you position:Home > us stock market live > us stock market live

China and US Stock Market: A Comprehensive Analysis

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In today's globalized economy, the stock markets of China and the United States play a pivotal role in shaping financial trends and investor sentiment. This article delves into a comprehensive analysis of the two markets, highlighting key differences, similarities, and future prospects.

Market Size and Growth

The China stock market has witnessed remarkable growth over the past few decades. With a market capitalization of over

Regulatory Framework

The regulatory frameworks of the Chinese and US stock markets differ significantly. The China Securities Regulatory Commission (CSRC) oversees the Chinese market, focusing on maintaining market stability and protecting investor interests. The US Securities and Exchange Commission (SEC) regulates the US market, emphasizing transparency, fairness, and efficiency. These differences in regulation have implications for market structure, trading practices, and investor protection.

Investment Opportunities

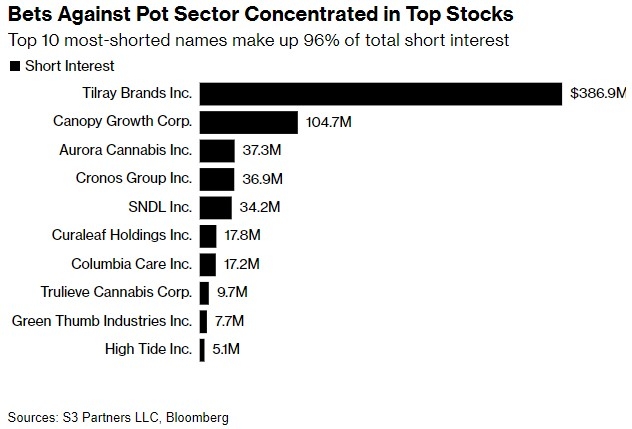

Investors in both markets have access to a wide array of investment opportunities. The Chinese stock market offers exposure to emerging sectors such as technology, healthcare, and renewable energy. The US stock market, on the other hand, features established industries like technology, finance, and consumer goods. Both markets offer opportunities for long-term growth and short-term trading.

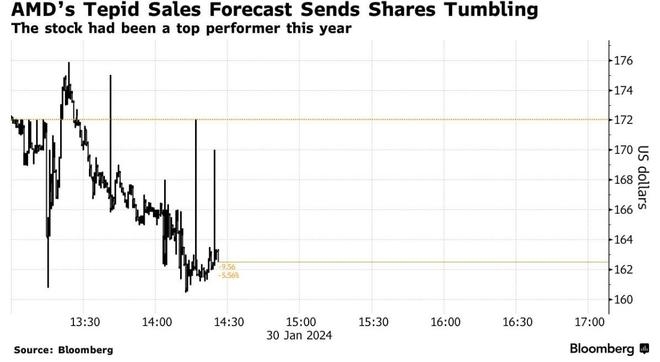

Market Volatility

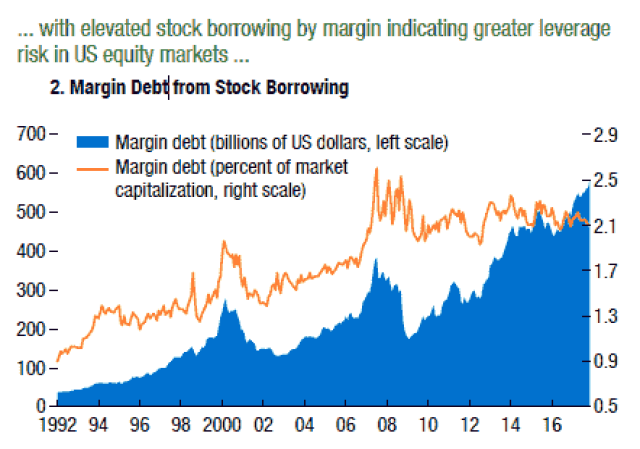

The Chinese stock market has historically been more volatile than the US market. This volatility can be attributed to various factors, including government intervention, economic reforms, and market sentiment. The US stock market, while not immune to volatility, has generally been more stable due to its well-established regulatory framework and mature market structure.

Cross-border Investing

Cross-border investing between China and the US has been on the rise in recent years. Many US investors are interested in accessing the fast-growing Chinese market, while Chinese investors seek exposure to the mature US market. This trend is driven by factors such as economic globalization, technological advancements, and increasing investor sophistication.

Case Study: Alibaba and Tencent

To illustrate the differences between the two markets, let's consider the cases of Alibaba and Tencent. Alibaba, a leading e-commerce company in China, was listed on the NYSE in 2014. Its IPO was one of the largest in history, raising over $25 billion. Tencent, another prominent Chinese company, operates in the gaming, social media, and fintech sectors. It is listed on the Hong Kong Stock Exchange.

While both companies have grown significantly, their market performance has been different. Alibaba's stock has experienced significant volatility, reflecting the Chinese market's volatility. In contrast, Tencent's stock has been more stable, reflecting the Hong Kong market's maturity.

Conclusion

The Chinese and US stock markets offer unique opportunities and challenges for investors. Understanding the differences and similarities between these markets is crucial for making informed investment decisions. As the global economy continues to evolve, the relationship between these two markets will undoubtedly play a vital role in shaping financial trends and investor sentiment.

so cool! ()

last:Stocks Blocked: Unraveling the Implications and Strategies for Investors

next:nothing

like

- Stocks Blocked: Unraveling the Implications and Strategies for Investors

- Dow Jones Futures Today: A Comprehensive Guide

- Nasdaq Has Revolutionized the Financial World: What You Need to Know

- Understanding the MarketWatch Index: A Comprehensive Guide

- Understanding the PE of the S&P 500: A Comprehensive Guide

- Live Trade Charts: Your Ultimate Guide to Real-Time Market Analysis

- Stellantis Stock US: A Comprehensive Guide to the Automotive Giant's Share P

- Best US Stocks for DCA in 2025: Your Ultimate Guide

- The Evolution of NASDAQ: A Journey Through the History of the Stock Exchange&

- Understanding Global Indices: The Key to Market Trends

- Unlocking Opportunities: Exploring Altcoins and US Stocks

- Unlock Your Financial Future: The Ultimate Guide to Buying Stocks

hot stocks

"Best Performing US Stocks: Top 5 fro

"Best Performing US Stocks: Top 5 fro- "Best Performing US Stocks: Top 5 fro"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Percentage of South Koreans Investing in US St"

- Buying U.S. Stocks from Australia: A Guide for"

- New US Stocks 2020: Exploring the Emerging Opp"

recommend

China and US Stock Market: A Comprehensive Ana

China and US Stock Market: A Comprehensive Ana

"US Stock Market Reacts to the Corona

S&P 500 News: Latest Developments and

June 22, 2025: US Stock Market Summary

Understanding the Stock Market to GDP Ratio in

How to Buy Raspberry Pi Stock in the US: A Com

Can the U.S. Government Buy Stocks? A Comprehe

How Many Stocks Were Sold in the US in 2018? A

How Many Sectors in the US Stock Market: A Com

Best Cheap US Stocks: Discover Hidden Gems for

Stock Market Quotations: The Ultimate Guide to

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- SNP 500 Today: A Comprehensive Look at the Cur"

- Stock L: Unlocking the Potential of Your Inves"

- US Dividend Stocks Smoked by Higher Yields: Wh"

- US Solar Stock Index: The Rise of Renewable En"

- Today's Top Momentum US Stocks: Unveiling"

- Aurora Stock US: Unveiling the Potential of Th"

- Dow Jones: A Comprehensive Guide to the Iconic"

- Build Quality Housing Stock: Germany, US, and "

- China-US Trade Talks: Stock to Buy for Profita"

- Trade US Stocks from Malaysia: Your Ultimate G"