you position:Home > stock coverage > stock coverage

Best Stocks to Invest in the US: Top Picks for 2023

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

Investing in the US stock market can be a lucrative endeavor, but identifying the best stocks to invest in can be a daunting task. With numerous sectors and companies to choose from, it’s crucial to conduct thorough research and stay informed about market trends. This article highlights some of the best stocks to invest in the US for 2023, based on their growth potential, financial health, and market trends.

Technology Sector:

The technology sector has been a powerhouse in the US stock market, with several companies dominating the landscape. One such company is Apple Inc. (AAPL), known for its innovative products and strong brand loyalty. Apple’s diverse product portfolio, including iPhones, iPads, and Macs, has contributed to its consistent revenue growth.

Another technology giant worth considering is Microsoft Corporation (MSFT). With its cloud computing platform Azure and its ongoing investments in artificial intelligence, Microsoft has a strong competitive advantage in the technology sector.

Healthcare Sector:

The healthcare sector has been experiencing significant growth, driven by an aging population and technological advancements. Johnson & Johnson (JNJ) is a well-established player in the healthcare industry, offering a wide range of products and services in pharmaceuticals, medical devices, and consumer healthcare.

Moderna Inc. (MRNA), another healthcare stock to consider, has gained attention for its COVID-19 vaccine. The company’s mRNA technology has the potential to revolutionize the pharmaceutical industry, making it a compelling investment opportunity.

Energy Sector:

The energy sector is experiencing a renaissance, with a growing focus on renewable energy sources. Tesla, Inc. (TSLA) has emerged as a leader in the electric vehicle (EV) market, thanks to its innovative technology and commitment to sustainability.

SolarEdge Technologies, Inc. (SEDG) is another energy stock to consider. The company specializes in solar inverters and power optimizers, contributing to the growth of the solar energy industry.

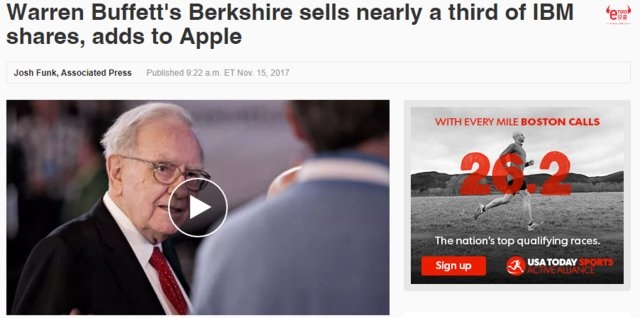

Consumer Discretionary Sector:

The consumer discretionary sector includes companies that cater to consumers’ wants and not their needs. Amazon.com, Inc. (AMZN) is a prime example of a company that has transformed the retail industry with its e-commerce platform and cloud computing services.

Walmart Inc. (WMT), on the other hand, has successfully merged traditional retail with online shopping, offering customers a seamless shopping experience. The company’s strong financial position and diverse product offerings make it a solid investment opportunity.

Conclusion:

Investing in the US stock market requires careful consideration and research. By focusing on sectors like technology, healthcare, energy, and consumer discretionary, investors can identify companies with strong growth potential. However, it’s crucial to stay informed about market trends and conduct thorough due diligence before making any investment decisions.

so cool! ()

last:Dow Jones US Total Stock Market Index History: A Comprehensive Overview

next:nothing

like

- Dow Jones US Total Stock Market Index History: A Comprehensive Overview

- Understanding Stock-Based Compensation Under US GAAP

- Can Canadians Trade Stocks via US Stock Brokers? Exploring Cross-Border Investing

- DJIA January 20, 2021: A Look Back at a Historic Market Day

- Lowest Stock Price Today: What You Need to Know

- US Momentum Stocks: September 2025's Best Performers

- Dow Jones Chart History: A Comprehensive Guide to Stock Market Evolution"

- Buying U.S. Stocks with a Weak Canadian Dollar: A Strategic Investment Approach

- Pure Tech Ventures Stock Price in US Dollars: A Comprehensive Guide

- e NYSE: Revolutionizing Stock Trading with Technology

- Nxt Stock US: A Comprehensive Guide to Understanding and Investing in NXT Cryptoc

- Stocks to Buy in US Market Today: Top Picks for Investors

hot stocks

IEA Global EV Outlook 2021: US Electric Vehicl

IEA Global EV Outlook 2021: US Electric Vehicl- IEA Global EV Outlook 2021: US Electric Vehicl"

- Best Performing US Stock Market Sectors in 202"

- Best Stocks to Invest in the US Now: Top Picks"

- Magnificent 7 US Stocks 2023 Performance: Top "

- Undervalued US Growth Stocks: Unlocking Hidden"

- Title: In-Depth Analysis of PNRA.O: A Comprehe"

- S&P 500 Inclusion Today: What You Need"

- Exploring the Era of 1950-60 US Rolling Stock:"

recommend

Best Stocks to Invest in the US: Top Picks for

Best Stocks to Invest in the US: Top Picks for

How Many Companies Are on the US Stock Market?

"Sex Doll US Stock: The Rising Trend

Can I Buy VW Stock in the US? Your Ultimate Gu

Optimizing US Building Stock: Strategies for E

Us China Trade War Stocks to Buy: 6 Must-Have

US Election 2020: How It Impacted the Stock Ma

"Are Canadian Stocks Safe if US Stock

Best Marijuana Stocks to Buy in the US: A Comp

US Healthcare Stocks Down: What You Need to Kn

Stock Market Mixed After China Retaliates to U

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Understanding the Average Annual Returns of th"

- Top US Mid Cap Stocks to Watch in 2025"

- "Riot US Stock: Unveiling the Powerho"

- Understanding the US Nuclear Energy Companies "

- Top 5 Shares to Buy Today in the USA"

- Understanding the US Stock Exchange Open UK Ti"

- Best Stocks to Invest in the US: Top Picks for"

- StockX: Revolutionizing the Secondary Market f"

- Oldest Stock Exchange in the US: A Look into t"

- Dow Nov 5, 2024: What to Expect in the Stock M"