you position:Home > us stock market live > us stock market live

2022 US Stock Market Outlook: A Comprehensive Analysis

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

The year 2021 was a rollercoaster ride for the US stock market, with unprecedented levels of volatility and unexpected market trends. As we gear up for 2022, investors and market analysts are abuzz with speculations about the potential direction of the stock market. This article aims to provide a comprehensive outlook for the 2022 US stock market, taking into account various factors that could influence its performance.

Economic Recovery and the Role of the Federal Reserve

The economy has been the focal point of discussions regarding the stock market outlook. With the COVID-19 pandemic waning and vaccination drives gaining momentum, there is optimism about a robust economic recovery in 2022. However, this recovery is not without its challenges.

The Federal Reserve plays a crucial role in shaping the economic landscape and, subsequently, the stock market. The Fed's decision on interest rates and monetary policy will have a direct impact on the market. In the face of rising inflation and a recovering economy, investors are keenly watching for any indication of when the Fed might start raising rates.

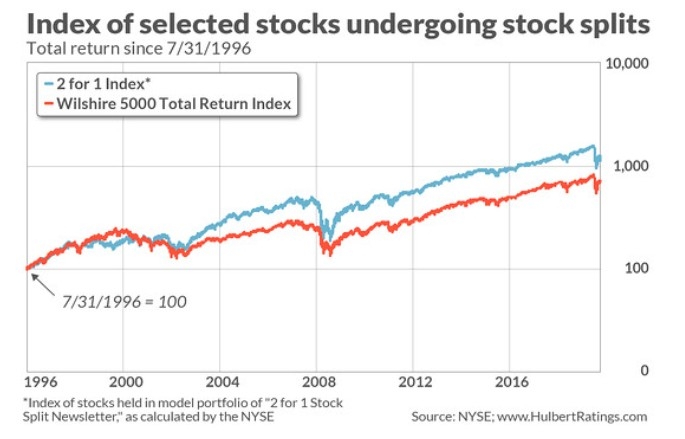

Sector Outlook: Technology vs. Value

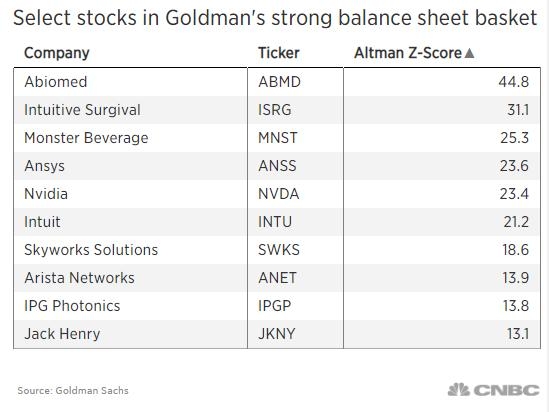

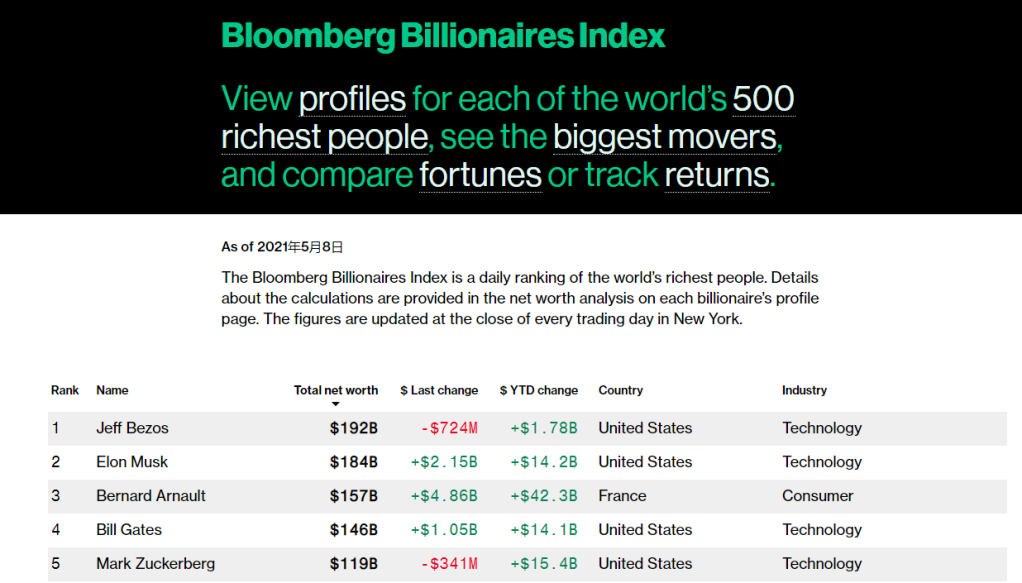

One of the key debates in the stock market is the battle between technology and value sectors. The tech sector, which includes giants like Apple, Amazon, and Google, has been the standout performer in recent years. However, there is growing sentiment that the tech sector might be due for a pullback as valuations become stretched.

On the other hand, the value sector, which consists of companies with lower price-to-earnings (P/E) ratios, is attracting attention. Many market analysts believe that the value sector has been undervalued for some time and could see significant gains in 2022.

Inflation and the Consumer Discretionary Sector

Inflation remains a significant concern for investors. As the economy recovers, there is a risk of higher inflation, which could erode the purchasing power of consumers. The consumer discretionary sector, which includes companies that produce non-essential goods and services, is particularly sensitive to inflationary pressures.

However, some analysts argue that inflation might not be as severe as initially feared and that the consumer discretionary sector could benefit from increased consumer spending as the economy recovers.

Global Factors to Consider

The US stock market is not isolated from global events. Geopolitical tensions, trade disputes, and changes in international relations could have a significant impact on the market. Additionally, the performance of other major stock markets, such as those in Europe and Asia, will also influence the US market.

Case Study: Tesla (TSLA)

One case study worth examining is Tesla (TSLA), a company that has been a bellwether for the technology sector. Despite the market volatility in 2021, Tesla managed to maintain strong growth and positive investor sentiment. This case illustrates the resilience and potential of the tech sector, even in uncertain times.

Conclusion

The 2022 US stock market outlook is filled with potential opportunities and risks. While the economic recovery and the role of the Federal Reserve will be crucial, investors should also be mindful of sector dynamics, inflation concerns, and global factors. As always, a diversified investment strategy is key to navigating the stock market's ups and downs.

so cool! ()

last:High Dividend Stocks US 2021: Top Picks for Income Investors

next:nothing

like

- High Dividend Stocks US 2021: Top Picks for Income Investors

- NYSE Now: Revolutionizing the Financial Landscape

- Share Market Watch: Stay Updated with the Latest Stock Market Trends"

- Stock Market Graph 30 Days: A Comprehensive Analysis

- Discover the Best Deals in Toronto, Ontario with Craigslist

- Dow Jones Index: A Comprehensive Guide to Understanding Its Significance and Impa

- US Gold Stocks List: Your Ultimate Guide to Investing in Gold

- Maximizing Returns with AXA Stock US: A Comprehensive Guide

- Fox News Stock Market Ticker: Your Ultimate Guide to Real-Time Market Updates

- How to Watch the Stock Market Like a Pro: A Comprehensive Guide

- NASDAQ Market Today: Latest Trends and Key Insights

- Amzn US Stock: The Ultimate Guide to Amazon's Stock Performance

hot stocks

"Best Performing US Stocks: Top 5 fro

"Best Performing US Stocks: Top 5 fro- "Best Performing US Stocks: Top 5 fro"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Percentage of South Koreans Investing in US St"

- Buying U.S. Stocks from Australia: A Guide for"

- New US Stocks 2020: Exploring the Emerging Opp"

recommend

2022 US Stock Market Outlook: A Comprehensive

2022 US Stock Market Outlook: A Comprehensive

US-Made L1A1 Stock Set: The Ultimate Upgrade f

The Evolution of the Total Value of the US Sto

"Coronavirus US Stock Market: Impact,

Stock Market Plunging: Understanding the Cause

Hblk.ca US Stock Symbol: A Comprehensive Guide

September 2022 Stock Market: A Comprehensive R

Best Performing US Large Cap Stocks Last Week:

Total Market Cap of the S&P 500: A Com

Best Cheap US Stocks: Discover Hidden Gems for

Title: Unveiling the iShares US Preferred Stoc

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- CNN Share Market: Navigating the Stock Landsca"

- Best US Cannabis Stocks to Watch on Reddit"

- Best App to Invest in US Stocks from UAE: Your"

- Stock Symbol for US Oil: Your Ultimate Guide t"

- Cannabis Companies Listing on U.S. Stock Excha"

- Babies R Us Christmas Stockings: The Ultimate "

- Unlocking the Potential of the US Dollar Stock"

- Amzn US Stock: The Ultimate Guide to Amazon�"

- How Do I Invest in the Top 1000 US Stocks? A C"

- US Express Enterprise Stock: A Comprehensive G"