you position:Home > us stock market today > us stock market today

Should I Divest from US Stocks?

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In the ever-evolving financial landscape, investors often find themselves at a crossroads when it comes to their investments in US stocks. The question, "Should I divest from US stocks?" is one that many are pondering, especially in light of recent market fluctuations and economic uncertainties. This article aims to explore the factors you should consider before making a decision.

Understanding Market Trends

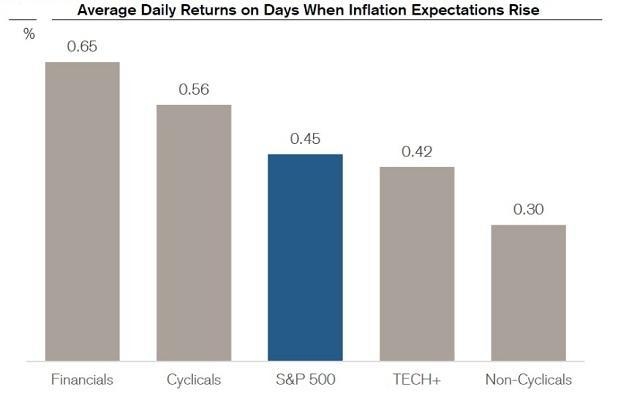

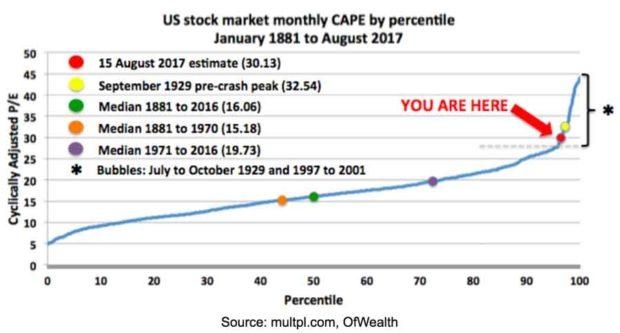

The stock market is a reflection of the economy, and as such, it is influenced by various factors, including political events, global trade policies, and corporate earnings. Recent market trends have been volatile, with the S&P 500 Index experiencing significant ups and downs. It's important to understand these trends before deciding whether to divest.

Economic Uncertainties

Economic uncertainties can be a major factor in the decision to divest from US stocks. Factors such as inflation, rising interest rates, and geopolitical tensions can impact the market negatively. For instance, the Federal Reserve's recent interest rate hikes have caused some investors to reconsider their investments in US stocks.

Diversification

One of the key principles of investing is diversification. By investing in a variety of assets, you can reduce your risk exposure. If you have a significant portion of your portfolio invested in US stocks, diversifying your investments could be a wise decision. Consider allocating your funds to other markets or asset classes, such as international stocks, bonds, or real estate.

Risk Tolerance

Your risk tolerance is a crucial factor in determining whether you should divest from US stocks. If you are risk-averse and prefer conservative investments, you may want to reconsider your exposure to the stock market. However, if you have a higher risk tolerance and are comfortable with short-term market fluctuations, you may choose to stay invested.

Long-Term Investment Goals

Your long-term investment goals should also guide your decision. If your investment horizon is short-term, you may be more susceptible to market volatility. However, if you have a long-term investment horizon, you may be able to ride out market fluctuations and benefit from long-term growth.

Case Study: Tech Sector

One sector that has seen significant fluctuations is the tech sector. Companies like Apple, Amazon, and Google have been major contributors to the US stock market. However, the recent rise of regulatory scrutiny and increased competition have caused some investors to question their investment in these companies. This case study highlights the importance of staying informed and adapting your investments based on market trends.

Conclusion

The decision to divest from US stocks is a complex one that requires careful consideration of various factors. Understanding market trends, economic uncertainties, risk tolerance, and long-term investment goals are all crucial aspects to consider. By staying informed and diversified, you can make a more informed decision that aligns with your investment strategy.

so cool! ()

last:Stock Market Since US Election: A Comprehensive Analysis

next:nothing

like

- Stock Market Since US Election: A Comprehensive Analysis

- Unlocking Profits with US Dollar Stock Index Funds: A Comprehensive Guide

- Unlock Global Investment Opportunities with Non-US Stock ETFs

- Understanding US Oil Stock Futures: A Comprehensive Guide

- Unlocking the Potential of AI Stocks in the US Market

- Dow Jones US Completion Total Stock Market Index: Vanguard's Comprehensive A

- Stock Tips Us: Unveiling the Secrets of the Market"

- Toys "R" Us Babies "R" Us Off-Hours Stock Cre

- US Stock Market Outlook for August 12, 2025: What to Expect

- Best Momentum Stocks in the US Market: Top 5 Picks for the Next 5 Days

- Us Cellular Stock Price Today: A Comprehensive Analysis

- The Best Way to Short the US Stock Market: A Comprehensive Guide

hot stocks

Maximizing Returns: Exploring General Electric

Maximizing Returns: Exploring General Electric- Maximizing Returns: Exploring General Electric"

- US Copper Stocks to Buy: Top Picks for Investo"

- Meip-US Stock Price: A Comprehensive Analysis"

- Ammunition Stocks: The Comprehensive Guide for"

- Buying US Stocks as a Foreigner: A Comprehensi"

- Monthly US Dividend Stocks: Your Guide to Cons"

- http stocks.us.reuters.com stocks fulldescript"

- US Pre-Market Stock: A Comprehensive Guide to "

recommend

Should I Divest from US Stocks?

Should I Divest from US Stocks?

Today's US Stock Market Live: Key Insight

Is the US Stock Market Open on Black Friday? W

"US Stock Closing Time: Everything Yo

Foreign Companies Listed on US Stock Exchanges

Maximizing Returns: Exploring General Electric

Japan Stock ETFs in the US: A Comprehensive Gu

Best US Stock to Buy Today: Top Picks for 2023

US Stock Futures Edge Lower: What It Means for

MP Stock US: Your Ultimate Guide to Mastering

"In-Depth Analysis of SGU Stock: A Mu

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- Best US Stocks to Buy Now for Long-Term Invest"

- Unlocking Profits: Understanding Dividend-Payi"

- "Bidu Us Stock Quote: The Ultimate Gu"

- Technical Analysis of US Stocks in July 2025: "

- US Cobalt Stock Price: Trends, Influences, and"

- US Airlines Stock Ticker: Key Insights for Inv"

- Cronos Group Stock: A Comprehensive Analysis o"

- How to Purchase Tencent Stock in the US: A Ste"

- Diamond Stocks in the US Market: A Lucrative I"

- Latest Analyst Picks: Top US Stocks to Watch"