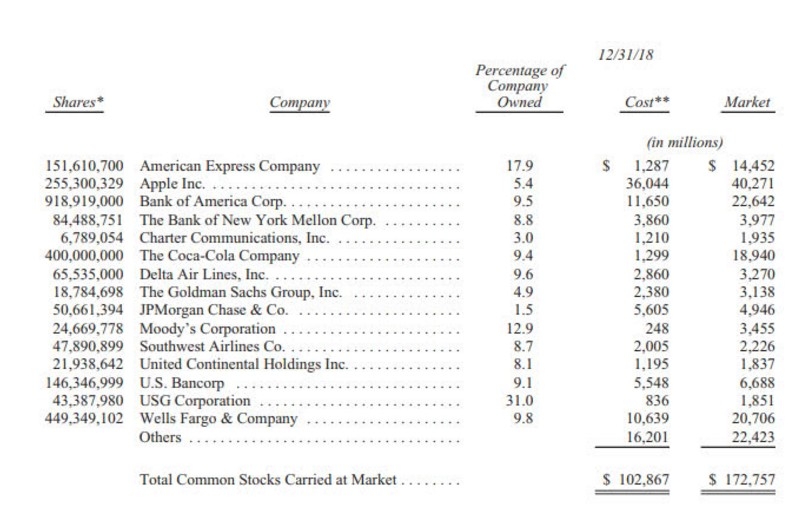

Another key S&P announcement was the revision of the credit ratings for several major global corporations. This revision, which included both upgrades and downgrades, reflected the changing economic landscape and the varying financial health of these companies. For instance, tech giants such as Apple and Google received upgrades, highlighting their robust financial positions and strong market performance.

Implications of S&P Announcements

The implications of S&P announcements can be far-reaching, affecting everything from individual investments to broader economic trends. For investors, understanding the rationale behind these announcements is crucial for making informed decisions. Here are some key implications to consider:

1. Market Sentiment: S&P announcements can significantly impact market sentiment. Downgrades, for example, can lead to increased volatility and uncertainty, while upgrades can boost investor confidence and drive up stock prices.

2. Borrowing Costs: Changes in credit ratings can influence borrowing costs for companies and governments. A downgrade can lead to higher interest rates, making it more expensive for these entities to borrow money.

3. Investment Decisions: S&P announcements can guide investors in making decisions about where to allocate their capital. Companies with higher credit ratings are often considered more stable and less risky, making them more attractive to investors.

Case Study: Apple's Credit Rating Upgrade

A notable case study is the credit rating upgrade for Apple. In 2014, S&P upgraded Apple's credit rating to AA+, reflecting the company's strong financial position and robust growth prospects. This upgrade was well-received by the market, with Apple's stock price surging in the aftermath. The upgrade not only boosted investor confidence but also highlighted the company's strategic focus on innovation and market expansion.

Conclusion

In conclusion, S&P announcements are a vital source of information for those in the financial sector. By staying informed about these announcements and understanding their implications, investors and financial professionals can make more informed decisions and navigate the complex world of finance with greater confidence.

so cool! ()

last:Understanding the S&P 500 Equity Index: A Comprehensive Guide

next:nothing

like

- Understanding the S&P 500 Equity Index: A Comprehensive Guide

- How Does the U.S. Allocate Gain from Stock Option Exercise?"

- Impact of Covid-19 on the US Stock Market: A Comprehensive Analysis

- Market Value of All US Stocks: A Comprehensive Analysis

- Real-Time Stock Ticker: The Ultimate Trading Companion"

- Stock Market Crash: Understanding the Implications and Recovery Strategies&qu

- Understanding Margin Trading and Short Selling in the US Stock Market

- Most Undervalued Stocks in the US Market: Uncovering Hidden Gems

- Bolas de Valores: Mastering the Art of Financial Investment"

- Can I Buy Tata Motors Stock in the US? A Comprehensive Guide

- Unlock the Power of the US Futures Stock Market: A Comprehensive Guide

- Maximize Your Investment Potential with Citibank HK's US Stock Trading Servi

hot stocks

Pre-Market US Stock Movers: Key Insights and A

Pre-Market US Stock Movers: Key Insights and A- Pre-Market US Stock Movers: Key Insights and A"

- Among Us Christmas Stockings: Uniquely Celebra"

- Samsung Note 12.2 P900 Stock ROM US: A Compreh"

- Top US Cannabis Stocks to Buy in 2023: A Guide"

- Is the US Stock Market Open on Election Day 20"

- The Dollar Value of the US Stock Market: Curre"

- Total Market Capitalization of US Stocks: A Co"

- "Unveiling the Excitement of US New S"

recommend

S&P Announcements: The Latest Updates

S&P Announcements: The Latest Updates

US Multifamily Stock: A Lucrative Investment O

TSMC US Stock Price Chart: A Comprehensive Ana

1917 US Rifle Stock 3-GMK Inspector: A Compreh

SP 500 Index Graph: A Comprehensive Guide to U

Best US Utility Dividend Stocks: A Guide for I

Latest US Stock Market Report: Key Insights an

Samsung Note 12.2 P900 Stock ROM US: A Compreh

Top US Penny Stocks 2018: Unveiling the Hidden

Carnival Stock Price: Understanding the Curren

Today's Stock Gainers: Unveiling the Mark

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Mezzion Pharma: A Deep Dive into Its US Stock "

- Hand Sanitizer Companies Stock in US: A Growin"

- CMK Corporation US Stock: A Comprehensive Anal"

- Stock Market Crash: Understanding the Implicat"

- Unlocking the Power of "Mon-ey&qu"

- Does the U.S. Government Own Stock in Companie"

- Us Rifle Stocks Coupon: Unlock Exclusive Disco"

- In-Depth Analysis of Syf: Full Description of "

- The 3 Main US Stock Exchanges: A Comprehensive"

- Penny Stocks Watchlist US: Your Ultimate Guide"