you position:Home > us stock market today live cha > us stock market today live cha

Stocks Dropped: Understanding the Market's Shifts and Implications

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In recent weeks, the stock market has experienced a significant downturn, leading to the term "stocks dropped" trending across financial news outlets. This article delves into the reasons behind this shift, its implications for investors, and strategies to navigate the volatile market landscape.

Market Dynamics and Factors Contributing to the Decline

The primary factors contributing to the recent stock market downturn include:

- Economic Concerns: Global economic uncertainties, such as rising inflation, supply chain disruptions, and geopolitical tensions, have caused investors to become increasingly cautious.

- Interest Rate Hikes: Central banks, particularly the Federal Reserve, have been raising interest rates to combat inflation, which has led to higher borrowing costs and a decrease in consumer spending.

- Corporate Earnings: Many companies have reported lower-than-expected earnings, adding to investor concerns about the overall health of the market.

Impact on Investors

The decline in stock prices has had a significant impact on investors, particularly those who are heavily invested in equities. Here are some key implications:

- Potential for Losses: Investors who hold stocks may experience capital losses as the value of their investments declines.

- Rebalancing Portfolios: Investors may need to rebalance their portfolios to ensure they are adequately diversified and aligned with their risk tolerance.

- Opportunities for Value Investors: The downturn presents opportunities for value investors to purchase undervalued stocks at lower prices.

Strategies for Navigating the Volatile Market

To navigate the volatile market landscape, investors can consider the following strategies:

- Diversification: Diversifying investments across various asset classes, sectors, and geographic regions can help mitigate risk.

- Long-Term Perspective: Maintaining a long-term perspective and avoiding panic selling can help investors ride out market fluctuations.

- Regular Portfolio Review: Regularly reviewing and rebalancing portfolios can help ensure they remain aligned with investment goals and risk tolerance.

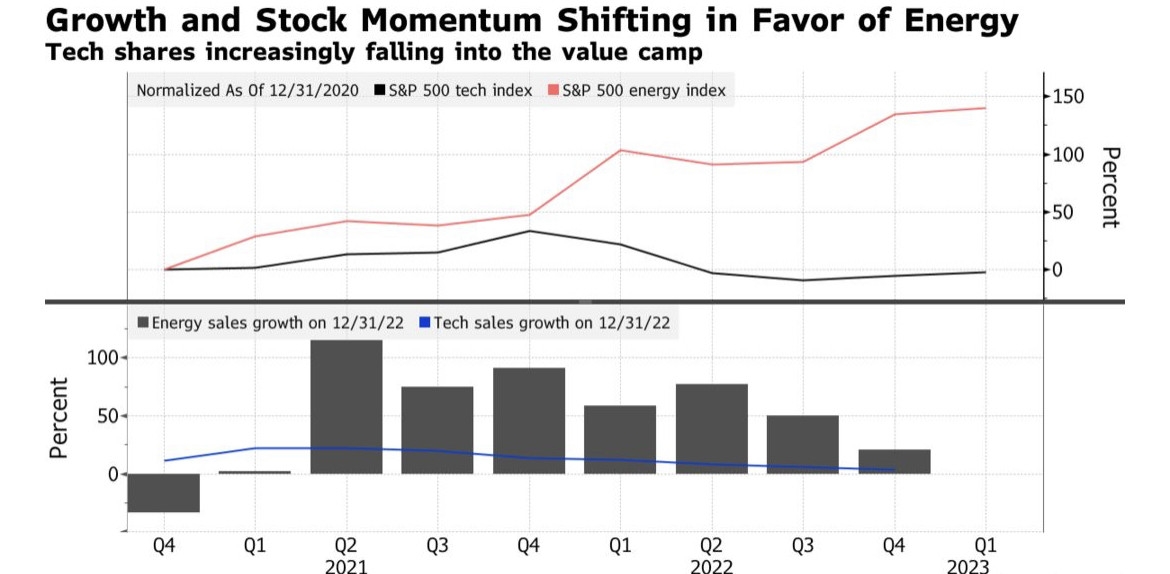

Case Study: Tech Sector Decline

One notable example of the recent stock market downturn is the decline in the tech sector. Many tech stocks, such as Apple, Microsoft, and Amazon, have experienced significant declines in their share prices. This decline can be attributed to several factors, including:

- Economic Uncertainties: The global economic environment has raised concerns about the future growth prospects of tech companies.

- Regulatory Scrutiny: Increased regulatory scrutiny in the tech sector has led to concerns about potential restrictions on business operations.

- Valuation Concerns: Many tech stocks were trading at high valuations prior to the downturn, making them more vulnerable to market corrections.

Despite the recent downturn, many experts believe that the tech sector remains a long-term growth opportunity. Investors who are willing to take on higher risk may find value in undervalued tech stocks.

In conclusion, the recent stock market downturn, characterized by the term "stocks dropped," has been driven by a combination of economic concerns, interest rate hikes, and corporate earnings issues. While this downturn has had a significant impact on investors, it also presents opportunities for those willing to navigate the volatile market landscape. By maintaining a long-term perspective, diversifying investments, and staying informed about market trends, investors can navigate the challenges and potential opportunities presented by the current market conditions.

so cool! ()

last:Understanding the Dow Market Cap: A Comprehensive Guide

next:nothing

like

- Understanding the Dow Market Cap: A Comprehensive Guide

- S&P 500 Rate of Return Year to Date: A Comprehensive Analysis

- Marifil Mines Ltd US Stock Symbol: Everything You Need to Know

- In Stock Tracker: The Ultimate Tool for Smart Shopping"

- US Stock Market Analysis: Key Insights from 25 November 2021

- Dow Jones Industrial Average for Today: Key Insights and Analysis

- DJIA Pre: A Comprehensive Guide to Understanding the Pre-Market Activity of the D

- Stock Screener Momentum Stocks US: Unveiling the Best Opportunities

- The Largest Stock Brokers in the US: A Comprehensive Overview

- Is the Dow Jones Up? A Comprehensive Guide to Today's Stock Market Performan

- Overhead US Bank Stadium Stock Footage: Capturing the Iconic Venue's Essence

- Unlock the Secrets of "Please Share Price" with Our Ultimate Gu

hot stocks

Unlocking Potential: Exploring US Small Cap Bi

Unlocking Potential: Exploring US Small Cap Bi- Unlocking Potential: Exploring US Small Cap Bi"

- Top US Stock to Buy: Unveiling the Ultimate In"

- "5 Crucial Things to Know Before Trad"

- Can Indian Citizens Trade in the US Stock Mark"

- US Bank Corp Stock Price Today: Key Insights a"

- US Made L1A1 Stock Set: The Ultimate Upgrade f"

- Best Performing US Stocks Past 5 Days: Momentu"

- Top 10 Dividend Stocks in the US: Secure Your "

recommend

Stocks Dropped: Understanding the Market'

Stocks Dropped: Understanding the Market'

Unlocking the Potential of www.market.com: A C

DFW.State.Or.US Fish Stocking: The Ultimate Gu

Best ETF for Non-US Stocks: Your Ultimate Guid

"5 Crucial Things to Know Before Trad

Understanding UBS US Stock: A Comprehensive Gu

Stock Invest US CLNE: Unveiling the Potential

Understanding BYD US Stock Ticker: A Comprehen

"Maximize Your Investment Potential w

Unlocking the Potential of MDT: A Deep Dive in

All Stocks List: Your Ultimate Guide to Unders

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Kia US Stock Ticker: A Comprehensive Guide to "

- Unlocking the Potential of Constellation Softw"

- Stock Market US Election Prediction: What to E"

- Unveiling the Power of US Stock Broker Researc"

- The Largest Stock Loss in US History: The 1929"

- European Stocks vs. US Stocks: A Comprehensive"

- Should I Buy US Foods Stock?"

- Margin Debt in the US Stock Market: A Comprehe"

- How US Job Data Impacts the Stock Market"

- Us Banks Stock Symbols: A Comprehensive Guide"