you position:Home > can foreigners buy us stocks > can foreigners buy us stocks

Maximizing Profits: The Ultimate Guide to Stock and Trade

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the fast-paced world of finance, understanding how to stock and trade effectively can be the difference between success and failure. Whether you're a seasoned investor or just starting out, this comprehensive guide will equip you with the knowledge and strategies needed to make informed decisions and maximize your profits.

Understanding the Basics of Stock and Trade

To begin, it's essential to grasp the fundamental concepts of stock and trade. Stock refers to a share of ownership in a company, and trading involves buying and selling these shares in the stock market. The goal is to buy low and sell high, capitalizing on price fluctuations to generate profits.

Key Strategies for Successful Stock and Trade

Research and Analysis: Thorough research is crucial before investing in any stock. Analyze the company's financial statements, industry trends, and market conditions to identify potential opportunities. Technical analysis and fundamental analysis are two popular methods used to assess stock performance.

Risk Management: Risk management is vital to protect your investments. Set a stop-loss order to limit potential losses and avoid making impulsive decisions based on emotions. Diversify your portfolio to spread out risk and reduce the impact of any single stock's performance.

Time Management: Time management is key to successful stock and trade. Keep up with the latest market news, company earnings reports, and economic indicators. This will help you stay informed and make timely decisions.

Continuous Learning: The stock market is constantly evolving, so it's crucial to continue learning. Attend workshops, read books, and follow reputable financial blogs and websites to stay updated on the latest trends and strategies.

Case Study: Apple Inc.

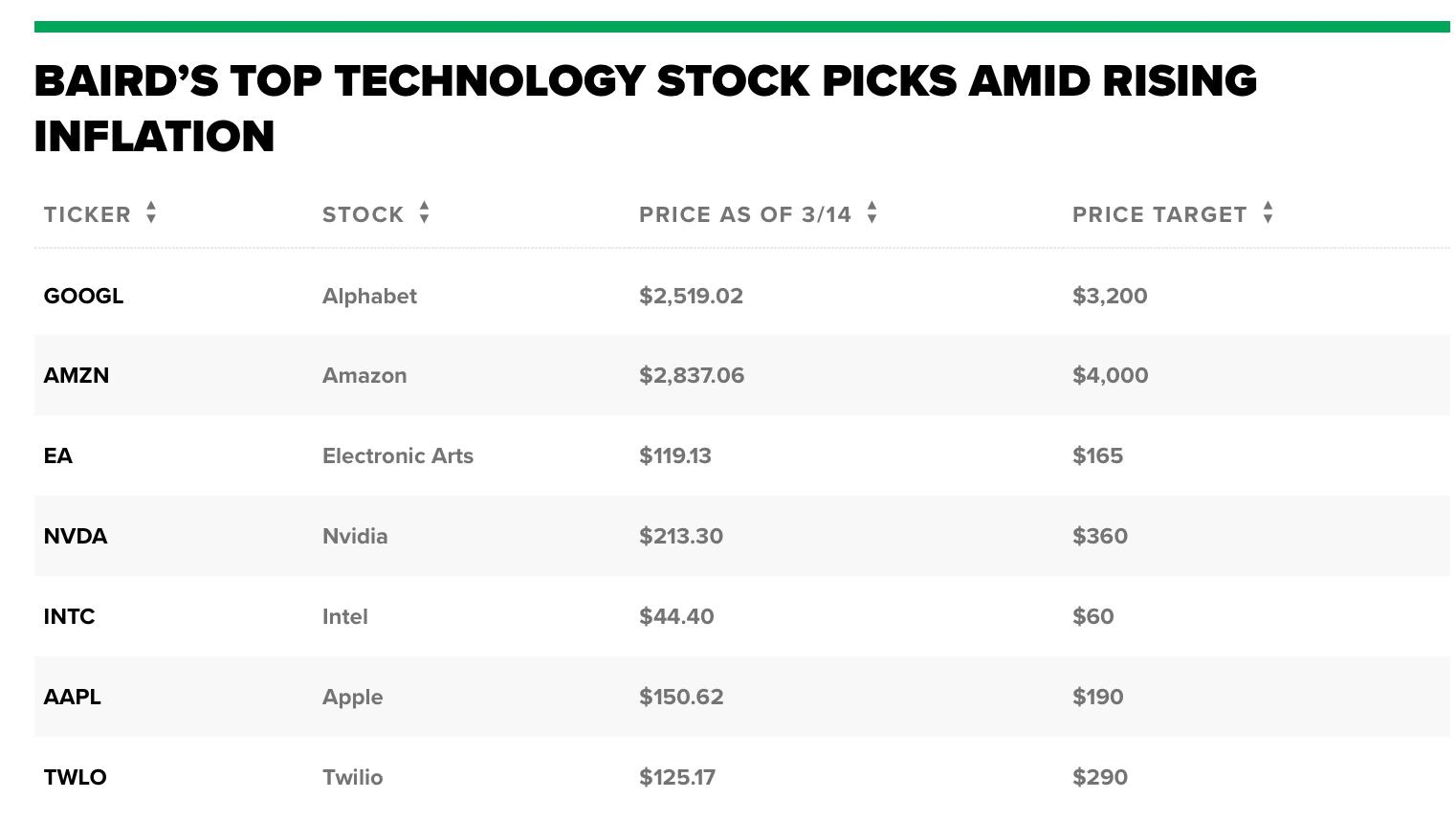

Let's consider a hypothetical scenario involving Apple Inc. (AAPL). In early 2020, the stock was trading at around $90 per share. By conducting thorough research and analyzing the company's financials, you identified that Apple's strong product lineup, growing revenue, and innovative technology made it a solid investment.

You decided to buy 100 shares of Apple at

By continuously monitoring the market and making informed decisions, you sold your shares at

Conclusion

In conclusion, stock and trade can be a powerful tool for generating profits, but it requires knowledge, discipline, and a strategic approach. By following the strategies outlined in this guide and staying informed, you can navigate the stock market with confidence and increase your chances of success. Remember, continuous learning and risk management are key to long-term profitability.

so cool! ()

last:Market Sectors Today: Exploring the Dynamic Landscape of Business

next:nothing

like

- Market Sectors Today: Exploring the Dynamic Landscape of Business

- Covid 19 US Stock Market: A Comprehensive Analysis

- Stock Market on January 20, 2025: A Deep Dive into Market Dynamics

- Marriott Stock US: A Comprehensive Analysis of the Hotel Giant's Performance

- Is Yahoo News Reliable? A Comprehensive Analysis"

- Us Market Graph: Decoding the Trends That Shape American Commerce"

- Stock Market Last Five Days: A Comprehensive Analysis

- Dow Tomorrow: Predicting Stock Market Trends for Future Success

- Carnival Stock Price: Understanding the Current Trends and Future Outlook

- Sears US Stock: The Latest Updates and Predictions

- Allergan US Pharma Stocks: A Comprehensive Guide to Investment Opportunities&

- Unlock the Power of Financial Insights with Googke Finance

hot stocks

Pre-Market US Stock Movers: Key Insights and A

Pre-Market US Stock Movers: Key Insights and A- Pre-Market US Stock Movers: Key Insights and A"

- Among Us Christmas Stockings: Uniquely Celebra"

- Samsung Note 12.2 P900 Stock ROM US: A Compreh"

- Top US Cannabis Stocks to Buy in 2023: A Guide"

- Is the US Stock Market Open on Election Day 20"

- The Dollar Value of the US Stock Market: Curre"

- Total Market Capitalization of US Stocks: A Co"

- "Unveiling the Excitement of US New S"

recommend

Maximizing Profits: The Ultimate Guide to Stoc

Maximizing Profits: The Ultimate Guide to Stoc

Is the US Stock Market Open All Day Today?

Bump Stocks in the US: A Comprehensive Look

2017 US Stock Market: The Fraction of Institut

Total US Stock Market Capitalization: A Compre

Strong US Stock: A Guide to Top Performers and

Top US Stocks to Buy in 2017: A Strategic Inve

Top Apps to Invest in US Stocks: Simplify Your

"Navigating Canada Taxes on US Stocks

Best US Airline Stocks: Top Picks for Investor

Dow Jones I: Revolutionizing Financial News

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Recent High Momentum Stocks: A Deep Dive into "

- Daimler AG: A Comprehensive Guide to its US St"

- US Airways Stock Price History: A Comprehensiv"

- BlackBerry Stock: A Comprehensive Analysis of "

- Top Performing US Stocks 2025 Outlook: A Compr"

- Unlocking Success: Mastering the Art of '"

- Unlock the Secrets of the US Stock Financial R"

- Sears US Stock: The Latest Updates and Predict"

- US Stock Market Analysis: Key Insights for Aug"

- Why Is the Stock Market Higher Today? Key Fact"