you position:Home > can foreigners buy us stocks > can foreigners buy us stocks

Dow Jones Stock Price Futures: A Comprehensive Guide

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the ever-evolving world of finance, understanding the intricacies of Dow Jones stock price futures is crucial for both seasoned investors and newcomers alike. These futures provide a unique way to speculate on the future movements of the stock market, offering both opportunities and risks. This article delves into the basics of Dow Jones stock price futures, their importance, and how they can impact your investment strategy.

Understanding Dow Jones Stock Price Futures

Dow Jones stock price futures are financial contracts that allow investors to speculate on the future price of the Dow Jones Industrial Average (DJIA). The DJIA is a widely followed stock market index that tracks the performance of 30 large, publicly traded companies in the United States. By trading Dow Jones stock price futures, investors can gain exposure to the overall market or individual stocks within the index.

How Dow Jones Stock Price Futures Work

Dow Jones stock price futures are similar to other types of futures contracts, such as commodity or currency futures. They are agreements to buy or sell the DJIA at a predetermined price on a specified future date. These contracts are typically traded on futures exchanges, such as the Chicago Mercantile Exchange (CME).

When trading Dow Jones stock price futures, investors can take either a long or short position. A long position means betting that the DJIA will increase in value, while a short position means betting that it will decrease. The value of the futures contract is based on the current level of the DJIA, and investors will make a profit or loss based on the difference between the contract's price and the DJIA's actual price at expiration.

Benefits of Trading Dow Jones Stock Price Futures

There are several benefits to trading Dow Jones stock price futures:

- Leverage: Futures contracts offer leverage, allowing investors to control a large amount of stock with a relatively small amount of capital. This can amplify gains, but it also increases the risk of losses.

- Hedging: Investors can use Dow Jones stock price futures to hedge their portfolios against potential market downturns. By taking an opposite position in the futures market, they can offset losses in their stock holdings.

- Market Exposure: Dow Jones stock price futures provide a way to gain exposure to the overall market without owning individual stocks. This can be particularly useful for investors who want to diversify their portfolios.

Risks of Trading Dow Jones Stock Price Futures

While Dow Jones stock price futures offer numerous benefits, they also come with significant risks:

- Volatility: The stock market can be highly volatile, and Dow Jones stock price futures can amplify this volatility. This can lead to rapid gains or losses.

- Leverage: As mentioned earlier, leverage can amplify gains, but it can also amplify losses. Investors must be careful not to over-leverage their positions.

- Market Risk: The performance of Dow Jones stock price futures is closely tied to the overall market. If the market takes a downturn, futures prices may plummet, leading to significant losses.

Case Study: Using Dow Jones Stock Price Futures to Hedge a Portfolio

Let's consider a hypothetical scenario where an investor holds a diversified portfolio of stocks. The investor is concerned about a potential market downturn and wants to protect their portfolio from losses. To hedge their portfolio, the investor decides to take a short position in Dow Jones stock price futures.

By taking a short position, the investor can offset any losses in their stock holdings if the market declines. For example, if the investor's portfolio is worth

In conclusion, Dow Jones stock price futures offer a unique way to speculate on the future movements of the stock market. While they come with significant risks, they can also provide substantial benefits for investors who understand how to use them effectively. By carefully considering their investment strategy and risk tolerance, investors can make informed decisions when trading Dow Jones stock price futures.

so cool! ()

like

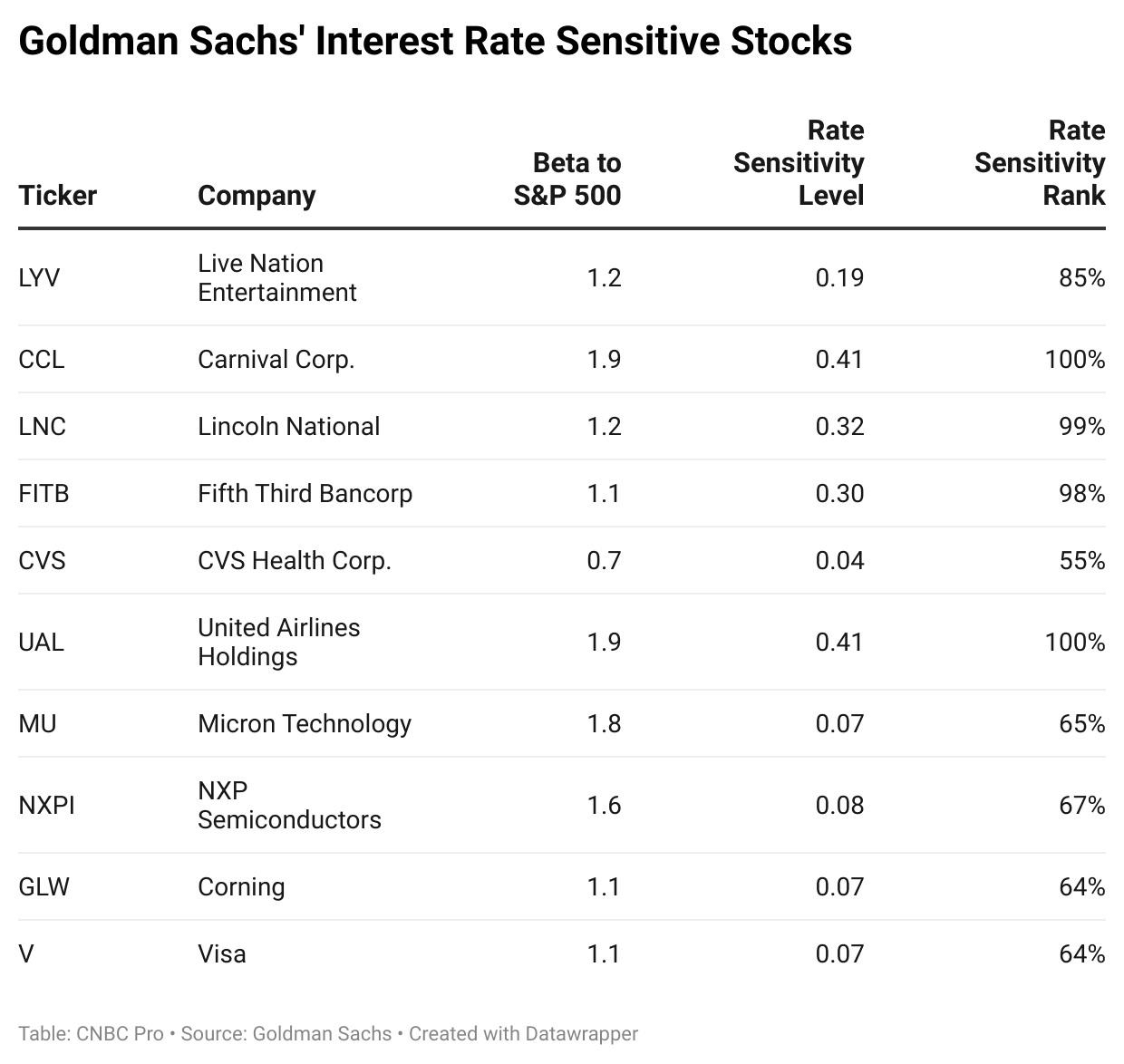

- Impact of Higher Interest Rates on US Stocks: What Investors Need to Know

- Define Joint Stock Company: A Deep Dive into US History

- Historical Stock Prices: Unveiling the Past for Future Investment Decisions&q

- How to Join the Stock Market in the US: A Step-by-Step Guide

- NYSE Today Hours: Your Ultimate Guide to Trading Hours at the New York Stock Exch

- MSN Stock Tracker: Your Ultimate Guide to Real-Time Stock Monitoring

- CNBC F: Unveiling the Future of Finance and Technology

- Unlocking the Power of Google Bourse: A Comprehensive Guide

- Googl Stock Price: Current Trends and Future Prospects

- Stock Marker Futures: A Comprehensive Guide to Trading Success"

- List of Shariah Compliant US Stocks: A Guide for Ethical Investors

- The Israel War's Impact on the US Stock Market: A Comprehensive Analysis

hot stocks

Pre-Market US Stock Movers: Key Insights and A

Pre-Market US Stock Movers: Key Insights and A- Pre-Market US Stock Movers: Key Insights and A"

- Among Us Christmas Stockings: Uniquely Celebra"

- Samsung Note 12.2 P900 Stock ROM US: A Compreh"

- Top US Cannabis Stocks to Buy in 2023: A Guide"

- Is the US Stock Market Open on Election Day 20"

- The Dollar Value of the US Stock Market: Curre"

- Total Market Capitalization of US Stocks: A Co"

- "Unveiling the Excitement of US New S"

recommend

Dow Jones Stock Price Futures: A Comprehensive

Dow Jones Stock Price Futures: A Comprehensive

https simplywall.st stocks us commercial-servi

Ex-US Stocks: Exploring Opportunities Beyond U

Aphria Stock: What You Need to Know About Inve

Biggest Gainers Stock Market Today: Unveiling

Indian ADRs in the US Stock Market: A Comprehe

Current Stock Market Results: Key Insights and

Hedge Funds Selling US Stocks: Insights and Im

Maximizing Returns: A Deep Dive into FLT.AX St

S&P 500 Index Fund Cost: Understanding

Best Way to Buy US Stocks from Canada: Your Ul

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- US Real Estate Stock Index: A Comprehensive Gu"

- How to Scan US Common Stocks with TC2000 on Yo"

- National Bank of Greece: A Deep Dive into Thei"

- Unlocking the Potential of DCPH.O: A Comprehen"

- Largest Cap Stocks in US: The Powerhouses of t"

- Dow on January 20, 2025: What to Expect in the"

- Best US Cobalt Stocks to Own: A Comprehensive "

- US Marine Stock A: Unveiling the Elite Force&#"

- US Fuel Oil Stocks: A Comprehensive Guide to C"

- Bofa Hartnett US Stock Flows: The Ultimate Gui"