you position:Home > new york stock exchange > new york stock exchange

Trade London Stock Exchange in the US: A Comprehensive Guide

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In today's globalized financial world, the ability to trade on international stock exchanges has become increasingly accessible to investors in the United States. One of the most prestigious and influential stock exchanges in the world is the London Stock Exchange (LSE). This article will provide a comprehensive guide on how to trade on the London Stock Exchange from the United States.

Understanding the London Stock Exchange

The London Stock Exchange is one of the oldest and most respected stock exchanges in the world. It was founded in 1801 and is home to over 3,500 companies, including some of the world's largest and most successful businesses. The LSE is divided into two segments: the Main Market and the Alternative Investment Market (AIM). The Main Market is for larger, more established companies, while the AIM is for smaller, high-growth companies.

How to Trade on the London Stock Exchange from the US

Trading on the London Stock Exchange from the United States is relatively straightforward, but there are a few key steps to follow:

Open a Brokerage Account: The first step is to open a brokerage account with a firm that offers access to the London Stock Exchange. Many major brokerage firms, such as Charles Schwab and Fidelity, offer this service.

Understand the Risks: Trading on international stock exchanges carries additional risks, including currency exchange rates and different regulatory requirements. It's important to do your research and understand these risks before you start trading.

Research and Analyze: Just like with any stock exchange, it's crucial to research and analyze the companies you're interested in trading. This includes looking at financial statements, news, and market trends.

Place Your Order: Once you've done your research, you can place your order through your brokerage account. You can choose to trade stocks, bonds, or other financial instruments listed on the LSE.

Monitor Your Investments: After placing your order, it's important to monitor your investments regularly. This will help you stay informed about market movements and make informed decisions.

Benefits of Trading on the London Stock Exchange

There are several benefits to trading on the London Stock Exchange from the United States:

Access to Global Markets: Trading on the LSE allows you to invest in companies from around the world, giving you a broader portfolio and potential for higher returns.

Diversification: The LSE is home to a wide range of industries and sectors, allowing you to diversify your portfolio and reduce risk.

Innovation: The LSE is known for its innovation and has been at the forefront of many technological advancements in the financial industry.

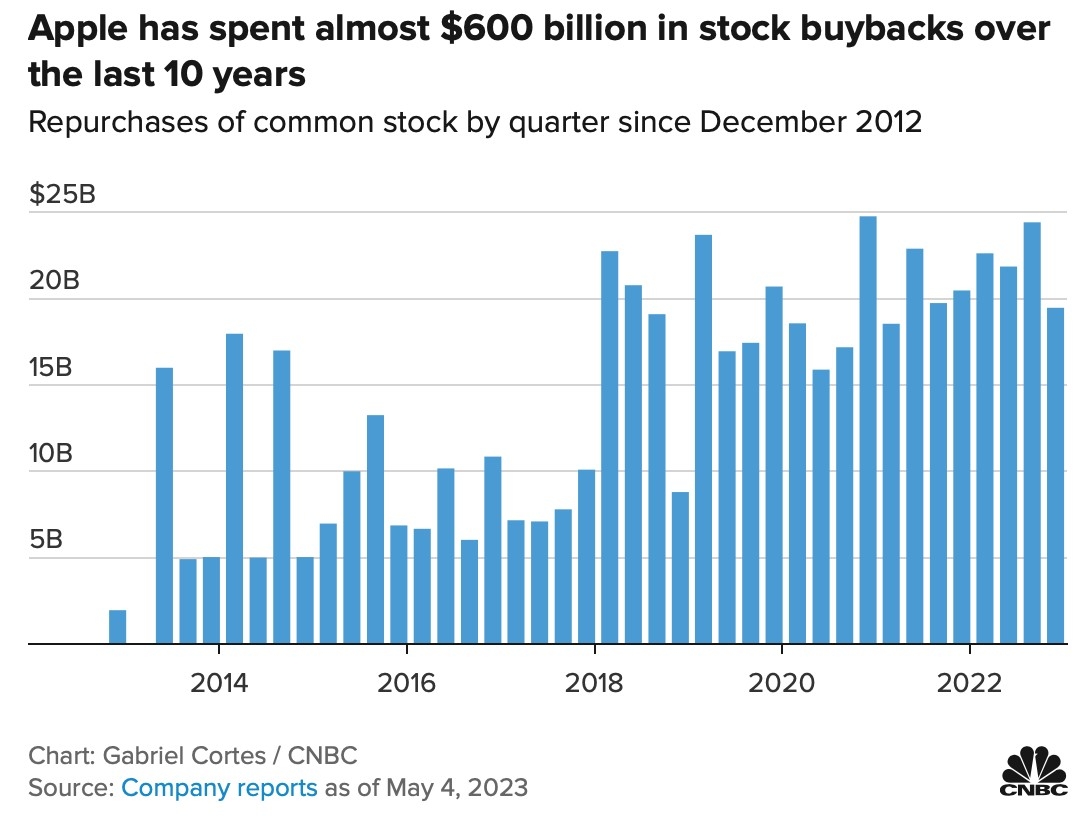

Case Study: Apple Inc. on the London Stock Exchange

One of the most notable companies listed on the London Stock Exchange is Apple Inc. In 2014, Apple became the first U.S. company to be listed on the LSE. This move allowed investors in the UK and other European countries to buy Apple stock directly, without the need for a U.S. brokerage account.

Conclusion

Trading on the London Stock Exchange from the United States is a viable option for investors looking to diversify their portfolios and gain access to global markets. By following the steps outlined in this guide, you can start trading on the LSE and potentially benefit from the many opportunities it offers.

so cool! ()

last:Stock Market Today: Key Insights and Analysis

next:nothing

like

- Stock Market Today: Key Insights and Analysis

- Global Market Futures: Unveiling the Future of Investment Opportunities

- Markets on Monday: A Comprehensive Guide to Stock Market Trends

- How Was the Market Yesterday: A Comprehensive Overview

- CNN 24 Hour Stock Market: Unveiling the Non-Stop Financial World"

- Mastering the Art of Finance: Your Ultimate Guide to Financial Success

- Balanced Blend of US Stock vs. International Stock: Maximizing Returns in a Globa

- Stock Market Closing Bell: A Glimpse into the Final Hour of Trading

- Latest Analyst Picks: Top US Stocks to Watch

- Cortus Stock: A Comprehensive Guide to Understanding and Investing

- Lonza US Stock: A Comprehensive Guide to Investing in the Swiss Biotech Giant

- Burberry Stock Price in US Dollars: A Comprehensive Analysis

hot stocks

HSBC US Stock Trading Fees: What You Need to K

HSBC US Stock Trading Fees: What You Need to K- HSBC US Stock Trading Fees: What You Need to K"

- Top Momentum Stocks in the US Market August 20"

- Unlocking Opportunities with US Small Value St"

- Shionogi Stock US: A Comprehensive Analysis of"

- Unlocking the Potential of Barclays Bank US St"

- American Stock Traders Outside the US: Opportu"

- Understanding DJIA Pre-Market Futures: A Compr"

- ACB US Stock Price Today: Current Trends and A"

recommend

Trade London Stock Exchange in the US: A Compr

Trade London Stock Exchange in the US: A Compr

Major US Airline Stocks Drop as Jefferies Down

HSBC US Stock Fee: Understanding the Costs and

Understanding the Blackberry US Stock Symbol:

Toys "R" Us Stock 2021: A Co

Understanding the US Stock Market: A Comprehen

Dow Futures Right Now: Current Trends and Anal

Is the US Stock Market Crashing? A Comprehensi

US Momentum Stocks: Top Performers August 2025

US Steel Stock Price Chart: A Comprehensive An

What Did the Market Do Today? A Comprehensive

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Foreigner Buy US Stock: A Comprehensive Guide "

- Can Not Find Us Stock Ticker for True Leaf Med"

- Stock Invest.US // UAB Exigam: Mastering the A"

- US Investment in Rare Earth Stocks Amid China&"

- Uber US Stock: A Comprehensive Analysis of the"

- Unlocking the Power of NASGAQ: Revolutionizing"

- Understanding Ex-Dividend Dates for US Stocks:"

- Recent Breakout Stocks: US Momentum That'"

- Top 5 US Stocks to Buy in 2024: Your Ultimate "

- Stocks That Benefit from a Weak US Dollar: A S"