you position:Home > can foreigners buy us stocks > can foreigners buy us stocks

Unlocking the Potential of Silver Stocks in the US

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the ever-evolving world of investments, silver stocks have emerged as a compelling option for investors seeking diversification and potential growth. With the US being a global leader in silver production and consumption, understanding the dynamics of silver stocks in the US is crucial for any investor looking to capitalize on this valuable metal. This article delves into the key aspects of silver stocks in the US, highlighting their potential, risks, and strategies for investment.

The Silver Market in the US

The US is the largest producer of silver in the world, with significant mining operations across the country. This dominance in production has made the US a key player in the global silver market. Moreover, the US is also a major consumer of silver, with various industrial, technological, and decorative applications driving demand.

Understanding Silver Stocks

Silver stocks represent shares of companies involved in the exploration, mining, and processing of silver. Investing in silver stocks allows investors to benefit from the price movements of silver while also participating in the growth potential of the mining companies themselves.

Key Factors to Consider When Investing in Silver Stocks

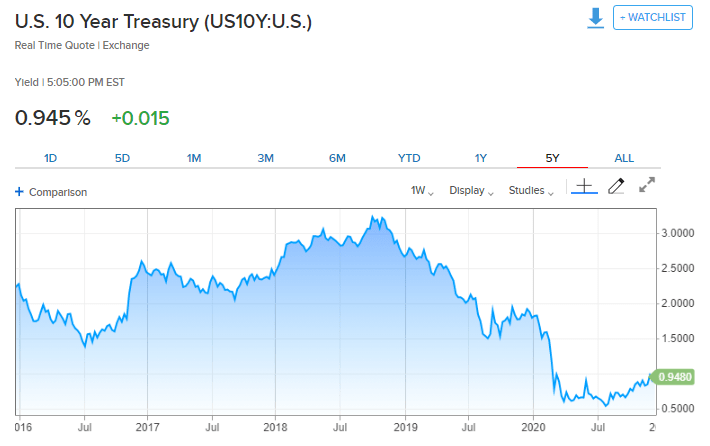

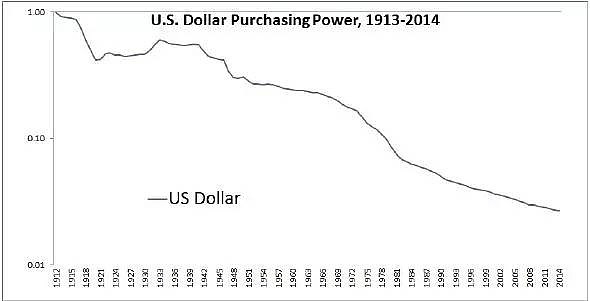

Market Trends: Keeping an eye on the broader market trends is crucial. Silver often moves inversely to the US dollar, making it a good hedge against inflation and currency devaluation.

Company Financials: Assessing the financial health of silver mining companies is essential. Look for companies with strong balance sheets, low debt levels, and a history of profitability.

Production and Reserves: Companies with substantial silver reserves and high production rates are often more attractive to investors.

Management Team: The expertise and experience of the management team can significantly impact the success of a silver mining company.

Geopolitical Factors: Political stability and regulatory environment in the countries where mining operations are located can influence the performance of silver stocks.

Top Silver Stocks in the US

Hecla Mining Company (HL): A leading silver producer in the US, Hecla Mining has a strong track record of production and exploration.

Pan American Silver Corp. (PAAS): One of the largest silver mining companies in the world, Pan American Silver has a diverse portfolio of mining operations across multiple countries.

Coeur Mining Inc. (CDE): A significant player in the US silver mining industry, Coeur Mining has a diverse portfolio of silver and gold mines.

Case Study: Silver Wheaton Corp. (SLW)

Silver Wheaton Corp. is a streaming company that provides investors with exposure to the price of silver without the need to own physical metal or mine it. By entering into long-term streaming agreements with mining companies, Silver Wheaton has built a strong portfolio of silver assets. This strategy has allowed the company to generate significant returns for investors, even during periods of volatility in the silver market.

Conclusion

Investing in silver stocks in the US can be a lucrative opportunity for investors looking to diversify their portfolios and capitalize on the potential growth of this valuable metal. By understanding the key factors to consider and staying informed about market trends, investors can make informed decisions and potentially reap the rewards of investing in silver stocks.

so cool! ()

last:Maximizing Your Investment Potential with Degiro US Stocks"

next:nothing

like

- Maximizing Your Investment Potential with Degiro US Stocks"

- DJIA Jan 20, 2025: A Glimpse into the Future of the Stock Market

- KRMA vs. International Stock Ratio: A Comprehensive Analysis"

- Mexus Gold: A Comprehensive Guide to Investing in US Stocks

- US Army Stock Price: A Comprehensive Analysis

- The Dollar Value of the US Stock Market: Current Trends and Future Prospects

- Long-Term Investors: Stocks to Watch in the US Market

- Ex-US Stocks: Exploring Opportunities Beyond U.S. Borders

- Hot Stock to Buy Today: Top Picks for Investors

- Fox Business News Channel: Your Ultimate Source for Financial Insights

- In-Depth Analysis of Syf: Full Description of This http Stocks US Reuters Coverag

- Analyst Upgrades Stocks Today: US Market Witnessing a Bullish Turn

hot stocks

Pre-Market US Stock Movers: Key Insights and A

Pre-Market US Stock Movers: Key Insights and A- Pre-Market US Stock Movers: Key Insights and A"

- Among Us Christmas Stockings: Uniquely Celebra"

- Samsung Note 12.2 P900 Stock ROM US: A Compreh"

- Top US Cannabis Stocks to Buy in 2023: A Guide"

- Is the US Stock Market Open on Election Day 20"

- The Dollar Value of the US Stock Market: Curre"

- Total Market Capitalization of US Stocks: A Co"

- "Unveiling the Excitement of US New S"

recommend

Unlocking the Potential of Silver Stocks in th

Unlocking the Potential of Silver Stocks in th

"Today's US Stock Market Index:

Oil Companies That Drill in the US with Stock:

Stock Trading Holidays: Understanding the Impa

Top 5 Military Stocks in the US to Watch in 20

iShares US Real Estate ETF Stock: A Comprehens

US as Stock Speculations: Unveiling the Opport

Dow Jones Industrial Volume: A Comprehensive G

Small Cap Biotech US Stocks List: Your Guide t

Us Large Cap Stocks with Low PE Ratio: A Value

Momentum Analysis: Understanding 5-Day Perform

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- "radient technologies stock us: A Dee"

- Defense US Stocks: Strategies for Safeguarding"

- 2017 US Stock Market: The Fraction of Institut"

- SP 500 Index Graph: A Comprehensive Guide to U"

- Stock Market in US Today: Current Trends and F"

- Best Performing US Stocks Last 5 Days: Momentu"

- US Multifamily Stock: A Lucrative Investment O"

- US Senators Stocks: The Intriguing Connection"

- Maximizing Your Investment Potential: A Compre"

- Earnings Calendar Next Week: What to Expect fo"