you position:Home > stock coverage > stock coverage

Understanding the Overall US Stock Market

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

The overall US stock market is a complex and dynamic entity that reflects the economic health and growth of the United States. It is an essential barometer for investors, businesses, and policymakers alike. This article delves into the key aspects of the US stock market, exploring its components, trends, and factors that influence its performance.

Components of the US Stock Market

The US stock market is primarily composed of three major indices: the Dow Jones Industrial Average (DJIA), the S&P 500, and the NASDAQ Composite Index. The DJIA tracks the performance of 30 large companies, the S&P 500 includes the top 500 companies, and the NASDAQ focuses on technology and growth stocks.

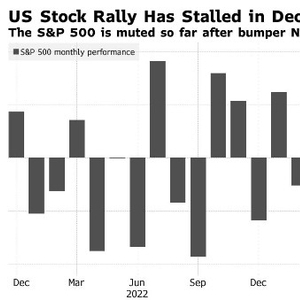

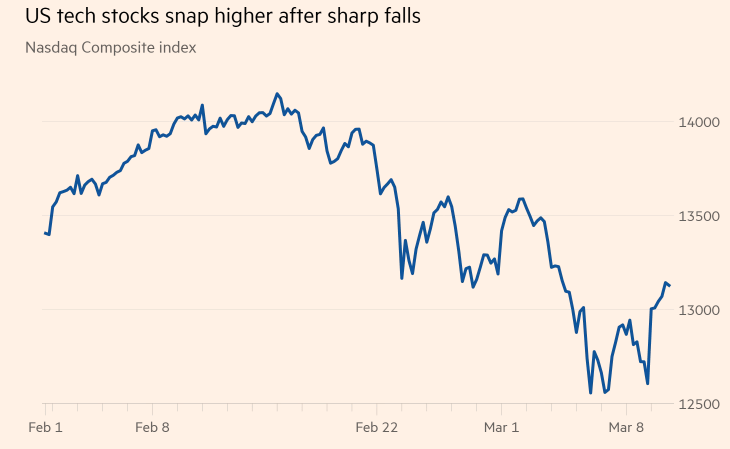

Trends in the US Stock Market

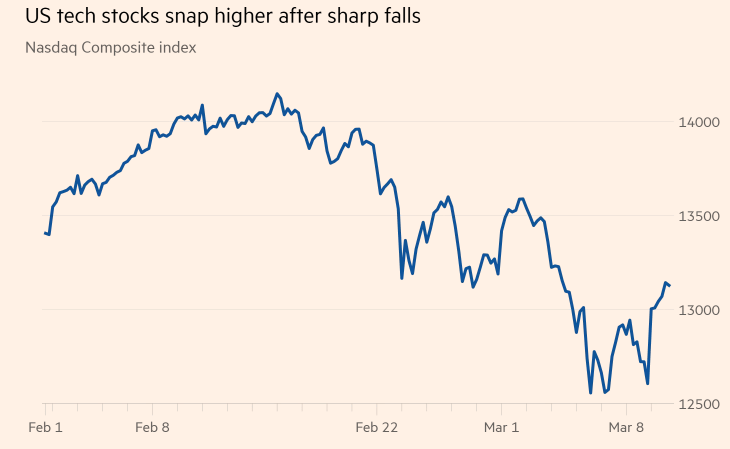

Over the past few years, the US stock market has experienced significant growth. This can be attributed to several factors, including strong economic growth, low unemployment rates, and favorable monetary policies. However, the market has also faced challenges, such as political uncertainty and global economic tensions.

Influencing Factors

Several factors influence the performance of the US stock market. These include:

- Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation rates play a crucial role in determining market trends.

- Monetary Policy: The Federal Reserve's monetary policy decisions, including interest rate changes, can significantly impact the stock market.

- Political Factors: Political stability and policy decisions at both the federal and state levels can influence investor confidence and market performance.

- Global Economic Conditions: Global economic conditions, such as trade wars and geopolitical tensions, can also impact the US stock market.

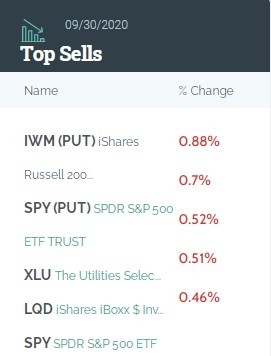

Case Study: The 2020 Stock Market Crash

One of the most notable events in the US stock market was the 2020 stock market crash, triggered by the COVID-19 pandemic. This event highlighted the vulnerability of the market to global events and the importance of diversification.

Diversification and Risk Management

To navigate the complexities of the US stock market, investors should focus on diversification and risk management. This involves investing in a mix of stocks, bonds, and other assets to mitigate risks and maximize returns.

Conclusion

The overall US stock market is a critical indicator of the country's economic health and growth. Understanding its components, trends, and influencing factors is essential for investors and policymakers. By staying informed and adopting a diversified investment strategy, investors can navigate the complexities of the market and achieve their financial goals.

so cool! ()

like

- Unlocking the Potential of RTN: A Deep Dive into Reuters' Full Description o

- Toy R Us Stock Quote: Unveiling the Numbers Behind the Iconic Brand

- Best REIT Stocks in the US: Top Picks for 2023

- S&P 500 Pre Market Futures: A Comprehensive Guide

- Complete List of US Stocks: A Comprehensive Guide for Investors

- Unlocking the Global Financial Landscape: Exploring Non-US Stock Market Data

- Dow Jones Average Last Week: A Comprehensive Look

- Top Highest-Performing Stocks in US Companies: Unveiling the Market Leaders

- Dow Jones Stock Market Futures: The Ultimate Guide to Trading Success

- Popular Momentum Stocks in the US: A Comprehensive Guide

- Allo.xyz: The Comprehensive Guide to Tokenized US Stocks

- Stocks on the Move: Unveiling the Dynamics Behind the Market's Shifts

hot stocks

IEA Global EV Outlook 2021: US Electric Vehicl

IEA Global EV Outlook 2021: US Electric Vehicl- IEA Global EV Outlook 2021: US Electric Vehicl"

- Best Performing US Stock Market Sectors in 202"

- Best Stocks to Invest in the US Now: Top Picks"

- Magnificent 7 US Stocks 2023 Performance: Top "

- Undervalued US Growth Stocks: Unlocking Hidden"

- Title: In-Depth Analysis of PNRA.O: A Comprehe"

- S&P 500 Inclusion Today: What You Need"

- Exploring the Era of 1950-60 US Rolling Stock:"

recommend

Understanding the Overall US Stock Market

Understanding the Overall US Stock Market

May 2025 US Stock Market Outlook: Predictions

Dow Jones Today: Google Search Insights and Ma

US-Iran War: How Stock Market Reacts

European vs. US Stocks: Key Differences and In

Unlocking the Potential of RTN: A Deep Dive in

Navigating Canadian Stock Dividends on US Tax

Computershare Stock Transfer Form US: A Compre

Best US Cannabis Stock: How to Invest in the G

US Defence Contractors on Stock Index: A Compr

U.S. Investor Interest in China Stocks: A Grow

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Stock Market Tanking: Navigating the Volatile "

- "Google's US Stock Performance: "

- Navigating the Bad Market: Strategies for Busi"

- CNBC Market Report: Latest Insights and Analys"

- Green Thumb Industries US Stock Price: A Compr"

- Square Enix Stock US: A Comprehensive Analysis"

- Is the US Stock Exchange Open Now? Your Ultima"

- Stock Market Forecast for the Next 6 Months in"

- Must Invest Stocks in US: Top 5 Reasons to Div"

- Best US Stocks Outlook 2025: Top Picks for Inv"