you position:Home > stock coverage > stock coverage

Is Selling Gifted Stock Income Taxed in the US? A Comprehensive Guide

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

Are you considering selling gifted stocks and want to know how it will affect your income tax? Understanding the tax implications of gifted stocks is crucial for making informed financial decisions. In this article, we'll delve into the details of selling gifted stock income and its tax implications in the United States.

Understanding Gifted Stocks

A gifted stock refers to shares of a company that are transferred to you without any consideration, meaning you receive them as a gift. These stocks can come from friends, family members, or even unrelated individuals. It's important to note that gifted stocks are distinct from inherited stocks, which have different tax rules.

Capital Gains Tax on Sold Gifted Stocks

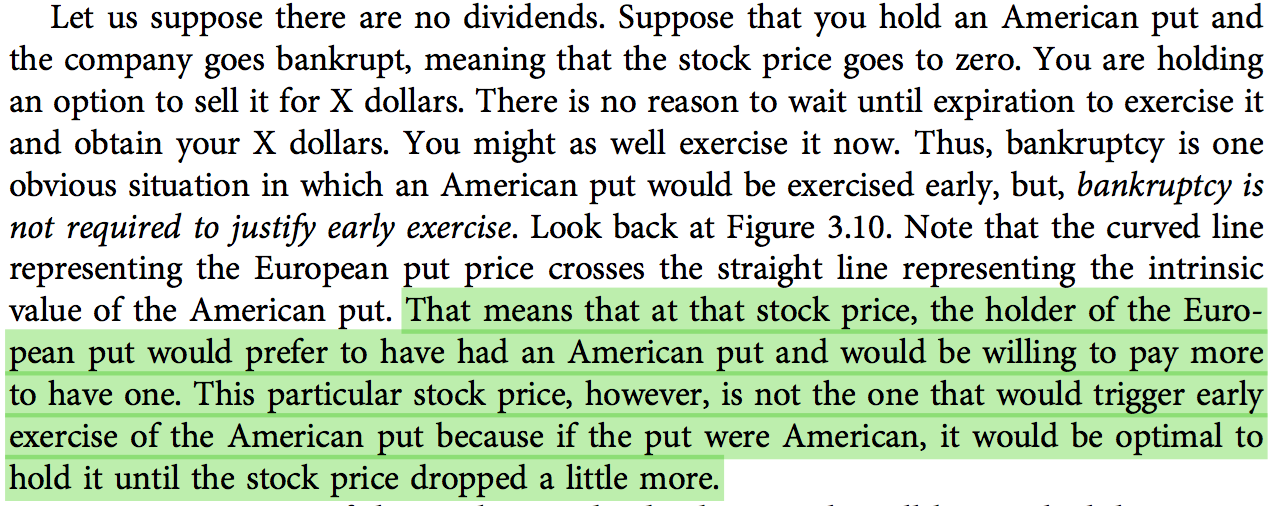

When you sell gifted stocks, the income generated from the sale is considered a capital gain. The tax rate on this gain depends on several factors, including your taxable income and the holding period of the stock.

Long-Term vs. Short-Term Capital Gains

If you hold the gifted stock for more than a year before selling it, the gain is classified as a long-term capital gain. The tax rate for long-term capital gains is typically lower than the rate for short-term gains.

For example, in 2021, the tax rate for long-term capital gains is 0%, 15%, or 20%, depending on your taxable income. If you sell the stock within a year of receiving it, the gain is considered a short-term capital gain, which is taxed as ordinary income.

Calculating the Taxable Gain

To calculate the taxable gain from selling gifted stocks, you need to determine the difference between the selling price and the cost basis of the stock. The cost basis is usually the fair market value of the stock at the time of the gift.

For instance, if you received 100 shares of a company's stock as a gift, and the fair market value at that time was

Reporting the Sale on Your Tax Return

It's crucial to report the sale of gifted stocks accurately on your tax return. You'll need to use Form 8949 and Schedule D to calculate and report the capital gains.

Example Case Study

Let's consider a hypothetical scenario. John received 100 shares of a company's stock as a gift worth

Important Considerations

Before selling gifted stocks, it's essential to consider the following:

- Tax Brackets: Your tax rate on the capital gain depends on your overall taxable income. Be aware of the tax brackets and ensure you're in the lowest possible bracket.

- State Taxes: Some states also tax capital gains, so it's important to check your state's tax laws.

- Tax Planning: Consider the timing of your sale to optimize your tax liability. Selling stocks in a year with lower taxable income can help reduce your tax bill.

Selling gifted stocks can be a significant source of income, but it's crucial to understand the tax implications. By following the guidelines outlined in this article, you can ensure that you're compliant with tax laws and make informed financial decisions.

so cool! ()

last:Bitcoin ETFs: A Game-Changer for the US Stock Market

next:nothing

like

- Bitcoin ETFs: A Game-Changer for the US Stock Market

- Understanding the US Beef Stock Market: A Comprehensive Guide

- The Thriving US Psilocybin Stocks: A Deep Dive

- AI Stocks US: The Future of Tech Investment

- Unlocking the Potential of SK hynix Stock US: A Comprehensive Guide

- Japan and US Stock Market: A Comparative Analysis

- Us Airways Stock Clerk: The Essential Role in Airport Operations

- Iran, Israel Conflict and Its Impact on the US Stock Market

- Toys "R" Us: NYSE Stock Price Analysis and Future Outlook

- US Stock Futures After Hours: Unveiling the Intricacies of Extended Trading

- US Rare Earth Mining Companies Stock: A Comprehensive Guide"

- Is Putin Manipulating Us Stock Market?"

hot stocks

IEA Global EV Outlook 2021: US Electric Vehicl

IEA Global EV Outlook 2021: US Electric Vehicl- IEA Global EV Outlook 2021: US Electric Vehicl"

- Best Performing US Stock Market Sectors in 202"

- Best Stocks to Invest in the US Now: Top Picks"

- Magnificent 7 US Stocks 2023 Performance: Top "

- Undervalued US Growth Stocks: Unlocking Hidden"

- Title: In-Depth Analysis of PNRA.O: A Comprehe"

- ATVI US Stock: A Comprehensive Guide to Unders"

- "http stocks.us.reuters.com stocks fu"

recommend

Is Selling Gifted Stock Income Taxed in the US

Is Selling Gifted Stock Income Taxed in the US

Iran's Attempt to Cause a Flash Crash in

US Large Cap Stocks with Low PE Ratio: A Glimp

Stocks for US Corporations: A Comprehensive Gu

Russians Investing in U.S. Corporations: A Gro

HWC US Stock: Unveiling the Potential of High-

"Top 5 Best Indian Stocks to Watch in

Stock Market News Tomorrow: What You Need to K

Understanding the US Stock Exchange: A Compreh

US Large Cap Stocks Momentum Analysis 2024: A

Unlocking the Potential of US Electricity Stoc

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Exploring the Game Among Us Stock Phenomenon"

- Us China Trade War Stocks to Buy: 6 Must-Have "

- "Geely US Stock: A Comprehensive Anal"

- Unlocking the Potential of Oil and Gas Stocks "

- Unusual Options Activity Sweeps Today's U"

- Unlocking the Potential of Apha Stock US: A Co"

- Best Performing Large Cap US Stocks Past Week:"

- Can US Investors Buy Canadian Stocks? A Compre"

- How to Buy HK Stock in the US: A Step-by-Step "

- February 2020 US Stock Market IPO Companies Li"