you position:Home > new york stock exchange > new york stock exchange

Mastering Market Index Performance: Strategies for Success

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the volatile world of finance, understanding and analyzing market index performance is crucial for investors and traders. The stock market is an ever-changing landscape, and staying ahead of the curve requires knowledge, strategy, and a keen eye for detail. This article delves into the ins and outs of market index performance, providing valuable insights and strategies to help you navigate the market successfully.

What is Market Index Performance?

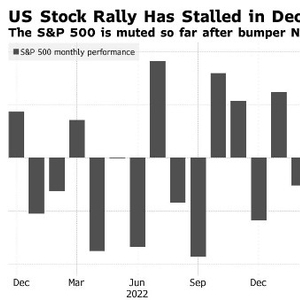

Market index performance refers to the overall movement and behavior of a collection of stocks or bonds. These indices serve as benchmarks for the market as a whole, giving investors a snapshot of market trends and performance. Some of the most well-known market indices include the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite.

Key Factors Influencing Market Index Performance

Several factors can influence the performance of market indices. Here are some of the most important ones:

- Economic Indicators: Economic indicators, such as GDP growth, unemployment rates, and inflation, can significantly impact market index performance. For instance, strong economic growth can lead to higher stock prices, while high unemployment rates can lead to a decline in market indices.

- Political Events: Political events, such as elections or policy changes, can also have a significant impact on market index performance. Investors often react to news and events, causing market indices to fluctuate accordingly.

- Market Sentiment: Market sentiment refers to the overall mood or attitude of investors in the market. When investors are optimistic, they tend to buy more stocks, leading to an increase in market indices. Conversely, when investors are pessimistic, they tend to sell more stocks, causing market indices to decline.

- Interest Rates: Interest rates play a crucial role in market index performance. Higher interest rates can lead to higher borrowing costs for companies, which can negatively impact their earnings and stock prices. Conversely, lower interest rates can stimulate economic growth and lead to higher stock prices.

Strategies for Analyzing Market Index Performance

To effectively analyze market index performance, investors can use several strategies:

- Technical Analysis: Technical analysis involves using historical data and price patterns to predict future market movements. This approach can help investors identify trends and potential entry and exit points.

- Fundamental Analysis: Fundamental analysis involves analyzing the financial health and business prospects of individual companies or the market as a whole. This approach can help investors identify undervalued or overvalued stocks and make informed investment decisions.

- Diversification: Diversifying your portfolio can help mitigate risk and protect against market downturns. By investing in a variety of stocks, bonds, and other assets, you can reduce the impact of any single stock or market index on your portfolio.

Case Studies: Real-World Examples

To illustrate the impact of market index performance, let's consider a few real-world examples:

- The 2008 Financial Crisis: In 2008, the global financial crisis led to a significant decline in market indices. The S&P 500 dropped by nearly 50% from its peak in October 2007 to its low in March 2009. Investors who had diversified their portfolios and stayed the course were better positioned to recover from the downturn.

- The 2019 U.S. Stock Market Rally: In 2019, the U.S. stock market experienced a strong rally, with the S&P 500 reaching record highs. This performance was driven by several factors, including strong economic growth, low unemployment rates, and supportive monetary policy.

By understanding the factors influencing market index performance and employing effective analysis strategies, investors can make informed decisions and potentially achieve greater success in the market. Stay informed, stay strategic, and keep an eye on market index performance to stay ahead of the curve.

so cool! ()

last:ACB Stock Invest: Unveiling the Potential of US Market Opportunities

next:nothing

like

- ACB Stock Invest: Unveiling the Potential of US Market Opportunities

- "Top Sites for Stock Analysis: Unveiling the Best Tools for Investors&am

- Top Personal Finance News You Can't Miss This Month

- Market Capitalization of US Stock Market: Total Overview and Analysis"

- Moncler Stock US: The Ultimate Guide to Investing in the Luxury Brand

- US Healthcare Stocks Down: What You Need to Know

- Stock Markets Down Today: What's Behind the Decline?

- Recent Business Articles: Unveiling the Trends and Insights of Today's Corpo

- Motilal Oswal US Stocks Charges: Unveiling the Costs for Global Investors

- Rare Earth Stocks: A Lucrative Investment Opportunity in the US

- Stock Options US Tax Treatment: A Comprehensive Guide"

- Stock Market Historical Graph: Decoding the Past for Future Insights

hot stocks

HSBC US Stock Trading Fees: What You Need to K

HSBC US Stock Trading Fees: What You Need to K- HSBC US Stock Trading Fees: What You Need to K"

- Top Momentum Stocks in the US Market August 20"

- Unlocking Opportunities with US Small Value St"

- Shionogi Stock US: A Comprehensive Analysis of"

- Unlocking the Potential of Barclays Bank US St"

- American Stock Traders Outside the US: Opportu"

- Understanding DJIA Pre-Market Futures: A Compr"

- ACB US Stock Price Today: Current Trends and A"

recommend

Mastering Market Index Performance: Strategies

Mastering Market Index Performance: Strategies

Marijuana Stocks to Buy: A Guide to Investing

Impact of US Stock Market on Indian Stock Mark

Unlocking the Potential of Run.O: A Deep Dive

Unlocking the Potential of the US Small Stock

Most Volatile US Stocks to Watch in August 202

Understanding the Significance of US Petroleum

TFSA or RRSP for US Stocks: Which is Best for

Shutterstock Image with Monumental US Flag: A

List of All Stock Markets in the US: Comprehen

US Small Cap Clean Energy Stocks: A Lucrative

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- US Energy Stocks 2018: A Deep Dive into the Ma"

- How to Buy TSX Stocks from the US: A Step-by-S"

- Unlocking the Potential of Marijuana Stocks in"

- US Oil Companies on the Stock Market: A Compre"

- Dai Stock in US Dollars: A Comprehensive Guide"

- Stock Performance Today: US Market Completion "

- Understanding US Capital Gains Tax on Israeli "

- Top 5 US Stocks to Buy in 2024: Your Ultimate "

- U.S. Stock Market Today News: Key Developments"

- Top ETFs to Invest in U.S. Stocks: Your Ultima"