you position:Home > new york stock exchange > new york stock exchange

Into Stock Pricing: Understanding the Essentials for Investors

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the fast-paced world of finance, understanding stock pricing is crucial for investors aiming to make informed decisions. Stock pricing involves a complex interplay of market dynamics, financial metrics, and investor sentiment. This article delves into the essentials of stock pricing, providing investors with the knowledge needed to navigate the stock market effectively.

Market Dynamics and Supply and Demand

The foundation of stock pricing lies in the principles of supply and demand. When demand for a stock increases, its price typically rises. Conversely, if demand decreases, the stock's price may fall. This dynamic is influenced by various factors, including economic indicators, corporate news, and global events.

Financial Metrics and Valuation

Financial metrics play a pivotal role in stock pricing. Key metrics such as earnings per share (EPS), price-to-earnings (P/E) ratio, and book value per share are used to assess a company's financial health and valuation. These metrics help investors determine whether a stock is overvalued, undervalued, or fairly valued.

Earnings Reports and Analyst Estimates

Earnings reports are a critical component of stock pricing. Companies release their financial results on a quarterly basis, providing investors with insights into their performance. Analysts closely monitor these reports and provide estimates and forecasts, which can significantly impact stock prices.

Dividends and Yield

Dividends are another important factor in stock pricing. Companies that pay dividends tend to attract investors seeking income. The dividend yield, which is calculated by dividing the annual dividend by the stock's price, is a key metric used to evaluate the attractiveness of a dividend-paying stock.

Technical Analysis and Chart Patterns

Technical analysis involves analyzing historical price and volume data to predict future stock movements. Chart patterns, such as head and shoulders, triangles, and flags, are used to identify potential buy and sell signals. While technical analysis is subjective, it can provide valuable insights into market trends and investor sentiment.

Fundamental Analysis and Company Performance

Fundamental analysis involves evaluating a company's business model, management team, and competitive position. By analyzing financial statements, balance sheets, and income statements, investors can gain a deeper understanding of a company's underlying performance and potential future growth.

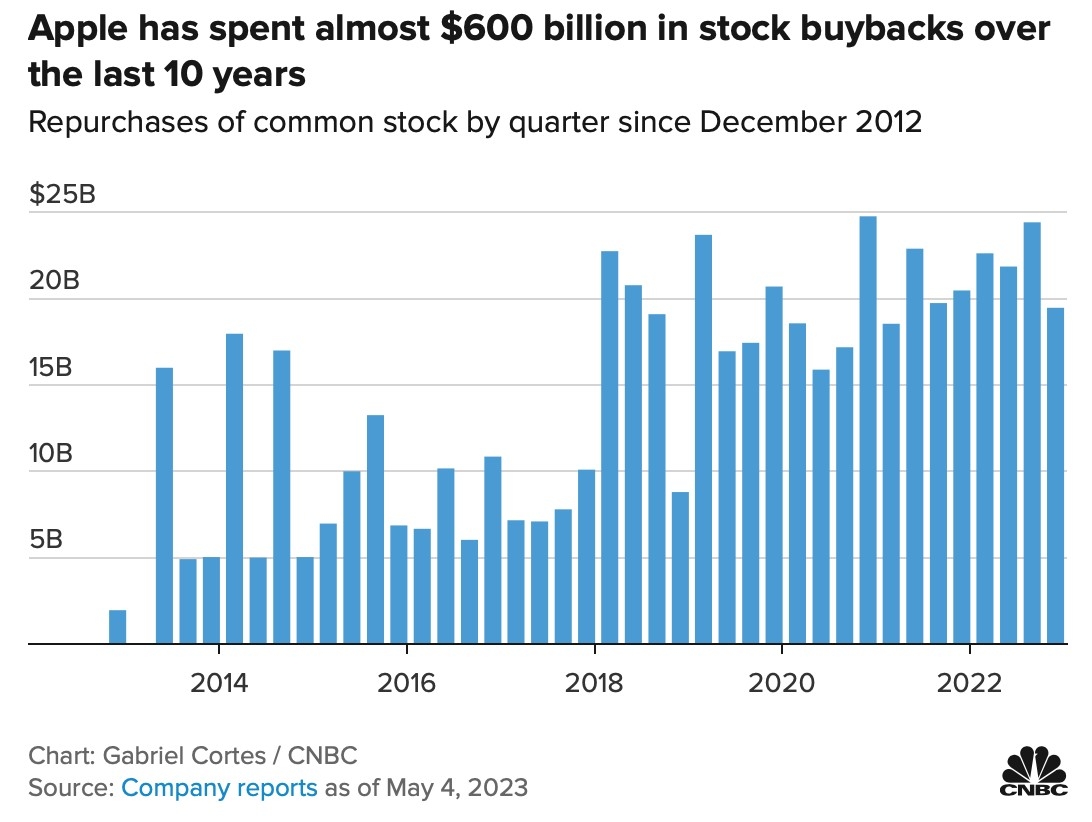

Case Study: Apple Inc. (AAPL)

Consider Apple Inc. (AAPL), a leading technology company. Over the past decade, AAPL's stock has experienced significant volatility, driven by market dynamics, financial metrics, and investor sentiment. For instance, during the COVID-19 pandemic, AAPL's stock surged as demand for its products increased. However, in the face of rising inflation and supply chain disruptions, the stock experienced a temporary decline.

By analyzing AAPL's financial metrics, such as its EPS and P/E ratio, investors can gain insights into its valuation. Additionally, monitoring the company's earnings reports and dividends can help investors make informed decisions about purchasing or selling the stock.

Conclusion

Understanding stock pricing is essential for investors seeking to navigate the stock market successfully. By considering market dynamics, financial metrics, and investor sentiment, investors can make informed decisions and potentially achieve their investment goals. Remember, investing in the stock market involves risk, and it is crucial to conduct thorough research and seek professional advice when necessary.

so cool! ()

last:Dow Jones Today: A Comprehensive Look at the Latest Financial News

next:nothing

like

- Dow Jones Today: A Comprehensive Look at the Latest Financial News

- All Stocks on NYSE: A Comprehensive Guide to the New York Stock Exchange

- Litelink Technologies US Stock Symbol: Unveiling the Key to Investment Opportunit

- Unlocking the Potential of PEGA Systems: A Deep Dive into the Stock

- US Stock Market: A CNBC Deep Dive

- Dow Jones: The Ultimate Guide to Understanding Financial Markets"

- NASDAQ, S&P 500, Dow Jones: Forecasting the Future of the Stock Market

- CNN Premarket Futures Stocks: A Comprehensive Guide to the Stock Markets

- Unlocking the Power of the 100 Index: A Comprehensive Guide

- In Stock at Toys "R" Us: The Ultimate Destination for Kids'

- Mutual Funds Having US Stocks: A Comprehensive Guide to Diversify Your Portfolio

- NYSE Closed Good Friday: Understanding the Impact on the Financial Markets

hot stocks

HSBC US Stock Trading Fees: What You Need to K

HSBC US Stock Trading Fees: What You Need to K- HSBC US Stock Trading Fees: What You Need to K"

- Top Momentum Stocks in the US Market August 20"

- Unlocking Opportunities with US Small Value St"

- Shionogi Stock US: A Comprehensive Analysis of"

- Unlocking the Potential of Barclays Bank US St"

- American Stock Traders Outside the US: Opportu"

- Understanding DJIA Pre-Market Futures: A Compr"

- ACB US Stock Price Today: Current Trends and A"

recommend

Into Stock Pricing: Understanding the Essentia

Into Stock Pricing: Understanding the Essentia

What Stock Made the Most Money Today? Unveilin

U.S. Stock Market Today News: Key Developments

How Will Democratic Win Affect Us Stocks?

Dbs Vickers Us Stocks: Your Ultimate Guide to

In-Depth Analysis of HP Stock: A Comprehensive

Unlocking Opportunities with US Small Value St

Expensive US Stocks: What You Need to Know

"Market-Weighted US Stock Indexes: A

"US Historical Stock Return: A Deep D

AI Stocks US: The Future of Investment in Arti

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Impact of US Stock Market on Indian Stock Mark"

- "Current Market Conditions: US Stocks"

- TSMC Stock Price US: A Comprehensive Analysis "

- S and P 500 Highest: Unveiling the Top Perform"

- Top US Stocks to Buy Right Now: A Smart Invest"

- Unlocking the Potential of NYC Stock Market: A"

- Dow Finish: The Ultimate Guide to Achieving a "

- Maximizing Returns: A Comprehensive Guide to B"

- Condome Stocks in the US: A Lucrative Investme"

- Active Small Cap US Stock Fund: A Strategic In"