you position:Home > us stock market today live cha > us stock market today live cha

NYSE New Highs and Lows: Understanding Market Dynamics

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

The New York Stock Exchange (NYSE) has long been a beacon for global investors, known for its volatility and the impact it has on the global economy. One of the most closely watched aspects of the NYSE is the occurrence of new highs and lows. This article delves into what these terms mean, their significance, and how they can influence investment decisions.

What Are New Highs and Lows?

New Highs refer to the highest price at which a stock has traded during a specific period, often a day or a month. Conversely, new lows are the lowest prices at which a stock has traded during the same period. These points are crucial indicators of market sentiment and can provide valuable insights into the health of the market.

Understanding Market Dynamics

The occurrence of new highs on the NYSE is often seen as a sign of optimism and confidence in the market. It suggests that investors are willing to pay higher prices for stocks, possibly due to strong earnings reports, positive economic indicators, or general market optimism. Conversely, new lows can indicate pessimism and fear, often due to negative news, economic downturns, or uncertainty in the market.

Impact on Investment Decisions

Understanding new highs and lows can significantly impact investment decisions. Investors often use these indicators to gauge market trends and make informed decisions. For instance, if a stock is making new highs, it might be a good opportunity to buy, assuming the trend continues. Similarly, if a stock is making new lows, it might be a good opportunity to sell or avoid.

Case Studies

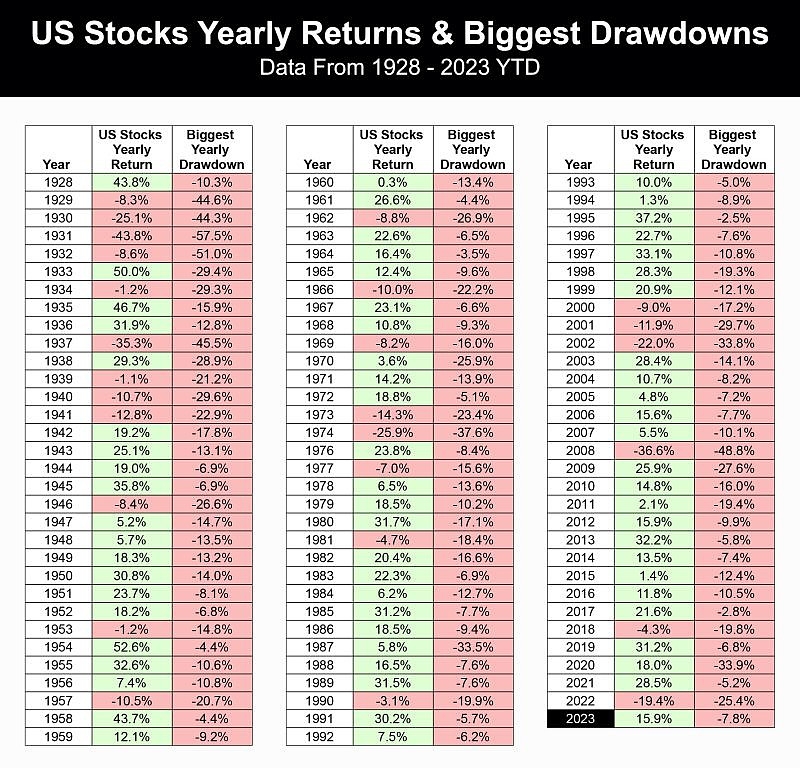

One notable example of new highs and lows on the NYSE is the dot-com bubble of the late 1990s. During this period, technology stocks were making new highs left and right, driven by optimism and speculation. However, this bubble eventually burst, leading to significant losses for investors. This case highlights the importance of understanding market dynamics and not being swayed by the hype.

Another example is the COVID-19 pandemic, which led to a significant downturn in the market. Many stocks hit new lows, but as the pandemic subsided, some of these stocks recovered and even hit new highs, showcasing the resilience of the market.

Conclusion

New highs and lows on the NYSE are crucial indicators of market sentiment and can significantly impact investment decisions. Understanding these indicators can help investors make informed decisions and navigate the volatile market landscape. By keeping an eye on these trends, investors can stay ahead of the curve and potentially capitalize on market opportunities.

so cool! ()

last:Maximizing Returns: The Power of US Education Stocks

next:nothing

like

- Maximizing Returns: The Power of US Education Stocks

- How Much Money Did the US Stock Market Lose Today?"

- MarketWatch Pre-Market: Your Ultimate Guide to Early Stock Insights

- Unlock the Power of Google Business News: Your Ultimate Guide

- Unveiling the Best Stock Quote Sites: Your Ultimate Guide to Investing Success

- Dow Price Now: Understanding the Current Market Dynamics

- Dow Charts Live: Real-Time Insights for Investors

- Dow Stock Market Chart Today: Unveiling the Latest Trends

- S&P 500 Historical Prices by Day: A Comprehensive Guide

- What Is the US Market Doing Today?

- Together Stock: How Collaborative Investment Strategies Are Transforming the Fina

- Today's Gainers: Unveiling the Top Performers in the Stock Market

hot stocks

Unlocking Potential: Exploring US Small Cap Bi

Unlocking Potential: Exploring US Small Cap Bi- Unlocking Potential: Exploring US Small Cap Bi"

- Top US Stock to Buy: Unveiling the Ultimate In"

- "5 Crucial Things to Know Before Trad"

- Can Indian Citizens Trade in the US Stock Mark"

- US Bank Corp Stock Price Today: Key Insights a"

- US Made L1A1 Stock Set: The Ultimate Upgrade f"

- Best Performing US Stocks Past 5 Days: Momentu"

- Top 10 Dividend Stocks in the US: Secure Your "

recommend

NYSE New Highs and Lows: Understanding Market

NYSE New Highs and Lows: Understanding Market

Can Indian Citizens Trade in the US Stock Mark

US Steel Price Stock: What You Need to Know

Delisting US Stock Exchange: Understanding the

Margin Debt in the US Stock Market: A Comprehe

"US Stock Exchange Market Capitalizat

Scotia iTrade Buying US Stocks: A Comprehensiv

Understanding the Dow Market Cap: A Comprehens

CMH US Stock: A Comprehensive Guide to Investi

Chart Us: Stocks vs. International Stocks –

FDA-Related News: What US Stocks Should You Ke

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Understanding the TFSA Tax on US Stocks"

- "How to Monitor the US Stock Market: "

- FQVTF Stock: What You Need to Know About the U"

- Philippine Companies: Investing in US Stocks -"

- US Steel Stock Price Target: What Analysts Are"

- Penny US Stocks to Buy: Top Picks for Investor"

- "US Pacific Marine Mammal Stock Asses"

- Oil Falls as US Crude Stocks Rise: Implication"

- Lumber Stocks: A Boon for Investors in the US"

- SK Hynix Stock in US: A Comprehensive Guide to"