you position:Home > can foreigners buy us stocks > can foreigners buy us stocks

Market Value of All US Stocks: A Comprehensive Analysis

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

The market value of all US stocks is a critical metric that reflects the overall health and performance of the American economy. This article delves into the factors influencing the market value, recent trends, and potential future outlook.

Understanding Market Value

The market value of stocks represents the total worth of all publicly traded companies in the United States. It is calculated by multiplying the total number of outstanding shares by the current market price per share. This figure provides a snapshot of the collective wealth of the nation's corporations.

Factors Influencing Market Value

Several factors can influence the market value of all US stocks. Here are some of the key factors:

Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation rates can significantly impact the market value. For instance, a strong GDP growth rate can boost investor confidence, leading to an increase in stock prices.

Corporate Performance: The financial performance of individual companies plays a crucial role in determining the overall market value. Companies with strong earnings reports and positive outlooks tend to see their stock prices rise.

Interest Rates: Interest rates set by the Federal Reserve can have a profound impact on the stock market. Higher interest rates can lead to increased borrowing costs for companies, potentially affecting their profitability and stock prices.

Market Sentiment: Investor sentiment can be swayed by various factors, including political events, economic news, and global events. Positive sentiment can drive stock prices higher, while negative sentiment can lead to declines.

Recent Trends

In recent years, the market value of all US stocks has experienced significant growth. This can be attributed to several factors:

Record Low Interest Rates: The Federal Reserve's decision to keep interest rates low has encouraged investors to seek higher returns in the stock market.

Tech Sector Growth: The technology sector has been a major driver of stock market growth, with companies like Apple, Microsoft, and Amazon leading the way.

Increased Corporate Profits: Many companies have reported strong earnings, leading to higher stock prices.

Potential Future Outlook

While the market value of all US stocks has seen significant growth, there are potential challenges ahead:

Economic Uncertainty: Global economic uncertainties, such as trade tensions and geopolitical events, could impact investor sentiment and stock prices.

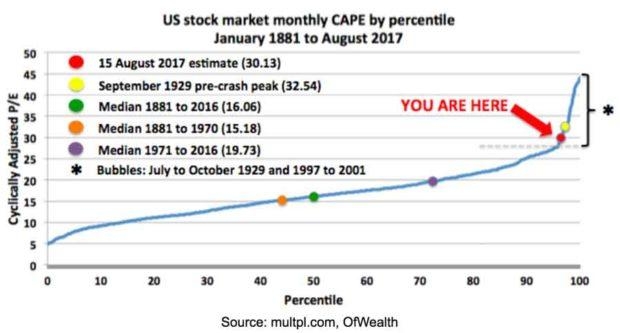

Market Valuations: Some analysts argue that the current market valuations may be stretched, raising concerns about potential market corrections.

Interest Rate Hikes: The Federal Reserve's decision to raise interest rates could lead to increased borrowing costs for companies, potentially affecting their profitability and stock prices.

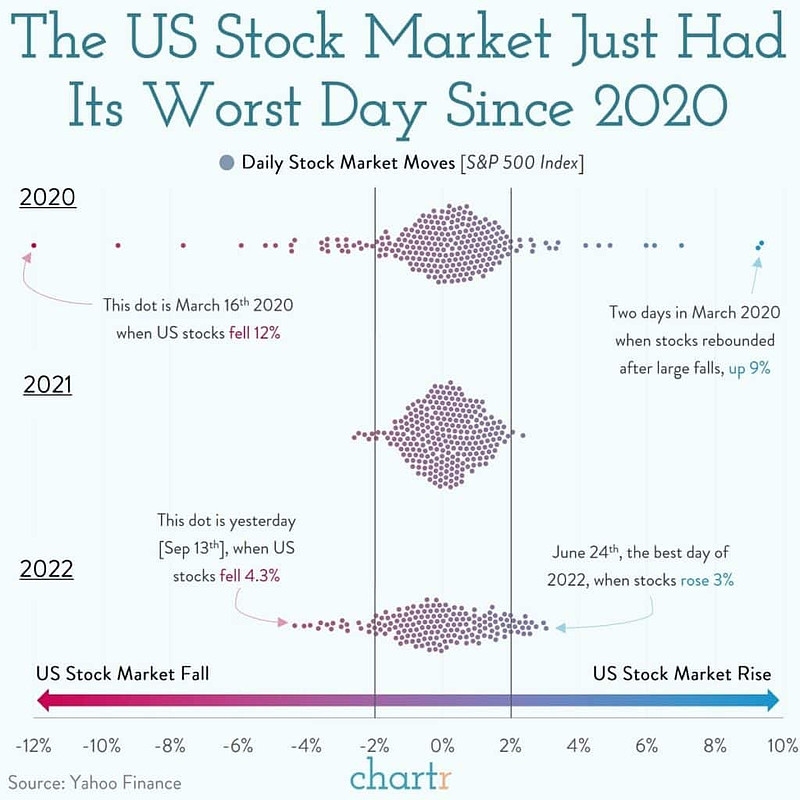

Case Study: The 2020 Market Crash

One of the most significant events affecting the market value of all US stocks was the 2020 market crash. The COVID-19 pandemic led to widespread lockdowns and economic uncertainty, causing a sharp decline in stock prices. However, the market quickly recovered, driven by strong corporate earnings and government stimulus measures.

In conclusion, the market value of all US stocks is a complex and dynamic metric that reflects the overall health of the American economy. Understanding the factors influencing this value is crucial for investors and policymakers alike. While the future may hold challenges, the long-term outlook for the US stock market remains positive.

so cool! ()

last:Real-Time Stock Ticker: The Ultimate Trading Companion"

next:nothing

like

- Real-Time Stock Ticker: The Ultimate Trading Companion"

- Stock Market Crash: Understanding the Implications and Recovery Strategies&qu

- Understanding Margin Trading and Short Selling in the US Stock Market

- Most Undervalued Stocks in the US Market: Uncovering Hidden Gems

- Bolas de Valores: Mastering the Art of Financial Investment"

- Can I Buy Tata Motors Stock in the US? A Comprehensive Guide

- Unlock the Power of the US Futures Stock Market: A Comprehensive Guide

- Maximize Your Investment Potential with Citibank HK's US Stock Trading Servi

- US Biotech Stocks List: Top Picks for Investors in 2023

- Dow Jones Closing Price Today: A Comprehensive Look

- Bors Finance: Revolutionizing the Financial Landscape

- Unlock the Power of Finance: A Comprehensive Guide

hot stocks

Pre-Market US Stock Movers: Key Insights and A

Pre-Market US Stock Movers: Key Insights and A- Pre-Market US Stock Movers: Key Insights and A"

- Among Us Christmas Stockings: Uniquely Celebra"

- Samsung Note 12.2 P900 Stock ROM US: A Compreh"

- Top US Cannabis Stocks to Buy in 2023: A Guide"

- Is the US Stock Market Open on Election Day 20"

- The Dollar Value of the US Stock Market: Curre"

- Total Market Capitalization of US Stocks: A Co"

- "Unveiling the Excitement of US New S"

recommend

Market Value of All US Stocks: A Comprehensive

Market Value of All US Stocks: A Comprehensive

Canopy Cannabis Stock: A Comprehensive Guide t

NYSE Is Closed: Understanding the Implications

Total US Stock Market Capitalization: A Compre

1917 US Rifle Stock 3-GMK Inspector: A Compreh

"First Nylon Stockings Sold in US: A

Carnival Stock Price: Understanding the Curren

Us Stock Exchange: A Comprehensive List of Com

IBM Stock Price in US Dollars: Current Trends

Earnings Calendar Next Week: What to Expect fo

Understanding BOFA Hartnett US Stock Flows: A

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Stock Market Crash of 2016: A Comprehensive An"

- Unlocking the Potential of JC Penny Stock: A C"

- Dividends: The Historical Power of Stocks"

- Rovio Stock US: A Comprehensive Guide to the F"

- Top Natural Gas Stocks in the US: A Comprehens"

- Aphria Stock: What You Need to Know About Inve"

- Top Momentum Stocks: 5-Day Performance of Larg"

- Top Apps to Invest in US Stocks: Simplify Your"

- Amazon Stock Price on July 19, 2025: What to E"

- "In-Depth Analysis: TRV Stock's "