you position:Home > us stock market today live cha > us stock market today live cha

Understanding the US Stock Futures Market: A Comprehensive Guide

![]() myandytime2026-01-19【us stock market today live cha】view

myandytime2026-01-19【us stock market today live cha】view

info:

In the fast-paced world of finance, staying ahead of the curve is crucial. One of the most dynamic and influential markets is the US stock futures market. This article delves into the intricacies of this market, providing a comprehensive guide for both beginners and seasoned investors.

What are US Stock Futures?

US stock futures are financial contracts that allow investors to buy or sell shares of a particular stock at a predetermined price on a specified future date. These contracts are traded on various exchanges, including the Chicago Mercantile Exchange (CME) and the Chicago Board of Trade (CBOT).

Key Features of US Stock Futures

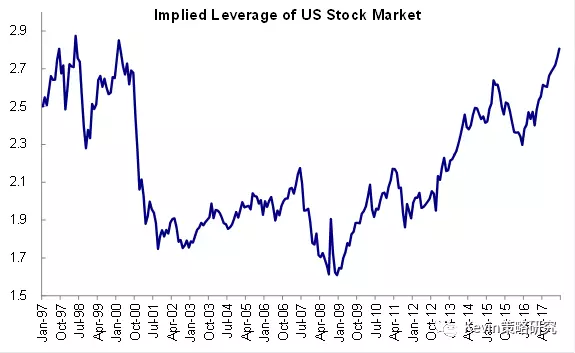

- Leverage: One of the primary advantages of stock futures is leverage. Investors can control a large amount of stock with a relatively small amount of capital.

- Hedging: Stock futures can be used to hedge against potential losses in the underlying stock. This is particularly beneficial for investors who already own shares of a particular company.

- Speculation: Investors can also use stock futures to speculate on the future price movements of a stock. This can be a lucrative strategy, but it also comes with higher risk.

How to Trade US Stock Futures

Trading US stock futures involves several steps:

- Choose a Broker: The first step is to choose a reputable broker that offers access to the US stock futures market.

- Open an Account: Once you have chosen a broker, you will need to open an account and deposit funds.

- Analyze the Market: Before placing a trade, it is crucial to analyze the market and understand the factors that influence stock prices.

- Place a Trade: Once you have analyzed the market, you can place a trade by specifying the stock, the number of contracts, and the price at which you want to buy or sell.

Risks and Rewards

Trading US stock futures carries both risks and rewards. Here are some key points to consider:

- Leverage: While leverage can amplify gains, it can also amplify losses. It is essential to manage leverage carefully.

- Market Volatility: The stock market can be highly volatile, and stock futures can be particularly sensitive to market movements.

- Regulatory Compliance: It is crucial to comply with all regulatory requirements when trading stock futures.

Case Study: Apple Stock Futures

To illustrate the potential of trading US stock futures, let's consider a case study involving Apple Inc. (AAPL).

- Scenario: An investor believes that Apple's stock price will increase in the next few months.

- Action: The investor buys Apple stock futures at $150 per contract.

- Outcome: If the stock price reaches

200, the investor can sell the futures contract for a profit of 50 per contract.

Conclusion

US stock futures offer a unique and powerful way to invest in the stock market. By understanding the basics and managing risks effectively, investors can capitalize on the opportunities presented by this dynamic market. Whether you are a beginner or an experienced investor, it is crucial to stay informed and make informed decisions.

so cool! ()

like

- US Stock Market 2019 Forecast: A Comprehensive Analysis

- US Stock Investor: Mastering the Market for Big Returns

- Trump on US Stock Market: Impact and Analysis

- Small Cap Stocks High Momentum US: A Winning Strategy?

- Investing in US Stocks from Europe: A Guide for International Investors

- Fastest Growing US Small Cap Stocks: Unveiling the Hidden Gems

- Construction Stocks: A Smart Investment in the US Real Estate Market

- Huawei Stock Buying in US: A Lucrative Investment Opportunity?

- Top Momentum Stocks Past 5 Days: A Deep Dive into US Market Trends

- Thai Agro Energy PCL US Stock Symbol: A Comprehensive Guide

- "Sector Performance: US Stock Market Dynamics on May 9, 2025"

- "Indian Companies Making Waves on US Stock Exchange"

hot stocks

Unlocking Potential: Exploring US Small Cap Bi

Unlocking Potential: Exploring US Small Cap Bi- Unlocking Potential: Exploring US Small Cap Bi"

- Top US Stock to Buy: Unveiling the Ultimate In"

- "5 Crucial Things to Know Before Trad"

- Can Indian Citizens Trade in the US Stock Mark"

- US Bank Corp Stock Price Today: Key Insights a"

- US Made L1A1 Stock Set: The Ultimate Upgrade f"

- Best Performing US Stocks Past 5 Days: Momentu"

- Top 10 Dividend Stocks in the US: Secure Your "

recommend

US Stock Market 2019 Forecast: A Comprehensive

US Stock Market 2019 Forecast: A Comprehensive

Analyst Recommendations: Top Stocks to Watch i

US Stem Cells Stock: The Future of Biotechnolo

Top 10 Dividend Stocks in the US: Secure Your

Best Performing US Large Cap Stocks Past Week:

Stock Finance: Sina.cn US Quotes – Your Ulti

US Growth Stocks: Short-Term Momentum and What

"Toys R Us Stockings: A Festive Tradi

2023 US Credit Rating Downgrade: Stock Market

"Greninja Amiibo Toys R Us Stock: A C

Block One Capital Inc Stock Symbol: US – A D

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- "Sector Performance: US Stock Market "

- "Maximize Your Investment Potential w"

- NHRA US Nationals Factory Stock: The Ultimate "

- How U.S. Bond Yields Affect the Stock Market"

- Unlock the Potential of BLO Stock US: A Compre"

- Duke Energy Dividend: A Lucrative Investment i"

- US Stock Futures Pre-Market: A Comprehensive G"

- Maximizing Returns with HSBC HK US Stock Tradi"

- http stocks.us.reuters.com stocks fulldescript"

- How to Buy Bitcoin Stock in the US: A Step-by-"