you position:Home > us stock market today live cha > us stock market today live cha

Save Stocks: Ultimate Guide to Protecting Your Investment Portfolio

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

Are you looking to save stocks and safeguard your investment portfolio? In today's volatile market, it's crucial to understand how to protect your investments and ensure long-term growth. This article delves into essential strategies for stock preservation, including diversification, risk management, and staying informed. Whether you're a seasoned investor or just starting out, these tips will help you navigate the financial landscape and maintain a healthy portfolio.

Understanding the Importance of Stock Preservation

Stock preservation is about more than just protecting your investments; it's about building a strong foundation for future growth. By implementing effective strategies, you can minimize potential losses and maximize returns. Here's a closer look at some key approaches to consider:

1. Diversification: Spreading Your Risk

One of the most effective ways to save stocks is through diversification. This involves investing in a variety of assets across different sectors, industries, and geographical locations. By doing so, you can reduce the impact of any single stock's performance on your overall portfolio.

Example: If you invest heavily in a single tech stock and it experiences a downturn, your entire portfolio could suffer. However, if you have a diverse range of investments, the impact of one stock's decline is likely to be mitigated.

2. Risk Management: Balancing Reward and Risk

It's essential to understand the risk associated with your investments. By conducting thorough research and analyzing historical data, you can make informed decisions about the level of risk you're comfortable with. Here are a few key risk management strategies:

- Stop-loss orders: Set a predetermined price at which you'll sell a stock to limit potential losses.

- Position sizing: Allocate a specific percentage of your portfolio to each investment to prevent overexposure to any single stock.

- Asset allocation: Diversify your investments across different asset classes, such as stocks, bonds, and real estate, to balance risk and return.

3. Staying Informed: Keeping Up with Market Trends

To effectively save stocks, it's crucial to stay informed about market trends and economic indicators. This includes:

- Economic reports: Pay attention to reports on unemployment rates, inflation, and GDP growth, as these can impact the stock market.

- Company news: Stay up-to-date with news and developments from the companies in which you've invested.

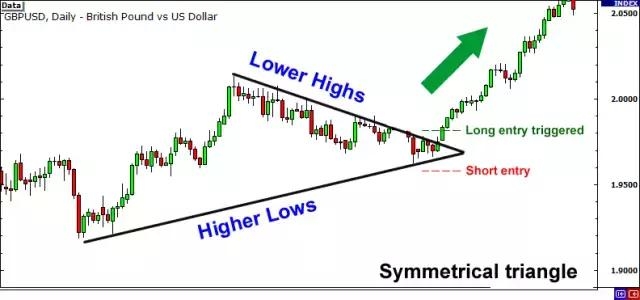

- Technical analysis: Use tools and resources to analyze stock charts and identify potential buy or sell signals.

Case Study: A Diversified Portfolio

Let's consider a hypothetical investor, John, who wants to save stocks. He decides to diversify his portfolio by investing in stocks from various sectors, including technology, healthcare, and consumer goods. By doing so, he minimizes the risk of his portfolio being negatively impacted by a downturn in any single sector.

After conducting thorough research, John decides to allocate 40% of his portfolio to technology stocks, 30% to healthcare, and 30% to consumer goods. He also sets stop-loss orders on his investments and regularly reviews his portfolio to ensure it remains balanced.

Conclusion

Saving stocks is an essential part of building a successful investment portfolio. By implementing strategies such as diversification, risk management, and staying informed, you can protect your investments and achieve long-term growth. Remember, investing is a long-term endeavor, and patience and discipline are key to success.

so cool! ()

like

- Top US Tech Stocks to Buy: Your Ultimate Guide to 2023's Investment Opportun

- Short Term Trading Ideas: Top US Stocks to Watch Today

- US Marine Stocks: The Rising Wave of Investment Opportunities

- Us/International 50/50 Stock Portfolio: A Strategic Blend for Diversification

- US Publicly Traded Pot Stocks: A Comprehensive Guide

- Market Tanking Today: Understanding the Current Stock Market Downturn

- Average Stock Market Return Over the Last 50 Years: Insights and Analysis&quo

- Best Performing US Stocks to Buy Now for 2025: A Strategic Investment Guide

- Unlocking the Power of the NYSE Stock Index: A Comprehensive Guide

- Dow Tesla Stock: The Intersection of Electric Vehicles and Market Dynamics

- Cresco Labs US Stock Ticker: A Comprehensive Guide to Cresco's Stock Perform

- Unlocking the Potential of After Markets: A Comprehensive Guide

hot stocks

Unlocking Potential: Exploring US Small Cap Bi

Unlocking Potential: Exploring US Small Cap Bi- Unlocking Potential: Exploring US Small Cap Bi"

- Top US Stock to Buy: Unveiling the Ultimate In"

- "5 Crucial Things to Know Before Trad"

- Can Indian Citizens Trade in the US Stock Mark"

- US Bank Corp Stock Price Today: Key Insights a"

- US Made L1A1 Stock Set: The Ultimate Upgrade f"

- Best Performing US Stocks Past 5 Days: Momentu"

- Top 10 Dividend Stocks in the US: Secure Your "

recommend

Save Stocks: Ultimate Guide to Protecting Your

Save Stocks: Ultimate Guide to Protecting Your

Unveiling the Potential of US Geothermal Stock

Quandl Get US Stock Price: How to Access and U

"Unlocking the Potential: The Thrivin

Market Watch Graph: A Comprehensive Guide to U

"How Many Stocks Are on the US Stock

Unlocking the Power of the NYSE Stock Index: A

Maximizing Stock Support: Strategies for Inves

The Most Popular Stock Traded in the US: A Clo

Casino Stock US: Unveiling the Thrilling Inves

US Debt Impact on Stock Market: Understanding

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- First 24-Hour US Stock Exchange Approved: Revo"

- How Did the US Stock Market End 2018? A Compre"

- US Stock Forecast 2023: What to Expect and How"

- Chart NASDAQ: A Comprehensive Guide to Underst"

- Is the US Stock Market a Bubble? A Comprehensi"

- Retailers Often Use Stock Management Systems t"

- Drip Us Stocks Canada: Your Guide to Smart Inv"

- All Active REITs on the US Stock Market: A Com"

- Unveiling the Secrets of US Stock Crash Predic"

- The Impact of US Elections on the Indian Stock"