you position:Home > us stock market live > us stock market live

Samsung Electronics Stock in US Dollars: A Comprehensive Guide

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the ever-evolving world of technology, Samsung Electronics has emerged as a global leader. With its diverse portfolio of products ranging from smartphones to home appliances, the South Korean giant has captured the attention of investors worldwide. For those looking to invest in Samsung Electronics, understanding the stock’s performance in US dollars is crucial. This guide provides a detailed analysis of Samsung Electronics’ stock in US dollars, highlighting key factors that influence its market value.

Understanding Samsung Electronics Stock in US Dollars

Samsung Electronics’ stock is traded on the South Korean stock exchange, known as the Korea Exchange (KRX). However, investors can purchase the stock in US dollars through various international brokers. The stock is denoted as ‘005930.KS’ on the KRX, and its price is quoted in South Korean won (KRW).

To track the stock’s performance in US dollars, investors need to convert the KRW price into USD. This conversion is essential for investors who want to assess the stock’s value in a currency they are familiar with or have easy access to.

Factors Influencing Samsung Electronics Stock in US Dollars

Several factors influence the performance of Samsung Electronics’ stock in US dollars:

Global Economic Conditions: The global economy plays a significant role in Samsung Electronics’ stock performance. Factors like economic growth, inflation rates, and currency fluctuations can impact the company’s revenue and profitability.

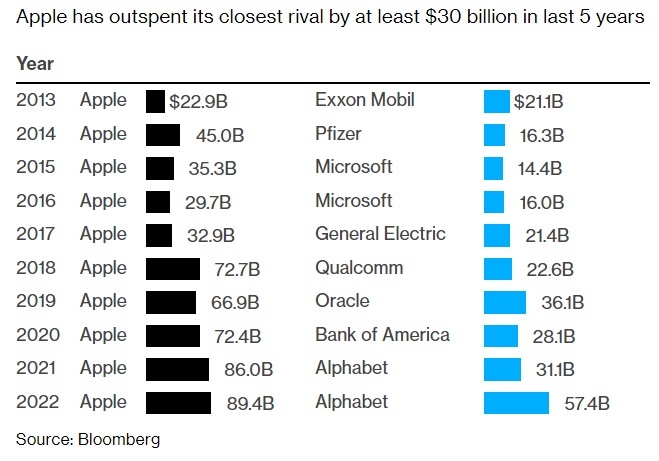

Technology Sector Trends: As a leading player in the technology sector, Samsung Electronics’ stock is influenced by industry trends. Innovations, market demand, and competition from other tech giants like Apple and Huawei can affect the company’s market position and stock price.

Corporate Performance: Samsung Electronics’ financial results, including revenue, earnings, and dividend yields, are crucial indicators of the stock’s performance. Strong financial performance can lead to increased investor confidence and a rise in the stock price.

Political and Geopolitical Factors: Political instability and geopolitical tensions can impact global trade and supply chains, affecting Samsung Electronics’ operations and profitability. For instance, trade disputes between the United States and South Korea can have a negative impact on the company’s stock.

Historical Performance

Over the years, Samsung Electronics has demonstrated a strong performance in the stock market. The company’s stock price has experienced both ups and downs, reflecting the dynamic nature of the global economy and the technology sector.

In recent years, the stock has shown resilience, with several periods of growth despite market volatility. For instance, between 2018 and 2020, the stock experienced a significant increase in value, driven by strong financial results and a positive market sentiment towards the technology sector.

Case Studies

COVID-19 Pandemic: The COVID-19 pandemic initially had a negative impact on Samsung Electronics’ stock, as global demand for consumer electronics declined. However, the company’s strong financial performance and focus on innovation helped it recover quickly, leading to a rebound in the stock price.

5G Technology: Samsung Electronics has been at the forefront of 5G technology development, which has positively impacted the company’s stock. The increased adoption of 5G networks and devices has driven demand for Samsung’s products, contributing to the stock’s growth.

Conclusion

Investing in Samsung Electronics stock in US dollars requires a thorough understanding of the company’s performance, the global economic landscape, and the technology sector. By analyzing key factors and historical performance, investors can make informed decisions and potentially achieve significant returns. As the technology sector continues to evolve, Samsung Electronics remains a compelling investment opportunity for those looking to diversify their portfolio.

so cool! ()

like

- SNP 500 Today: A Comprehensive Look at the Current State of the S&P 500 I

- Stock Market Today: Key Highlights and Analysis from Reuters

- Best Stocks for Future: Top Picks for Investors Seeking Long-Term Growth"

- S&P 500 News: Latest Developments and Market Insights

- Dow Jones: A Comprehensive Guide to the Iconic Financial Index

- MStock Market Today: Your Ultimate Guide to Today's Financial Landscape

- Tell Me About the Stock Market Today: Key Highlights and Analysis

- Unsubscribe from Product Alert on Shop-Admin.cricut.com: How to Manage Product 30

- Hblk.ca US Stock Symbol: A Comprehensive Guide to Understanding Its Significance

- Stock Market Tuesday Close: A Comprehensive Review"

- Top 10 Penny Stocks in the US: Opportunities and Risks to Consider

- All Us Stocks: A Comprehensive Guide to the Best Investment Opportunities&quo

hot stocks

"Best Performing US Stocks: Top 5 fro

"Best Performing US Stocks: Top 5 fro- "Best Performing US Stocks: Top 5 fro"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Percentage of South Koreans Investing in US St"

- Buying U.S. Stocks from Australia: A Guide for"

- New US Stocks 2020: Exploring the Emerging Opp"

recommend

Samsung Electronics Stock in US Dollars: A Com

Samsung Electronics Stock in US Dollars: A Com

Aurora Stock US: Unveiling the Potential of Th

"Unlocking Opportunities: A Comprehen

Unlocking Opportunities in US Marijuana Stocks

Best US Nuclear Energy Stocks: A Comprehensive

Free Us Stock Screener: Your Ultimate Tool for

Best Performing Large Cap US Stock in Q2 2025:

S&P 500 News: Latest Developments and

Understanding the US Stock Market: A Comprehen

Us Elections on Stock Market: How Political Sh

Carnival Corporation & PLC: A Deep Div

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- December 2022 IPOs: A Look at the US Stock Mar"

- Stock Ticker on Desktop: The Ultimate Guide to"

- Current Market Capitalization of US Stock Mark"

- Game Stock Price US: What You Need to Know"

- Hblk.ca US Stock Symbol: A Comprehensive Guide"

- Best Performing Large Cap US Stock in Q2 2025:"

- US Steel Stock Q2 Earnings 2019: A Deep Dive"

- Buy Nestlé Stock US: A Smart Investment in Gl"

- Are There US Marijuana Stocks? A Comprehensive"

- S&P vs NASDAQ vs Dow: A Comprehensive "