you position:Home > can foreigners buy us stocks > can foreigners buy us stocks

Understanding the US Stock Losses: Causes and Consequences

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In the volatile world of financial markets, US stock losses are a common concern for investors. These losses can stem from a variety of factors, including market trends, economic conditions, and individual investment decisions. This article delves into the causes of stock losses in the US, their consequences, and ways investors can mitigate them.

Market Trends and Economic Conditions

Market trends and economic conditions play a significant role in determining the performance of stocks. When the economy is in a downturn, businesses may face reduced revenues and profits, leading to a decrease in stock prices. For instance, the COVID-19 pandemic had a profound impact on the stock market, with many companies witnessing significant losses.

Inflation and interest rate hikes are other economic factors that can contribute to stock losses. When inflation rises, the value of money decreases, impacting the purchasing power of companies. Similarly, higher interest rates can increase borrowing costs, affecting the profitability of businesses.

Technological Advances and Disruption

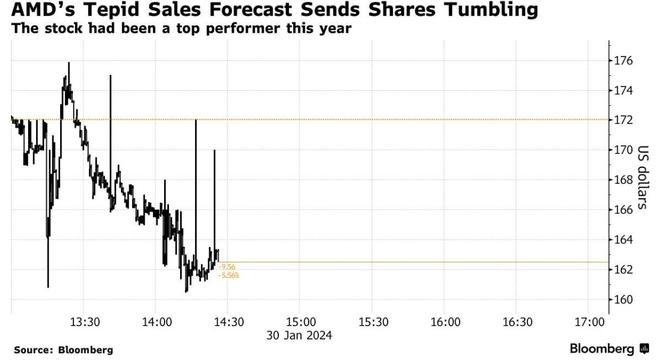

Technological advancements and disruptions can also lead to stock losses. For example, the rise of new technologies such as artificial intelligence and blockchain has disrupted traditional industries, leading to a decline in the value of stocks in these sectors.

Investment Decisions

Individual investment decisions can also result in stock losses. Poorly timed investments, overleveraging, and failing to diversify are common reasons for losses. For instance, investing heavily in a single stock or sector without proper research can lead to significant losses if the market takes a downturn.

Case Study: Tech Stocks and the Dot-Com Bubble

One notable example of stock losses due to market trends is the dot-com bubble of the late 1990s. Many investors saw tech stocks as a way to make significant returns, leading to a surge in their prices. However, as the bubble burst, many tech stocks experienced significant losses, leading to widespread investor disappointment.

Mitigating Stock Losses

To mitigate US stock losses, investors can consider the following strategies:

- Diversification: Diversifying your portfolio can help reduce the impact of stock losses. By investing in a variety of stocks, sectors, and asset classes, you can reduce the risk of significant losses in any single area.

- Research and Education: Educating yourself about the markets and conducting thorough research before making investment decisions can help you make more informed choices.

- Risk Management: Understanding your risk tolerance and implementing risk management strategies can help protect your investments.

- Regular Rebalancing: Regularly rebalancing your portfolio can help ensure that it remains aligned with your investment goals and risk tolerance.

In conclusion, US stock losses can occur due to a variety of factors, including market trends, economic conditions, and individual investment decisions. By understanding these factors and implementing effective strategies, investors can mitigate their risks and achieve more stable returns.

so cool! ()

last:Indian Stocks That Trade in the US: A Comprehensive Guide

next:nothing

like

- Indian Stocks That Trade in the US: A Comprehensive Guide

- Stock Trading Holidays: Understanding the Impact on the US Market

- Current Cape Ratio for US Stocks & International Markets by September 202

- Maximizing Your Investment Potential with Online US Stock Trading

- SGEN US Stock Price: A Comprehensive Analysis

- Low Volatility Growth Stocks: A Strategic Investment Choice for US Investors

- US Banks Stock Index: A Comprehensive Guide to Understanding Its Performance and

- Number of Stocks in CRSP US Total Market Index: A Comprehensive Analysis"

- Stock Market in US Today: Current Trends and Future Outlook

- http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol cvsi.

- https simplywall.st stocks us commercial-services nyse-man manpowergroup"

- Raytheon Stock: A Comprehensive Analysis of US Market Performance

hot stocks

Pre-Market US Stock Movers: Key Insights and A

Pre-Market US Stock Movers: Key Insights and A- Pre-Market US Stock Movers: Key Insights and A"

- Among Us Christmas Stockings: Uniquely Celebra"

- Samsung Note 12.2 P900 Stock ROM US: A Compreh"

- Total Market Capitalization of US Stocks: A Co"

- "Unveiling the Excitement of US New S"

- Buy Stocks Outside US: A Guide to Global Inves"

- Best Widow and Orphan Stocks in the US Now: To"

- Unlocking the Potential of US Industrials Stoc"

recommend

Understanding the US Stock Losses: Causes and

Understanding the US Stock Losses: Causes and

Top Performing US Stock Sectors in 2025: A Com

Maximizing Returns with PyPL and US Stock Mark

Title: Cipla Stock US: A Comprehensive Analysi

US Stock Market 2021 Forecast: A Comprehensive

Can U.S. Citizens Trade in the Indian Stock Ma

Understanding the Tencent US Stock Code: A Com

Can You Trade Stocks Without a Work Authorizat

Impact of the US-China Trade War on the Stock

"How Many People Trade Stocks in the

Understanding the US OTC Stock Market: A Compr

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Do You Need US Citizenship to Buy Stock?"

- Unlocking the Potential of ACAT.O: A Comprehen"

- "Car Us Stock": The Ultimate"

- "Unlocking Opportunities: Exploring P"

- Stock Trading Holidays: Understanding the Impa"

- Unlocking Profit Potential: Top US News Money "

- Top Natural Gas Stocks in the US: A Comprehens"

- Heckler & Koch US Stock: A Comprehensi"

- US Army Stock Antwerp: A Comprehensive Guide t"

- Maximizing Your Investment Potential with Onli"