you position:Home > stock coverage > stock coverage

Understanding the Nike US Stock Price: A Comprehensive Analysis

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the highly competitive world of sports apparel and footwear, Nike Inc. stands as a global leader. Its stock, listed on the New York Stock Exchange under the ticker symbol "NKE," has been a subject of keen interest among investors and consumers alike. This article delves into the factors influencing the Nike US stock price, providing a comprehensive analysis of its performance and future prospects.

Historical Performance

Nike's stock has seen significant growth over the years. Since its initial public offering (IPO) in 1980, the company's stock has delivered a remarkable return on investment. From a split-adjusted price of around

Several factors have contributed to this growth. Nike's strong brand recognition and innovative product offerings have helped the company maintain a competitive edge in the market. Additionally, expansion into new markets and successful marketing campaigns have further bolstered its position as a market leader.

Current Market Dynamics

As of the latest available data, Nike's US stock price stands at approximately $US 130. However, the stock has experienced fluctuations in recent months. To understand these fluctuations, it is crucial to consider the following factors:

Economic Conditions: The global economy plays a significant role in determining the stock price of companies like Nike. Economic downturns can lead to reduced consumer spending, affecting Nike's sales and, consequently, its stock price.

Competition: The sports apparel industry is highly competitive, with several major players vying for market share. Increased competition can lead to lower profit margins and, in turn, negatively impact the stock price.

Product Launches: Nike's ability to launch successful new products is crucial for its growth. The company's recent focus on sustainability and innovation has helped it stay ahead of the curve and maintain its market leadership.

Supply Chain Disruptions: The COVID-19 pandemic has caused significant disruptions in global supply chains, affecting Nike's production and distribution. These disruptions have had a temporary impact on the company's stock price, but Nike's strong financial position has helped it navigate these challenges.

Future Prospects

Looking ahead, Nike's future prospects appear promising. The company has made significant strides in diversifying its product offerings and expanding into new markets. Its focus on sustainability and innovation is expected to drive further growth in the coming years.

Case Study: Nike's Sustainable Product Line

Nike's commitment to sustainability is evident in its "Considered" product line, which includes environmentally friendly materials and manufacturing processes. This initiative has not only helped reduce the company's carbon footprint but has also resonated with environmentally conscious consumers. The success of the "Considered" line serves as a testament to Nike's ability to adapt to changing consumer preferences and market trends.

Conclusion

In conclusion, the Nike US stock price is influenced by various factors, including economic conditions, competition, product launches, and supply chain disruptions. Despite these challenges, Nike's strong brand recognition, innovative product offerings, and commitment to sustainability position it well for future growth. As investors and consumers alike continue to monitor its performance, Nike's stock remains a compelling investment opportunity.

so cool! ()

last:Closing Bell on Wall Street Today: Key Insights and Market Moves

next:nothing

like

- Closing Bell on Wall Street Today: Key Insights and Market Moves

- Do Foreigners Pay Taxes on U.S. Stocks? A Comprehensive Guide

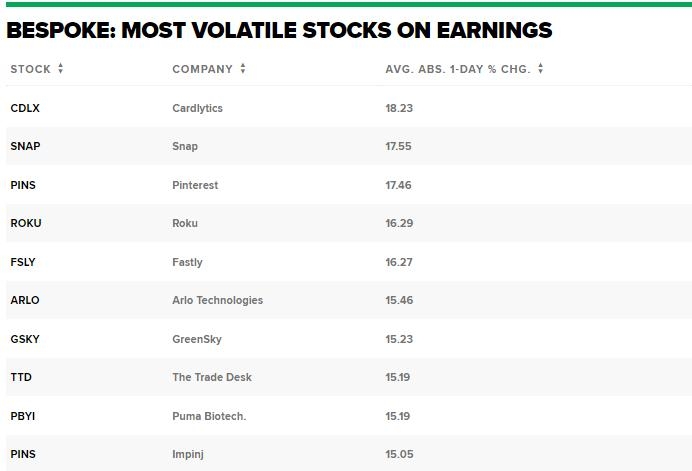

- High Volatile US Stocks: Understanding the Risks and Rewards

- Maximize Your Investment Potential with Finance Yahoo Com Quotes

- Best Stocks for 2021: Top Picks for Investors

- US Stock Earnings Calendar 2025: A Comprehensive Guide

- US Silver Stock Quote: A Comprehensive Guide to Understanding the Market

- Unlocking the Potential of US Conec Stock: A Comprehensive Guide

- US Market Stock Chart: A Comprehensive Guide to Understanding Stock Trends&qu

- Stock Prices Are: Understanding the Factors Influencing Market Fluctuations&q

- List of NYSE: Top Stocks to Watch in 2023"

- Stock Market Still Crashing: What You Need to Know"

hot stocks

IEA Global EV Outlook 2021: US Electric Vehicl

IEA Global EV Outlook 2021: US Electric Vehicl- IEA Global EV Outlook 2021: US Electric Vehicl"

- Best Performing US Stock Market Sectors in 202"

- Best Stocks to Invest in the US Now: Top Picks"

- Magnificent 7 US Stocks 2023 Performance: Top "

- Undervalued US Growth Stocks: Unlocking Hidden"

- Title: In-Depth Analysis of PNRA.O: A Comprehe"

- S&P 500 Inclusion Today: What You Need"

- Exploring the Era of 1950-60 US Rolling Stock:"

recommend

Understanding the Nike US Stock Price: A Compr

Understanding the Nike US Stock Price: A Compr

Stocks Protected Against the US-China Trade Wa

"HDFC Securities Invests in US Stocks

Is the US Stock Market Closed Right Now? Every

Enbridge US Stock: A Comprehensive Guide to In

US Stock Market Bull Market Status in May 2025

Case Brief of Com Stock v. US: A Deep Dive int

Small Cap Stocks News US: The Ultimate Guide t

German Companies on the US Stock Exchange: A L

"Top 5 Best Indian Stocks to Watch in

Us Airways Stock Clerk: The Essential Role in

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Green Thumb Industries US Stock Price: A Compr"

- ABCann: A Leading US Stock to Watch in 2023"

- Bitcoin ETFs: A Game-Changer for the US Stock "

- Defense Stocks in the US: A Strategic Investme"

- Is Nvidia a US Stock? Understanding the Invest"

- Chart of the US Stock Market by President: A D"

- FDA US Stocks News 2025: The Future of Investm"

- Is the US Stock Market Open on December 31?"

- How to Buy HK Stock in the US: A Step-by-Step "

- US Diesel and Heating Oil Stocks Scrape Lows B"